AmFirst Real Estate Investment Trust or also known as AmFirst REIT ( KLSE: 5120) is a Malaysia based REIT listed in December 2006. As of 31 March 2020, they have an asset under management of approximately MYR 1.6 bil consisting of 9 properties. Their primary investment is in commercial properties with some diversification to the retail side.

| Properties | Location | RM in mil | % |

| Bangunan AmBank Group | Kuala Lumpur | 266 | 16% |

| Menara AmBank | Kuala Lumpur | 322 | 20% |

| Menara AmFirst | Petaling Jaya | 66 | 4% |

| Wisma AmFirst | Kelana Jaya | 118 | 7% |

| The Summit Subang USJ | Subang Jaya | 374 | 23% |

| Prima 9 | Cyberjaya | 73 | 4% |

| Prima 10 | Cyberjaya | 66 | 4% |

| Jaya 99 | Melaka | 104 | 6% |

| Mydin Hypermall | Bukit Mertajam | 259 | 16% |

| Total | 1,647 | 100% |

All the properties are located in Malaysia with a huge concentration in central Malaysia. Of the total properties, the bigger chunk of properties pertains to The Summit Subang USJ and Menara AmBank in which cumulatively holds 43% of the total.

There are various aspects we can discuss with the latest 2020 annual report released. So let’s dive in.

Operational Overview

Similar to our usual segment, we will start out with the operational performance of the REITs. As we always shared, an ideal REIT should have a strong operational performance.

1. An overall drop in occupancy rate

Looking at the occupancy rate of AmFirst REIT, there is a mixture of performance. There are a number of properties with a positive occupancy rate increase such as Bangunan AmBank and Menara AmFirst. Similarly, there are also properties with a drop in occupancy rates such as The Summit and Jaya 99. If we were to look at the average, the overall occupancy has declined from 86.7% in FY19 to 84.9% in FY20.

The decline as per management is due to the effect of US and China trade war. The outbreak of COVID-19 pandemic has further added the uncertainty onto the already much challenging weak business sentiment and demand of commercial spaces.

2. Concentration in the banking sector for office component and hypermarket for the retail component

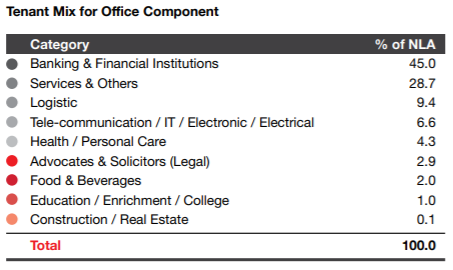

AmFirst REIT is predominantly a commercial REIT with a small diversification in retail REITs. Looking at the office component, 45% of the tenant relates to the banking sector. Having a huge tenant concentration is not always ideal as a lost in tenant would be detrimental to the REIT. But in this case, the majority of this pertains to lease to AmBank Group which happens to be the sponsor of AmFirst REIT.

On the retail component, a huge proportion of the lease is with the hypermarket sector. It is mainly relating to the lease to Mydin Supermarket. The lease is entered on 1 February 2016 for 30 years. Pursuant to the lease rental agreement, the lease rental receivable from Mydin is incremental by 10% for every 5 years from the commencement date up to the term of 30 years. Given the incorporation of growth aspect in the lease agreement, this is a fairly positive aspect for AmFirst REIT.

Financial Overview

3. Dropped in both revenue and net realised income

| MYR in 000s | FY18 | FY19 | FY20 |

| Revenue | 114,099 | 121,229 | 120,682 |

| Net Property Income | 76,040 | 79,942 | 76,565 |

| Net Income – Realised | 30,686 | 28,205 | 25,493 |

The overall performance for AmFirst REIT has declined in FY20. Looking at its revenue, we note a decline from MYR121.2 mil in FY19 to MYR 120.7 mil in FY20 mainly from the drop in occupancy rate shared in the previous section. Similarly, the net realised income of AmFirst REIT has been on a consistent decline ever since FY18 from a drop of MYR30.7 mil to MYR25.5 mil in FY20.

Apart from the drop in occupancy rate, the decrease in net realised income is also contributed by an increase in provision for impairment loss of trade receivables considering the potential credit risk as a result of the uncertainty in the COVID-19 pandemic.

Having said that, the COVID-19 pandemic will definitely be continuing challenge investors should pay attention to. The ability of the REIT to fare through this pandemic is vital for its future growth.

Others

4. High Gearing level close to the permissible limit

| FY18 | FY19 | FY20 | |

| Gearing | 46.8% | 47.3% | 47.6% |

AmFirst REIT’s gearing stood at 47.6% as of 31 March 2020. This has been increasing year on year from 46.8% in FY18 to 47.6% in FY20. This is fairly high as compared to other REITs in the Malaysia market which poses a risk to investors. Further, the gearing level is just below the permissible range of 50% set out.

The borrowings as of 31 March 2020 consists of 100% floating-rate loan. What it means is that the fluctuation in interest rate will affect them. But given the fact that interest rate has been on the decline, this might be favourable for AmFirst REIT in the short term.

Read More: How does interest rates affect REITs

5. Declining distribution per unit (DPU)

| FY16 | FY17 | FY18 | FY19 | FY20 | |

| Distribution Per Unit | 5.10 | 4.06 | 4.20 | 4.00 | 3.45 |

One of the key aspect investors are attracted to REITs is for the generous dividend distribution. Hence it is only natural that we look at the distribution per unit (DPU) of AmFirst REIT. Looking at the DPU over the past 5 years, the DPU has been declining from 5.10 cents in FY16 to 3.45 cents in FY20 posing a worrying sign.

Read More: Why you should never buy a REIT purely because they have a high dividend yield

6. Price to book ratio

The net asset value per share of AmFirst REIT as at 31 March 2020 is MYR 1.21. Comparing this to the closing unit price of MYR 0.40 as at 31 March 2020, this would translate to a price to book rate of less than 1. The decline in market price is mainly attributed to the poor business fundamentals of AmFirst REIT.

Summary

From REIT Pulse perspective, AmFirst REIT has been performing rather poorly both operationally and financially over the years. Gearing has been increasing year on year while distribution per unit has been on the decline. The only positive aspect is the strong sponsor and the long lease they had with Mydin Hypermarket. With the uncertainty of COVID-19 pandemic, this would be another worrying sign to investors.

What are your thoughts on AmFirst REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.