KIP REIT (KLSE: 5280) is a Malaysian based retail REIT which was recently listed in the Bursa Malaysia market on February 2017. The assets are located mainly in the populated suburban area in Johor, Negeri Sembilan, Melaka and Selangor. As at 30 June 2020, KIP REIT properties are valued at MYR 807 mil consisting of 7 properties.

Of the 7 properties, 6 of the properties are acquired since the date of IPO with AEON Mall Kinta City newly acquired in July 2019 during the financial year. Upon acquisition, it has been providing tremendously result to KIP REIT. Looking at the total properties composition, the newly acquired building account for the biggest proportion of the asset.

In this post, we will look into the operational and financial performance of KIP REIT in FY2020.

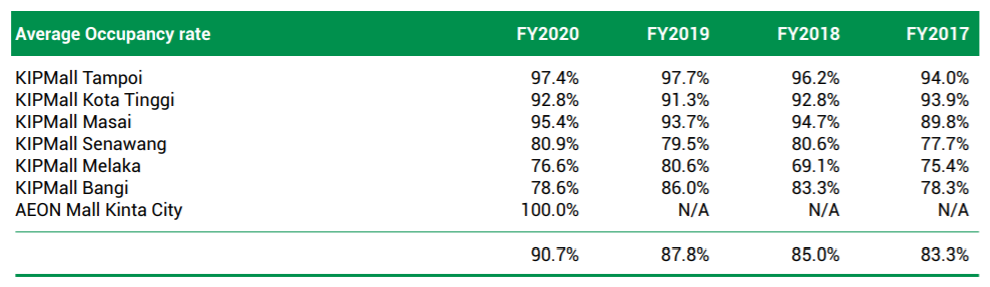

1. Overall improvement in average occupancy rate contributed by newly acquired properties

Looking at the 6 existing KIP buildings, there have been a mixed in the individual property occupancy rate where 3 properties has an increase in occupancy rate with another 3 having a slight decline in occupancy rate. The overall decline is due to the dampened consumer demand from the uncertainty of the COVID-19 pandemic.

The highlight of FY20 is the completed acquisition of AEON Mall Kinta City in July 2019. Upon the successful acquisition, it has also allowed KIP REIT to expand its exposure into Perak. The acquisition of AEON Mall Kinta City is entered through a triple-net-lease with AEON Co. Sdn. Bhd. as the Master Lessee. For those who are new to this term, what is meant is AEON Co Sdn Bhd will be bearing the majority of the property expenses. This would reduce the expenses exposure of KIP REIT.

The lease with AOEN Co Sdn Bhd will expire on FY26 giving securing them with a guaranteed rental income for the next 5 years.

2. Improved FY20 financial performance from the newly acquired AEON Mall

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 26,350 | 62,773 | 63,065 | 74,540 |

| Net Property Income | 17,525 | 41,918 | 41,953 | 56,018 |

| Net Realised Income | 14,660 | 34,293 | 30,692 | 31,851 |

The revenue and net property income of KIP REIT have been on a stable and increasing trend since their IPO in FY17. As both the revenue and net property income growth have been stable, we will look at the net realised income for the sake of this analysis.

Looking at the net realised income, the huge increased from MYR 14.7 mil in FY17 to MYR34.3 mil in FY18 is mainly attributed by the full-year performance in FY18. As the listing was only completed in February 2017, the FY17 result would only reflect approximately 5 months of results.

In FY19, the net realised income declined from MYR 34.3 mil in FY18 to MYR 30.7 mil in FY19. The decline is attributed to due to the increase in total borrowing and hence finance cost to finance solar photovoltaic system and AEON Mall Kinta City acquisition down payment. Furthermore, there has been an increase in management fee expenses.

Based on the latest annual report, the performance has further improved from MYR 30.7 mil in FY19 to MYR31.9 mil in FY20 due to the acquisition of AEON Mall Kinta City. As shared earlier, the newly acquired property account for the biggest proportion of the assets. This acquisition would definitely be a plus to KIP REIT.

3. Increased gearing due to new acquisition but still within a healthy range

| FY17 | FY18 | FY19 | FY20 | |

| Gearing | 14% | 14% | 16% | 37% |

| Fixed: Variable ratio | 100%:0% | 0%:100% | 0%:100% | 68%:32% |

As at 30 Jun 2020, KIP REIT has a total borrowings of MYR 312.4 million. Throughout FY17 to FY19, the loan profile has been mixed of either fixed or variable. But if we were to look at the loan profile of FY20, of the total loan, 68% of the loan is fixed in nature whereas 32% of it is variable. This would give KIP REIT 68% certainty in borrowing cost with 32% of the loan subject to interest rate risk. Given the interest rate cut in Malaysia, this would be potentially favourable to them in the short term.

The gearing level has been increasing from 14% in FY17 to 37% in FY20 from the acquisition of AEON Mall Kinta City. This is still within a healthy range and way below the permissible limit of 50% still giving them ample opportunities to further grow.

Read More: How does Interest Rate Affect REITs

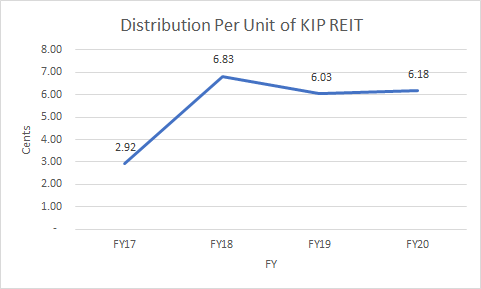

4. Mixed DPU Performance

Distribution Per Unit, one of the aspect investors would be keen to look at have been experiencing a slight mix in performance. In FY19, the DPU dropped from 6.83 cents to 6.03 cents consistent to the dropped in net realised income as explained in the earlier points.

In FY20, the DPU increased from 6.03 cents in FY19 to 6.18 cents. The increased is contributed by the acquisition of AEON Mall Kinta City. Looking at the performance moving forward, the uncertainty of COVID-19 pandemic might impact KIP REIT overall performance, especially on the 6 older properties.

Summary

Looking at the overall performance of KIP REIT, they are a relatively new REIT with only 4 years of performance to look at. Overall their performance has been fairly stable despite the uncertainty of the COVID-19 pandemic. They will still have to fare through the dampened consumer demand with the controlled movement in Malaysia. The newly acquired AEON Mall has contributed to KIP REIT performance in FY20 with the mix in performance of the other 6 properties. Investors who are keen should definitely keep a lookout of the 6 older existing properties.

Comparing the NAV per unit as at 30 June 2020 of MYR 1.01 to the latest traded price of MYR 0.80, it would give investors a price to book of approximately 0.79. As usual, we will let you decide if this is worth investing it.

What are your thoughts on KIP REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.