Hektar Real Estate Investment Trust or also known as Hektar REIT ( KLSE: 5121) is Malaysia’s first retail-focused REIT. They invest in income-producing commercial real estate primarily used for retail purposes. As of 31 December 2019, they have approximately MYR 1.2 bill asset under management with properties across Malaysia.

| Location | Valuation (MYR’mil) | % | |

| Subang Parade | Selangor | 440.00 | 36% |

| Makhota Prade | Malacca | 329.00 | 27% |

| Wetex Parade | Johor | 144.50 | 12% |

| Central Square | Kedah | 97.00 | 8% |

| Kulim Central | Kedah | 130.00 | 11% |

| Segamat Central | Johor | 96.00 | 8% |

| Total | 1,236.50 | 100% |

They own 6 different malls in Kedah, Selangor, Malacca and Johor. Looking at the summary above, Subang Parade and Makhota Parade make up the biggest proportion where they cumulatively make up 63% of the total portfolio of Hektar REIT.

In this post, we will look at the performance of Hektar Reit based on its 2019 and Q1 2020 results.

Operational Overview

An ideal REIT should have a strong operational performance. In this segment, we will look at how Hektar REIT has performed operationally in 2019 and in Q1 2020.

1. Declining portfolio occupancy

| FY15 | FY16 | FY17 | FY18 | FY19 | Q1 2020 | |

| Subang Parade | 94.7% | 93.0% | 90.9% | 88.2% | 93.9% | 88.3% |

| Makhota Prade | 95.5% | 96.4% | 96.1% | 96.0% | 96.4% | 96.6% |

| Wetex Parade | 98.7% | 100.0% | 100.0% | 98.5% | 96.2% | 96.2% |

| Central Square | 98.0% | 96.6% | 95.3% | 96.9% | 89.7% | 89.6% |

| Kulim Central | 99.3% | 98.9% | 98.2% | 93.5% | 95.0% | 95.0% |

| Segamat Central | 0.0% | 0.0% | 94.7% | 78.6% | 77.1% | 79.5% |

| Average | 96.6% | 96.2% | 95.1% | 92.1% | 92.5% | 91.3% |

The occupancy rate of the REIT portfolio is one of the key metrics to evaluate the performance of the properties. At an average glance, the occupancy of the properties has declined from 96.6% to 92.5% in FY19. Comparing the occupancy performance of FY19 with Q1 2020, we note a further drop to 91.3%.

The decline is mainly driven by the drop in the occupancy rate of Subang Parade due to its asset enhancement planning & repositioning exercise to bring in new mini anchor. It will definitely be interesting to see how this exercise will turn out given the huge contribution of Subang Parade to Hektar REIT.

Another area investor should keep a look-out for is the impact of the movement control order on the tenants in Q2 2020.

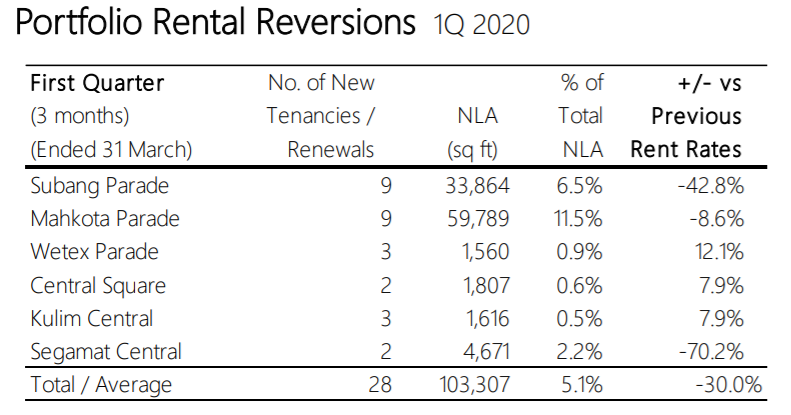

2. Negative rental reversion in Q1 2020

One of the ways the REIT manager can grow the REIT organically is through rental reversion. In FY20 itself, there will be approximately 233 tenants which are due for renewal accounting for close to 40% of the net lettable area. The ability of the REIT manager to retain and obtain a positive rental reversion will be key to the growth of Hektar REIT.

However, looking at the Q1 2020 presentation, the first quarter rental reversion has declined by 30%. The major drop is contributed by the negative reversion in Subang Parade and Segamat Central. The 42.8% decline in Subang Parade is due to the management plan on repositioning the mall to bring in new mall tenants. This will be further strained by the uncertainty of the Covid-19 pandemic in Q2 2020.

Financial Overview

3. An increase in revenue but a decline in net property income

| FY18 | FY19 | |

| Gross Revenue | 135,107 | 137,089 |

| Direct Cost & Property Expenses | (56,390) | (61,654) |

| Net Property Income | 78,717 | 75,435 |

| Income distribution | 41,623 | 35,894 |

Looking at the financial performance of Hektar REIT, we notice a year on year increase in revenue from MYR 135.1 mil in FY18 to MYR 137.1 mil in FY19. The increase is mainly contributed by a slight improvement in occupancy rate from 92.1% in FY18 to 92.5% in FY19. Further, the manager has managed to obtain a 0.5% rental reversion during the year.

However, if we were to look at the net property income, it has declined from MYR 78.7 mil in FY18 to MYR 75.4 mil in FY19. This is from the increase in property maintenance expense. An area investor should be aware of is that the average age of the portfolio is over 20 years. Their youngest mall, Segamat Central was opened in 2011 and their oldest, Subang Parade was opened in 1988. Given the age of the properties, it cost more to maintain the buildings.

Others

4. Gearing level of 44.1% as at 31 December 2019

The Group’s gearing stood at 44.1% as at 31 December 2019 as compared to 44.4% on 31 December 2018. Though there is a slight drop in the gearing level and still within the permissible limit, the gearing is still fairly high when compared to other REITs in the Malaysia market.

The borrowings as of 31 December 2019 amounts to MYR 563 mil in which 100% of it is floating rate in nature. What it means that the fluctuation in interest rate will affect them. Given the fact that interest rate has been on the decline, this might be favourable for Hektar REIT in the short term.

5. Declining distribution per unit (DPU)

| Cents | FY15 | FY16 | FY17 | FY18 | FY19 |

| Total DPU | 10.50 | 10.50 | 9.60 | 9.00 | 7.77 |

The next aspect we will be looking at is the distribution per unit (DPU) of Hektar REIT. We note a consistent declining trend from 10.5 cents in FY15 to 7.77 cents in FY19.

Furthermore, the uncertainty of COVID-19 pandemic will further impact the performance of Hektar REIT adversely. This is a worrying sign and should be an area investors should consider before investing in it.

6. Price to book ratio

The net asset value per share of Hektar REIT as at 31 December 2019 is MYR 1.46. When compared to the closing price as at 31 December 2019 of MYR 1.52, it would translate to a price to book ratio of approximately 1.04.

Summary

From REIT Pulse point of view, Hektar REIT operational performance has been on the decline over the years. Despite an increase in revenue over the past years, their distribution per unit has been on the declining trend. Further, the Q1 2020 negative rental reversion and decline in occupancy rate is another worrying sign.

We would expect a further impact on the Q2 2020 performance with the announcement of the movement control order late March 2020 lasting all the way to late June 2020.

What are your thoughts on Hektar REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.