Al-Salam REIT (KLSE: 5269) is a diversified Islamic Malaysian based REIT listed in the Bursa Malaysia market on September 2015. The REIT’s operations include retail, office, education and F&B sector which consists of both restaurant and non-restaurant outlets. They are a shariah-compliant REIT which mean their operations are in compliance with the Islamic REIT Guidelines.

Read more: Understanding the REIT structure and its underlying expenses

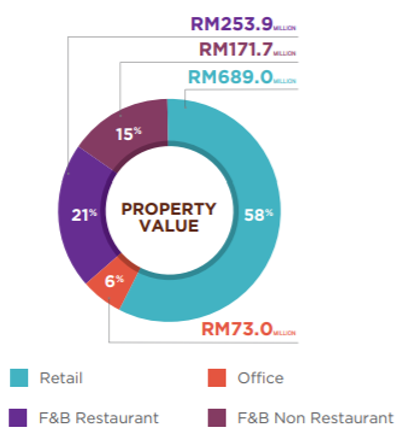

As of 31 December 2019, Al-Salam REIT owns 49 real estate properties. Though they are asset-heavy based on the number of properties, the retail sector which consists of only 3 properties accounts for 58% of the overall composition.

In this post, we will dive deeper into the operational and financial performance of Al-Salam REIT based on its 2019 and 1H2020 results.

1. Declining occupancy rate of retail properties coupled with an increased in F&B properties

| FY17 | FY18 | FY19 | |

| Retail Segment | |||

| – Komtar JBCC | 95% | 95% | 60% |

| – @Mart Kempas | 92% | 99% | 99% |

| – Mydin Gong Badak | – | 96% | 100% |

| Office Segment | |||

| – Menara KOMTAR | 91% | 90% | 89% |

| F&B Restaurant | |||

| – Various properties | 22 (100%) | 22 (100%) | 38 (100%) |

| F&B Non-Restaurant | |||

| – Various properties | 5 (100%) | 5 (100%) | 6 (100%) |

| – Malaysian College of Hospitality & Management | 100% | 100% | 100% |

In regards to the operational performance, the occupancy rate of the retail segment which makes up the bigger proportion is on a declining trend. Komtar JBCC’s occupancy rate declined from 95% in FY17 to 60% in FY19 due to the increase in competition coupled with dampened consumer spending which had impacted its performance in 2019.

The second segment we will be looking at is the F&B restaurant and non-restaurant sector. These 44 properties are leased to QSR Group of Companies for the operations of KFC and Pizza Hut. The number of leased properties have increased from 27 properties in FY17 to 44 properties in FY19. An important aspect of these properties is they are entered on a triple lease agreement which means the tenant will be paying a huge proportion of the property expenses.

Looking forward, we would expect Komtar JBCC which make up a bigger proportion of the retail assets to further be affected. They are located close to the border of Singapore and hence the huge reliant on Singaporean’s consumer. The strict travel restriction will potentially affect Al-Salam REIT negatively.

2. An overall decline in net realised income

| MYR in 000s | FY17 | FY18 | FY19 |

| Revenue | 80,033 | 82,151 | 94,912 |

| Net Property Income | 56,887 | 58,245 | 69,121 |

| Net Realised Income | 35,542 | 31,867 | 28,395 |

Both the revenue and net property income increased from MYR 80.0 mil in FY17 to MYR 94.9 mil in FY19 and MYR 56.9 mil to MYR 69.1 mil in FY19 respectively. The improvement in FY18 compared to FY17 to FY18 is mainly attributed to the addition of Mydin Gong Badak late FY18 coupled with an improvement in occupancy of Mart Kempas. In FY19, the increase is mainly due to:

- Full-year result of Mydin Gong Badak

- Addition of approximately 17 new F&B properties

Despite the improvement in revenue and net property income, net realised income, on the other hand, have declined from MYR 35.5 mil in FY17 to MYR 28.4 mil in FY19. The dropped is mainly attributed to the lower net income of Komtar JBCC with occupancy rate declining from 95% down to 60% in FY19.

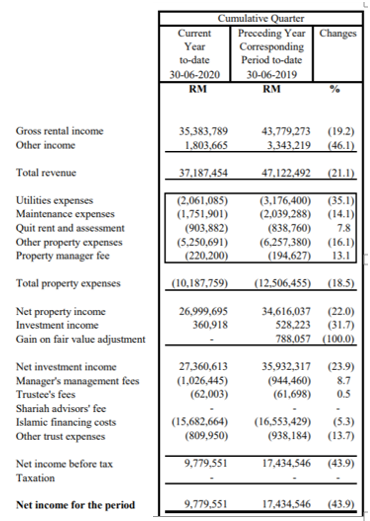

3. Declining 1H 2020 Performance

Based on the latest available quarterly report, the net income had declined from MYR 17.4 mil in 1H19 to MYR 9.8 mil in 1H20. Overall, all the properties sector experienced a decline in performance due to the rental rebate granted to tenants arising from the Covid-19 pandemic and MCO since mid-March 2020. The retail sector with account for a major proportion of the properties composition took the biggest hit with the retail sector NPI declining by 38.8% compared to the previous half.

Financing cost which comprises of a huge proportion of the expenses has declined by 5.3%. This decline is attributed mainly from the lower OPR rate due to the interest rate cut.

4. Borrowing variable in nature with relatively high gearing

| FY16 | FY17 | FY18 | FY19 | |

| Gearing | 36% | 36% | 44% | 48% |

As at 31 December 2019, Al-Salam REIT has a total borrowings of MYR 597 million. Of the total loan, all of it is variable in nature. A variable loan can be both beneficial and adverse to a REIT. The downside of variable loan is that they are subject to interest rate risk. The positive aspect, on the other hand, is that a cut in interest rate would be favourable to them which is what they are experiencing at the moment

The gearing level is relatively high at 48% in FY19 which is still below the permissible limit. This is an area investors would need to keep an eye on with gearing level increasing from 36% in FY16 up to 48% in FY19.

Read More: How does Interest Rate Affect REITs

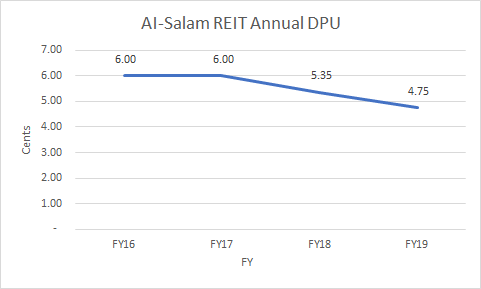

5. Declining Distribution Per Unit (DPU)

Distribution per unit is an aspect which attracts investors to REIT in the very first place. Hence, it only makes sense to look at the DPU of Al-Salam REIT. Looking at their historical DPU, it has been on a declining trend from 6 cents from FY16 to 4.75 cents in FY19. The decline is consistent with the drop in net realised income following a poor performance of the retail segment.

With the uncertainty of the COVID-19 pandemic, we would expect the distribution per unit to continue to decline.

Summary

The performance of Al-Salam REIT is heavily reliant on two aspects (i) the properties in the retail sector and (ii) the F&B properties leased to QSR Group of Companies for the operations of KFC and Pizza Hut. Performance of the retail sector has declined in FY19 mainly from the poor performance of Komtar JBCC. With the outbreak of COVID-19 pandemic, this would further affect the retail sector.

Despite a low price to book of 0.60 comparing the latest traded price against the NAV as at 31 December 2019 of 1.06, we find that the performance of the properties will continue to be poor at least for the short term. Coupled that with the high gearing and declining DPU, we will let you decide if this is worth investing.

What are your thoughts on AmanahRaya REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.