Tower REIT (KLSE: 5111) is a Malaysian based REIT which invest mainly in commercial real estate. They were listed on the Bursa Malaysia market back in April 2006. As at 30 June 2020, they owned two commercial properties, Menara HLX and Plaza Zurich valued at MYR 342.3 mil and MYR 220.3 mil respectively.

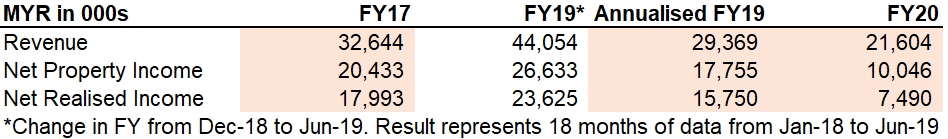

For investors who are new to Tower REIT, it is important to know that there was a change in Tower REIT financial year from 31 December 2018 to 30 June 2019. Hence, the comparative information in FY19 would reflect 18 months of performance as compared to 12 months of data in both FY17 and FY20.

As a result of the change in the financial year, many were confused assuming the performance have improved. In reality, the performance was merely a reflection of 6 months of additional data. With the release of the latest FY20 annual report, we will look into how Tower REIT has performed.

1. Overall Decline In Occupancy Rate

| FY17 | FY18 | FY19 | FY20 | |

| Menara HLX | 51% | Change FY | 34% | 21% |

| Plaza Zurich | 58% | Change FY | 64% | 67% |

There has been no change in the number of properties owned by Tower REIT since FY15 and the REIT’s operations are wholly reliant on these two key properties. Menara HLX accounts for 61% of the overall properties composition when compared to Plaza Zurich. It is located in the heart of Kuala Lumpur near the city main business district. Despite the strategic location, the occupancy rate has declined from 51% in FY17 to 21% in FY20.

The decline is mainly attributed to the oversupply situation, especially for commercial office space. Further, the COVID-19 pandemic would have further contributed to the decline. Given the fact that Menara HLX accounts for a huge proportion of the REIT operations, the performance of the REIT is highly dependent on Menara HLX. This would be a challenging obstacle for the management to fare through with the existed oversupply coupled with the uncertainty in COVID-19 pandemic.

Plaza Zurich performance, on the other hand, has improved with the occupancy rate growing from 58% in FY17 to 67% in FY20.

2. Deteriorating financial Performance

Looking at the financial results at a first glance, it looks at though performance has improved in FY19. However, it is important to note that the results in FY19 represent 18 months of data as there has been a change in the Tower REIT financial year-end. Upon annualizing the financial result in FY19, we noted that the revenue and net property income have both declined year on year.

Similarly, the net realised income has declined from MYR18 mil in FY17 to MYR 7.5 mil in FY20. The decline is mainly attributed to the poor outlook of the commercial office space with a supply glut which resulted in a massive decline in the occupancy rate for Menara HLX.

3. Low debt with massive headroom for growth opportunities

Historically, Tower REIT has zero to low borrowings level. However, as at 30 June 2020, there has been a slight increase in borrowing of MYR 24 mil representing a gearing of 4%. Despite the debt, there is still a massive headroom for growth opportunities which is what Tower REIT needed.

We will discuss further on the growth opportunities in the following point.

4. Proposed Acquisition of Guoco Tower

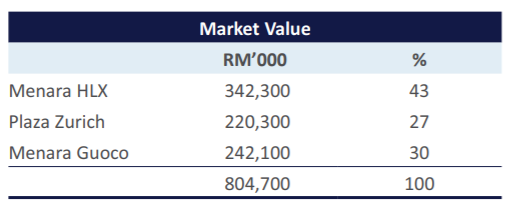

During the year FY20, the management has proposed the acquisition of Guoco Tower for a cash consideration of MY 242.1 million of which will be fully funded by debt financing. Given the low gearing of Tower REIT, this is a massive growth opportunity to the already struggling existing operations.

Upon the completion of the acquisition, the expected market value of the investment properties would be at MYR 804.7 mil.

Guoco Tower is located in the commercial heart of Damanssary City with green building features and Multimedia Super Corridor (MSC) Malaysia Cycbercentre Status. The building currently enjoys an occupancy rate of 97.1% consisting of tenants from both multinational corporations and local companies.

This would be an area where investors who are interested in Tower REIT should look out for to see if the proposed acquisition will help grow the REIT.

5. Declining distribution per unit

| Cents | FY17 | FY19 | FY20 |

| Reported | 6.0 | 8.0 | 2.4 |

| Annualised | 6.0 | 5.4 | 2.4 |

Annualised distribution per unit to no surprise is on a declining trend. If we were to annualised the FY19 DPU for a better comparison, the distribution per unit has declined from 6.0 cents in FY17 to 2.4 cents in FY20. This is in line with its declining financial performance. With the proposed acquisition of Guoco Tower due to be completed early FY21, investors can keep a lookout on whether the DPU would have improved.

Summary

Based on our high-level analysis of Tower REIT, we are in the view that its existing operational and financial performance has been a declining trend and it will take a massive turnaround for the management to effect change on the existing properties. The positive aspect of Tower REIT, on the other hand, is they have a tremendously low gearing. This would give them a huge headroom for further growth opportunities. Even with the proposed acquisition of Guoco Tower fully finance by debt, this would still give them ample of debt headroom for further acquisition and enhancement exercise.

From the NAV per unit as at 30 June 2020 of MYR 1.89 as compared to the latest traded price of MYR 0.61, this would give investors a price to book of 0.32. As usual, we will let you decide if this is worth investing.

What are your thoughts on Tower REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.