Malaysia REITs are publicly-traded companies listed in Malaysia which invest in real estate assets. They have a fairly simple model whereby they pool capital from investors and invest it in real estate properties. The invested properties will then be leased out to tenants in return for rents.

Being an investor of REITs, you are essentially a co-owner of the properties and as such, you will be entitled to earn the rental income collected in the form of dividends. If you are new to REITs and would like to learn more about them, do check out these posts:

Read More:

- What are REITs and what you need to know about these investments

- Understanding REITs structure and the underlying expenses

- Understanding the different type of REITs

There are REITs listed in a various geographical region from the United States, Hong Kong, Singapore and etc. In Malaysia itself, there are 18 REITs which are listed in the Bursa Malaysia exchange. Each of these REITs is different from one another. In this post today, we will be introducing all these 18 Malaysia REITs to you. Hopefully, it will help you in your investing journey.

Note: For the purpose of consistency of information, do note that the financials stated here are based on its available audited annual report. They are not the latest available data.

List of Malaysia REITs

Al-Aqar REIT

Al-Aqar REIT (KLSE: 5116) is a healthcare REIT which was listed in the Bursa Malaysia stock exchange in 2007. They are the only healthcare REIT to be listed in the Bursa Malaysia Exchange to date. Their assets are primarily located across Malaysia with a property in Australia. Some of their assets include hospitals, retirement home, as well as medical/nursing colleges.

Industry: Healthcare REIT

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 103,839 | 99,648 | 102,649 | 106,110 |

| Net Property Income | 97,595 | 93,207 | 96,609 | 100,326 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 7.7 | 7.7 | 7.7 | 7.8 |

Here are some key things you need to know of their performance:

Al-Salam REIT

Al-Salam REIT (KLSE: 5269) is a diversified REIT listed in the Bursa Malaysia market in September 2015. Their operations include retail, office, education and F&B sector which consists of both restaurant and non-restaurant outlets.

Industry: Diversified REIT

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 76,135 | 80,033 | 82,151 | 94,912 |

| Net Property Income | 56,913 | 56,887 | 58,245 | 69,121 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 6.0 | 6.0 | 5.4 | 4.8 |

Here are some key things you need to know of their performance:

Amanah Harta Tanah PNB

Amanah Harta Tanah PNB (KLSE: 5127) is a REIT which invest in office and retails assets. There were listed in the Bursa Malaysia market on 28 December 1990. They have announced their intention to delist the REITs and with effect from 14 January 2021, their shares will be suspended from trading for the implementation of the selective unit redemption exercise. Nevertheless, here are the details in regards to Amanah Harta Tanah PNB.

Industry: Office and Retail REIT

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 23,364 | 39,545 | 39,221 | 38,576 |

| Net Property Income | 17,226 | 33,033 | 31,497 | 32,078 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 4.5 | 5.2 | 5.6 | 5.8 |

Here are some key things you need to know of their performance (not so relevant given the delisting):

AmanahRaya REIT

AmanahRaya REIT (KLSE: 5127) is a diversified REIT listed in the Bursa Malaysia market on February 2007. They have properties in the retail, office, healthcare, hospitality and industrial sector. Here are some details of the REIT.

Industry: Diversified REIT

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 57,633 | 61,036 | 97,244 | 96,876 |

| Net Property Income | 53,549 | 53,799 | 79,570 | 80,666 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 5.9 | 5.5 | 6.1 | 6.2 |

Here are some key things you need to know of their performance:

AmFirst REIT

AmFirst REIT ( KLSE: 5120) is a Malaysia based REIT listed in December 2006. They primary invest in office properties with some diversification to the retail side.

Industry: Office and retail

Year-End: 31-March

Historical Financial Performance (Audited):

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 111,539 | 114,099 | 121,229 | 120,682 |

| Net Property Income | 72,802 | 76,040 | 79,942 | 76,565 |

Distribution per unit:

| Cents | FY17 | FY18 | FY19 | FY20 |

| Distribution per Unit | 4.1 | 4.2 | 4.0 | 3.4 |

Here are some key things you need to know of their performance:

Atrium REIT

Atrium REIT (KLSE: 5130) is an industrial-focused REIT which was listed on Bursa Malaysia exchange in 2007. They primarily invest in industrial properties with assets across multiple states in Malaysia.

Industry: Industrial

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 14,522 | 17,304 | 18,779 | 22,961 |

| Net Property Income | 12,337 | 15,296 | 17,257 | 21,413 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 5.9 | 7.4 | 8.0 | 6.6 |

Here are some key things you need to know of their performance:

- 7 Key Things To Know Of Atrium REIT 2019 Performance

- 5 Key Things To Know of Atrium REIT 3Q20 Performance

Axis REIT

Axis REIT is REITs in Malaysia which invests heavily in industrial and business space assets. Apart from business space and industrial properties, Axis REIT also invests in office and retail properties.

