UOA REIT (KLSE: 5110) is a Malaysian based REIT which was listed in Bursa Malaysia in December 2005. They invest primarily in estate-related assets predominantly used for commercial purposes. As at the date of this analysis, there are trading at MY1.22.

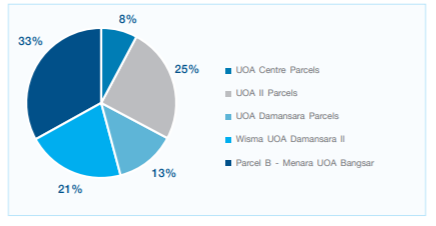

UOA REIT owns 5 commercial real estate assets which are all located in Kuala Lumpur. From the 5 properties, Menara UOA Bangsar and UOA II Parcels are the biggest contributors in terms of size and revenue. Cumulatively, these two properties account for approximately 58% of the total rental income.

With the recent development of COVID-19 and restricted movement order, we wonder how UOA REIT would be affected. We have decided to look into their 2019 performance to see how they would fare in this period. Here are 5 things you need to know of their 2019 performance.

1) An overall increase in occupancy rate

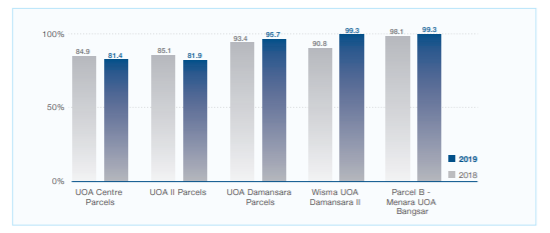

The average occupancy rate of UOA REIT has improved slightly as compared to FY18 with a mixture of performance across the 5 properties. Weighted average lease expiry (“WALE”) of the portfolio as at 31 December 2019 is approximately 1.37 years.

The occupancy rate for UOA Damansara Parcels, Wisma UOA Damansara II and Parcel B- Menara UOA Bangsar has improved. Cumulatively these 3 properties make up of approximately 73% of the total properties composition.

On the other hand, the occupancy rate for UOA Centre Parcels and UOA II Parcels have dropped from 84.9% and 85.1% in FY18 to 81.4% and 81.9% respectively in FY19. UOA II Parcels which is the second-biggest property in the UOA REIT portfolio have been on a declining trend from 96.4% back in FY15 to 81.9% in FY19.

To increase the attractiveness of UOA II Parcels, a covered pedestrian bridge linking UOA II directly to the existing KLCC-Bukit Bintang Walkway will be constructed. This initiative is expected to be completed in 2020 and will definitely be an area investors should look out for. Given the significance of UOA II Parcels.

2) Financial Performance

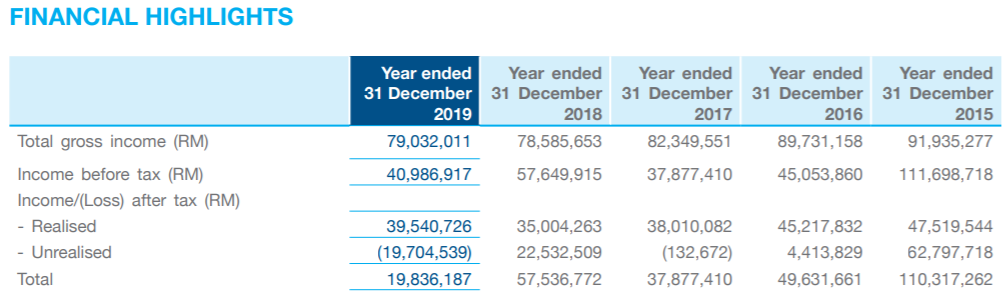

Looking at the financial performance in FY19 itself, the gross income (including other income) has improved from MYR78.6 mil in FY18 to MYR79.0 mil in FY19. The improvement is mainly due to the increase in overall occupancy rate.

The profit after tax, on the other hand, appears to have slipped from MYR57.5 mil in FY18 to MYR19.8 mil in FY19. However, this is mainly due to unrealised fair value gain of MYR22.5 million from investment properties in FY18 and unrealised loss of MYR19.7 million in FY19 mainly from the deferred tax arising from the fair value adjustment in properties.

