Axis REIT is one of the few REITs in Malaysia which invests heavily in industrial and business space assets. There were listed in the Bursa Malaysia Market on August 2005 with 53 properties valued at MYR 3.3 billion as at 31 December 2020. Apart from business space and industrial properties, Axis REIT also invests in office and retail properties.

They are one of the 5 REITs in Malaysia with industrial asset exposure as at the date of this writing. In this post today, we will be looking into Axis REIT FY20 performance. As usual, we will also be discussing on its historical performance to help investors understand the REIT better.

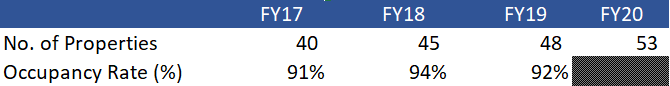

1) Continuous expansion of its properties from FY17 to FY20

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| No. of Properties | 40 | 45 | 48 | 53 |

| Properties Valuation | 2,482,200 | 2,798,500 | 2,990,610 | 3,280,240 |

The REIT Manager has been proactive in the overall growth of Axis REIT. They have grown from 40 properties in FY17 to 53 properties bringing their total properties valuation up to approximately MYR 3.3 billion. This is through their active development and acquisition strategy which is a plus as it helps in the inorganic growth of Axis REIT. The 5 new properties which was acquired in FY20 was as follows:

- Acquisition of Axis Facility 2@ Nilai on 28 February 2020 for a purchase consideration of MYR 50 million.

- Completed acquisition of Axis Facility 2 @ Bukit Raja on 7 March 2020 for a purchase consideration of MYR 37 million.

- Acquisition of D37c Logistics Warehouse on 9 June 2020 for MYR 65 million.

- Acquisition of Axis Shah Alam Distribution Centre 5 on 10 November 2020 for MYR 95 million.

- Completed acquisition of Axis Industrial Facility @ Shah Alam on 3 December 2020 for MYR 11.87 million.

Looking back, there were only 6 properties in their portfolio back in 2006. To grow to where they are today is definitely commendable.

2) Stable occupancy rate from FY17 to FY19

No doubt that Axis REIT has been growing inorganically through the REIT manager proactive growth strategy. If we we were to look into its operational performance, it has been stable throughout the years. Its overall occupancy rate has been stable at a range from 92% to 95% throughout FY17 to FY19. In terms of FY20, there is no available data for us to comment on.

One great aspect of Axis REIT is the level of diversification of their properties. Though they are predominantly operating in the industrial space, they too have a small exposure in both office and retail properties.

3) Stable increase in overall financial performance from FY17 to FY20

| MYR in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 172,715 | 210,588 | 222,464 | 232,234 |

| Net Property Income | 146,203 | 182,761 | 191,708 | 198,518 |

The next area we will look into is the financial performance of Axis REIT. Looking at its net property income, it has grown from MYR 146.2 million in FY17 to MYR 198.5 million in FY20. This is in line with its stable occupancy rate as well as Axis REIT’s efforts in expanding its portfolio.

The impressive part of its performance is that despite the uncertainty of COVID-19 pandemic, they still managed to record an increase in its net property income. With the addition of their newly acquired properties, this will further boost the growth of Axis REIT.

4) Increase in distribution per unit from FY17 to FY19 with a drop in FY20

| MYR in cents | FY17 | FY18 | FY19 | FY20 |

| Distribution Per Unit (DPU) | 8.26 | 8.74 | 9.26 | 8.75 |

In terms of distribution per unit, Axis REIT has a year on year increase in distribution per unit from FY17 to FY19. However, in FY20, they have a dropped in DPU from 9.26 cents in FY19 to 8.75 cents in FY20.

Based on its share price of MYR 2.03 as at 31 December 2020, this would give investors a yield of 4.3%.

Read More: Why you should not buy REIT purely from its dividend yield

5) Gearing level within healthy range

| FY17 | FY18 | FY19 | FY20 | |

| Gearing | 33% | 37% | 29% | 33% |

As at 31 December 2020, Axis REIT has a total borrowings of MYR1.1 billion. This translates to a gearing level of 33% which in our view are fairly healthy. Furthermore, the gearing level of Axis REIT is well below the permissible limit of 50% giving them ample debt headroom for future acquisition and asset enhancement initiatives.

This is definitely a plus given their constant proactive acquisition initiatives in growing the REIT. Not only that, the healthy gearing level will definitely be beneficial to them in an uncertain COVID-19 environment.

Read More: How does interest rate affect REITs

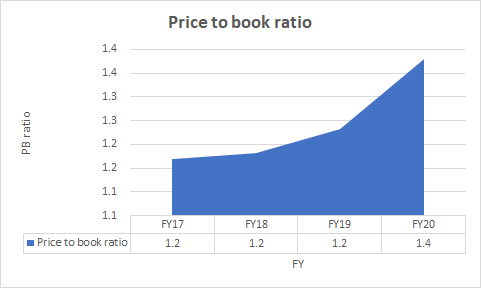

6) Price to book ratio

Based on its 31 December 2020 net asset value per unit of MYR 1.47 and closing price of MYR 2.03, this would give investors a price to book ratio of 1.4. This is high when compared to its preceding 3 years. On one end, the valuation is high for a reason due to the great outlook of Axis REIT and on the other end, investors would then have to decide if this is worth investing in.

7) Growth Prospect

In terms of the growth prospect of Axis REIT, the REIT manager remains cautious in this uncertain COVID-19 pandemic climate. Management has commented that while pandemic impact on Axis REIT has been manageable thus far, any further uncertainty or prolonged pandemic may impact their performance in FY21.

Nevertheless, the manager has remain cautious in its capital management. Its healthy gearing level would allow them to continue their acquisition initiatives. As at 31 December 2020, there are a few material events worth pointing out:

- On 19 November 2020, Axis REIT has executed an SPA for a proposed acquisition of 3 1 ½ storey detached factories within Kawasan Perindustrian i-Park in Johor for a total proposed purchase consideration of MYR 28.2 million. One out of the 3 proposed acquisitions was completed on 12 January 2021 and now known as Indahpura Facility 2. As for the 2 remaining properties, due diligence are still ongoing.

- 2 letter offer for proposed acquisition of (i) manufacturing facility located in Kawasan Perindustrian Bukit Raja Selatan, Shah Alam, Selangor and (ii) warehouse located in Mukim of Plentong, Johor Bahru has been duly accepted.

Summary

Based on our summary, Axis REIT has no doubt been growing historically. They have been fairly resilient despite the COVID-19 pandemic though the management did said that any prolonged pandemic may impact Axis REIT in FY21. The management proactive acquisition is the main driver of the growth of Axis REIT and with the healthy gearing level, there’s still ample headroom for them to further grow.

What are you thoughts on Axis REIT FY20 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.