Industry: Diversified (Concentrated on industrial space)

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 171,340 | 172,715 | 210,588 | 222,464 |

| Net Property Income | 144,292 | 146,203 | 182,761 | 191,708 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 8.3 | 8.3 | 8.7 | 9.3 |

Here are some key things you need to know of their performance:

CMMT REIT

CMMT REIT or also known as CapitaLand Malaysia Mall Trust is a retail REIT based in Malaysia. They have retail properties presence in Klang Valley, Kuantan and Penang.

Industry: Retail

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 372,617 | 368,934 | 350,146 | 342,276 |

| Net Property Income | 242,492 | 237,146 | 214,969 | 202,120 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 8.4 | 8.2 | 7.9 | 6.3 |

Here are some key things you need to know of their performance:

- Key Things To Know of CMMT REIT 2019 Performance

- 6 Key Things You Need to Know Of CMMT REIT 2020 Performance

Hektar REIT

Hektar Real Estate Investment Trust or also known as Hektar REIT is a retail-focused REIT. Their properties are located across Malaysia in the region of Kedah, Selangor, Malacca and Johor.

Industry: Retail

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 124,571 | 125,543 | 135,107 | 137,089 |

| Net Property Income | 74,335 | 73,738 | 78,716 | 75,436 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 10.5 | 9.6 | 9.0 | 7.8 |

Here are some key things you need to know of their performance:

IGB REIT

IGB REIT (KLSE: 5227) is a retail REIT which was listed in the Bursa Malaysia stock exchange in 2012. They owns two main retail malls in Malaysia, Mid Valley Megamall and The Gardens Mall. If you have stayed in Kuala Lumpur, you would have most likely visited these malls.

Industry: Retail

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 507,344 | 524,918 | 535,689 | 552,132 |

| Net Property Income | 361,109 | 373,563 | 386,250 | 398,786 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 8.6 | 9.1 | 9.2 | 9.2 |

Here are some key things you need to know of their performance:

KIP REIT

KIP REIT (KLSE: 5280) is a retail REIT which was recently listed in the Bursa Malaysia market in February 2017. Their assets are mainly located in Johor, Negeri Sembilan, Melaka and Selangor.

Industry: Retail

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 26,350 | 62,773 | 63,065 | 74,540 |

| Net Property Income | 17,525 | 41,918 | 41,953 | 56,018 |

Distribution per unit:

| Cents | FY17 | FY18 | FY19 | FY20 |

| Distribution per Unit | 2.9 | 6.8 | 6.0 | 6.2 |

Here are some key things you need to know of their performance:

KLCC Property Holdings

KLCC Property Holdings is the largest REIT in Malaysia and the country’s only Stapled Security. Comprising KLCC Property Holdings Berhad and KLCC REIT, their assets are primarily in the office, retail and hotel sector.

Industry: Office, hotel and retail

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 1,343,546 | 1,366,751 | 1,405,941 | 1,423,021 |

| Net Property Income | 999,342 | 999,749 | 1,010,891 | 1,020,020 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 22.8 | 20.7 | 23.4 | 25.0 |

MQ REIT

MQ REIT is a REIT that invests primarily in commercial, office, car park and retail properties. They were listed in the Bursa Malaysia exchange on January 2007. Here are some key details about them:

Industry: Office and Retail

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 136,648 | 181,502 | 172,527 | 160,992 |

| Net Property Income | 107,155 | 141,341 | 132,802 | 121,748 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 8.4 | 8.4 | 8.1 | 6.8 |

Here are some key things you need to know of their performance:

- 4 Key things to know of MQREIT 3Q20 Performance

- 5 Key Things You Need To Know Of MQREIT 2019 Performance

Pavilion REIT

Pavilion REIT (KLSE: 5212) is one of the largest retail-focused REIT in Malaysia. They were listed in Bursa Malaysia in December 2011. Their properties consist of both retail and office-related assets.

Industry: Retail and Office

Year-End: 31-December

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 459,701 | 490,001 | 554,977 | 585,353 |

| Net Property Income | 314,774 | 322,913 | 374,787 | 375,184 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 8.2 | 8.2 | 8.8 | 8.5 |

Here are some key things you need to know of their performance:

Sunway REIT

Sunway REIT (KLSE: 5176) is one of the largest diversified real estate investment trusts in Malaysia being listed in the Bursa Malaysia Market on July 2010. They have properties in various sector such as industrial, education, hospitality, healthcare, office and retail.

Industry: Diversified

Year-End: 30-June

Historical Financial Performance (Audited):

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 522,868 | 560,406 | 580,299 | 556,875 |

| Net Property Income | 388,817 | 419,930 | 439,695 | 416,809 |

Distribution per unit:

| Cents | FY17 | FY18 | FY19 | FY20 |

| Distribution per Unit | 9.2 | 9.6 | 9.6 | 7.3 |

Here are some key things you need to know of their performance:

Tower REIT

Tower REIT (KLSE: 5111) is a REIT which invest mainly in commercial real estate. They were listed on the Bursa Malaysia market in April 2006. For investors who are new to Tower REIT, it is important to know that there was a change in Tower REIT financial year from 31 December 2018 to 30 June 2019. Hence, the comparative information in FY19 would reflect 18 months of performance as compared to 12 months of data in both FY17 and FY20.