Looking at the realised profit after tax itself, the performance has improved by approximately 12.9% year-on-year from MYR35.0 million in FY18 to MYR39.5 million in FY19.

Given that this is our first post on UOA REIT, let’s have a high-level look at the past financial performance. If we were to look at the realised profit after tax of FY15 to FY18, it appears to have declined from MYR47.5 mil in FY15 down to MYR35.0 mil in FY18. The decline is due to the decline in occupancy rate mainly from Wisma UOA Pantai which have subsequently been sold off in FY18. Another contributor is from the decline in occupancy rate in UOA II Parcel.

Going forward, investors should definitely pay close attention to the UOA II Parcel performance post enhancement exercise. The impact of COVID-19 on the performance of UOA REIT should also be an area to look out for.

3) Distribution Per Unit (DPU)

The dividend yield of UOA REIT is at 7.41% based on the closing price in December 2019. Which is a relatively reasonable yield. Looking at the historical distribution, the DPU appears to have declined from 11.02 cents in FY15 to 9.11 cents in FY9. There is a slight pickup in FY18 post disposal of Wisma UOA Pantai.

Going forward, it will be depending on management’s ability to improve the occupancy rate of UOA II parcel and to remain resilient from the impact of COVID-19.

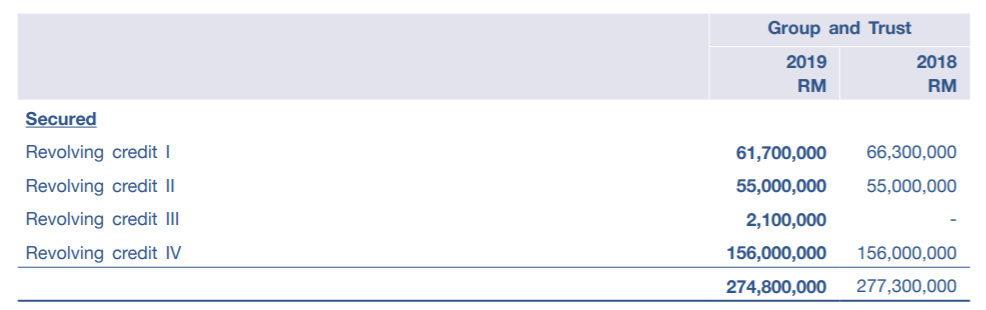

4) Gearing and Borrowing

They have a total borrowings of MYR274.8 mil mainly through revolving credit facility which is subject to periodic review and repayable on demand. The ‘repayable on-demand’ feature on the facility definitely poses risk in the event where the loan is called upon.

However, the manager is of the opinion that the facility will be rolled over and to remain available.

Another area on the facility is the interest rate where it will be reviewed on a periodic basis. This would lead to interest rate fluctuation risk. However, given the recent reduction in interest rate announced, that would be favourable news to them.

As at 31 December 2019, they have a gearing ratio of 26.3% which is below the permissible limit. This would give them a huge debt headroom for further acquisition and enhancement initiatives.

5) Price to Book ratio

The NAV per unit as at 31st December 2019 is at MYR1.671. This would come up with a price to book ratio of 0.73 based on the closing traded price in 2019. We will let you decide if this is worth buying.

Summary

Overall, the financial performance of UOA REIT has improved slightly upon the disposal of Wisma UOA Pantai in FY18. Further, there is an improvement in occupancy for 3 of their properties which make up a huge proportion of the portfolio. This may be a plus to UOA REIT going forward provided the occupancy rate remains stable.

However, the decline in occupancy for UOA II Parcel will definitely be of concern given the significance to the portfolio. It will very much depend on the management ability to push up the occupancy rate of UOA II Parcel as well as to fare through the uncertainty of COVID-19.

That’s it for our analysis on UOA REIT. What is your take on this REIT? Share your thoughts with us at the comment below.

If you like this analysis, here is more REIT analysis.

UOA REIT debt is 100% in revolving credit, which is short term in nature, renewable on 1 to 6 months. Although the chances is rare, but should issuer decides to stop the renewal, things would go ugly in very short time.