Parkway Life REIT is one of Asia’s largest listed healthcare REITs by asset size. It is based in Singapore having listed on the Singapore stock exchange since August 2007. They invest predominantly in healthcare-related assets such as hospitals, and nursing homes.

As at the date of writing, Parkway Life REIT owns a well-diversified portfolio of 55 properties across Singapore, Malaysia, and Japan. They own 51 assets in Japan, 3 hospitals in Singapore, and 1 specialist clinic in Malaysia. REITs in the healthcare sector are known to be defensive as compared to REITs in other sectors such as retail and hospitality. In this post, we will look into Parkway Life REIT FY20 and 1H21 performance to see how it has performed.

Historical Performance (FY18 – 20)

1. Assets mainly concentrated in Singapore and Japan with favourable features

While having presence across 3 countries, its assets are mainly concentrated in Singapore and Japan. Its portfolio of 3 properties in Singapore accounts for 57.4% of its total assets while Japan accounts for 42.5% of the total. In this 2 key markets, Parkway Life REIT has entered into a contract with favourable features.

In Singapore:

- They have signed a long term master lease with Parkway Hospitals Singapore for a 15 + 15 years from August 2007

- The lease agreeement is entered via a triple net lease arrangement which mean Parkway Life REIT does not bear costs such as property tax, property insurance, and other property operating expenses

- Built in rental escalation which guarantees a minimum1% growth annually

Likewise in Japan:

- Healthy average lease expirty of 11.29 years enabled through a long master lease structure

- Built in “Up-only” rental review

These distinct features are no doubt favourable as they enable Parkway Life REIT to grow organically while minimizing expense.

2. 100% occupancy rates in key markets

Its Japan and Singapore assets which account for 99.9% of the total enjoy a healthy 100% occupancy rate as at 31 December 2020. This is an amazing performance especially when we factored in the built-in rental escalation. Essentially this meant that in a stable environment, Parkway Life REIT rental income would grow purely from the positive rental reversion.

MOB Specialist Clinics which is located in Malaysia on the other hand has an occupancy rate of 31%. Having said that, its asset in Malaysia which account for only 0.1% of the total would not be a material contributor to the overall performance.

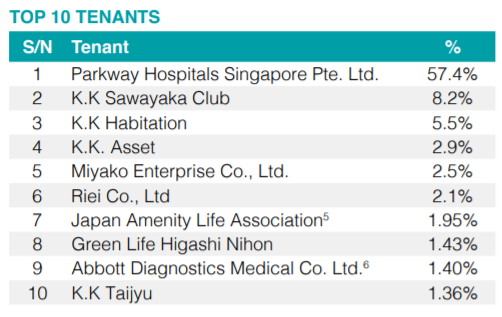

An aspect which is worth pointing out is the tenant concentration risk which is fairly common in the healthcare REIT sector. Parkway Hospital account for approximately 57% of the total. Nevertheless, investors can be rest assured by the quality reputation of Parkway Hospital which minimise the overall risk of default.

3. Year on year increase in financial performance

| SGD in 000s | FY18 | FY19 | FY20 |

| Revenue | 112,838 | 115,222 | 120,892 |

| Net Property Income | 105,404 | 108,225 | 112,528 |

Looking at its financial performance, Parkway Life REIT has reported a year on year increase in performance. Revenue increase from SGD 112.8 mil in FY18 to SGD 120.9 mil in FY20. This increase is mainly contributed by the built-in rental reversion in both its Japan and Singapore assets.

4. Stable and increasing distribution per unit

| SGD in cents | FY18 | FY19 | FY20 |

| Distribution per unit | 12.87 | 13.19 | 13.79 |

Likewise, Parkway Life REIT has reported a stable and positive distribution per unit over the years. This is no doubt a favourable point to investors. However, Parkway Life REIT being a defensive REIT in general would be traded at a slight premium as compared to its peers. As a result, the dividend yield may not necessarily be attractive, Based in its latest trades price, this would give investors a yield of c.2.8% which is not that great. We will let you decide and weigh in on the following.

5. Healthy gearing level

As at 31 December 2020, Parkway Life REIT has a total borrowings of SGD 796 mil representing a gearing level of 38.5%. This is below its permissible limit giving them ample debt headroom for further acquisition and asset enhancement initiatives.

1H21 Performance

6. Divested 1 properties with an acquisition of 2 new properties in Japan

In 1H21, Parkway Life REIT divested one of its non core asset at a sale yield of 4.3%. Likewise, they have further acquired 2 nursing homes in Japan and 7.7% below valuation price.

7. Financial Performance decline slightly in 1H21

In 1H21, Parkway Life REIT reported a slight decline in financial performance. Revenue decline from SGD 60.1 mil in 1H20 to SGD 59.6 mil in 1H21. The decrease was largely attributable to the divestment of P-Life Matsudo early this year and the depreciation of Japanese Yen.

Nevertheless, its distribution per unit in 1H21 has increased as compared to 1H20. This is mainly due to the COVID retention amount in the prior year.

Summary

Based on our overall analysis, Parkway Life REIT remains to be a defensive REIT with great operational and financial outlook. The question investors need to ask if it make sense to pay a premium for Parkway Life REIT with an overall distribution yield which is not as attractive as compared to other REITs.

What are your thoughts on Parkway Life REIT FY20 and 1H21 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

If you are looking for a brokerage account, Tiger Brokers is currently offering a deal of a lifetime that you might not want to miss.

- Registration: 500 Coins

- Account Opening: 60 Commission-Free Trades within 180 Days (Applicable for U.S. stocks, H.K. stocks, Singapore stocks and Australian stocks )

- Funding your account with more than ≥ SGD 2,000: 1 FREE Apple(NASDAQ: AAPL)share

Do consider using our link and promo code “REITPULSE” as this will support our blog while earning some rewards. Likewise, you can read more on our reviews on Tiger Brokers.

Do join our community over at Facebook and Instagram.