Industry: Office

Year-End: 30-June

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY19 | FY20 |

| Revenue | 35,591 | 32,644 | 44,054 | 21,604 |

| Net Property Income | 23,091 | 20,433 | 26,633 | 10,046 |

Distribution per unit:

| Cents | FY16 | FY17 | FY19 | FY20 |

| Distribution per Unit | 6.9 | 6.0 | 8.0 | 2.4 |

Here are some key things you need to know of their performance:

UOA REIT

UOA REIT (KLSE: 5110) is a REIT which was listed in Bursa Malaysia in December 2005. They invest primarily in estate-related assets predominantly in the office sector. Here are some facts about them.

Industry: Office

Year-End: 30-June

Historical Financial Performance (Audited):

| MYR in 000s | FY16 | FY17 | FY18 | FY19 |

| Revenue | 89,388 | 82,044 | 78,200 | 78,734 |

| Net Property Income | 66,504 | 59,530 | 57,257 | 57,928 |

Distribution per unit:

| Cents | FY16 | FY17 | FY18 | FY19 |

| Distribution per Unit | 10.5 | 8.6 | 9.1 | 9.1 |

Here are some key things you need to know of their performance:

YTL Hospitality REIT

YTL Hospitality REIT is a Malaysia based REIT which invest primarily in hotel properties. Their assets range from business to luxury hotels spreading across a range of unique locations worldwide. Some of the key brands you might be familiar are JW Marriott Hotel Kuala Lumpur, The Ritz-Carlton, and etc. Here are some facts about them.

Industry: Hospitality

Year-End: 30-June

Historical Financial Performance (Audited):

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 332,736 | 500,953 | 490,905 | 426,446 |

| Net Property Income | 209,616 | 248,827 | 253,279 | 235,219 |

Distribution Per Unit

| Cents | FY17 | FY18 | FY19 | FY20 |

| Distribution per Unit | 8.1 | 7.9 | 7.9 | 6.7 |

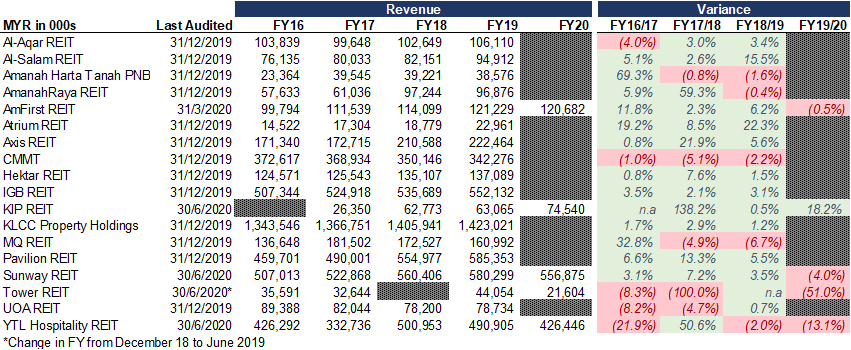

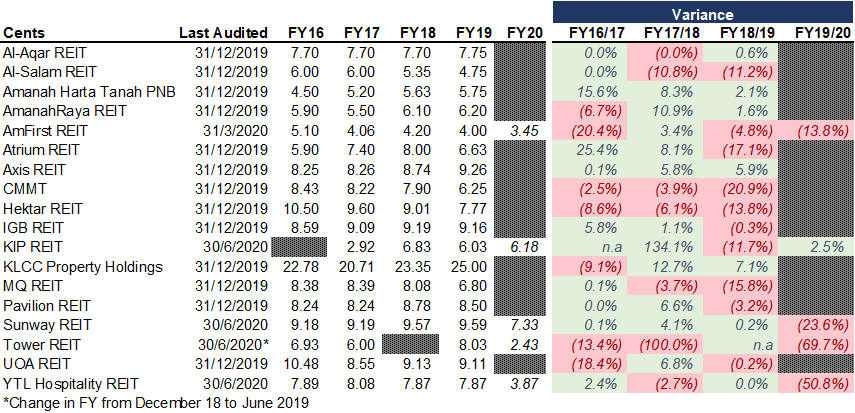

Malaysia REITs Side by Side

For those who are interested, we have also put together a compilation of all the Malaysia REITs Revenue Net Property Income and its Distribution Per Unit as below. The key idea is that it would allow investors to evaluate and compare each of these REITs against one another.

If you like the snapshot above, do consider supporting our M-REIT data pack where we had a great compilation of all the Malaysia REITs performance in which we update fairly regularly (as at when the quarterly/half yearly report is released.

We hope by the end of this post you would have learned a little bit more on some of the REITs in Malaysia. If you are new to REITs, feel free to check out our free REITs Guide.

Guide to REITs in Malaysia and Singapore

New to REITs? We got you covered with our comprehensive 30+ page guide to help you get started with REITs in Malaysia and Singapore.

You will learn:

- What are REITs

- Why invest in REITs

- The type of REITs in Malaysia and Singapore

- Understanding REIT structure

- And Many More..

Do join our community over at Facebook and Instagram.