KIP REIT is a Malaysia-based REIT that invests predominantly in retail assets across Malaysia. Since our last post on KIP REIT, there have not been many major developments. As at 30 June 2021, KIP RET owns 7 retail assets which are mainly located in the suburban area in Johor, Negeri Sembilan, Melaka, and Selangor.

With the recent release of its FY21 annual report, we will dive deeper into KIP REIT FY21 performance to see how it has performed.

1. Slight decline in the overall occupancy rate

| FY19 | FY20 | FY21 | |

| KIPMall Tampoi | 98% | 97% | 89% |

| KIPMall Kota Tinggi | 91% | 93% | 88% |

| KIPMall Masai | 94% | 95% | 89% |

| KIPMall Senawang | 80% | 81% | 78% |

| KIPMall Melaka | 81% | 77% | 80% |

| KIPMall Bangi | 86% | 79% | 82% |

| AEON Mall Kinta City | n.a | 100% | 100% |

| Average Occupancy | 88% | 91% | 90% |

Looking at one of the key drivers of REITs, KIP REIT has a slight decline in occupancy rate from 91% in FY20 to 90% in FY21. From a 3 years standpoint, its occupancy rate is fairly stable. Having said that, there are few areas we would like to point out

Firstly, the overall occupancy rate which appears to be improving in FY20 is mainly driven by AEON Mall Kinta City which was only acquired in FY20. AEON Mall Kinta City retains its 100% occupancy rate based on its master lease agreement with AEON. This is no doubt a plus to KIP REIT as a whole.

Now looking at its other assets performance in FY21, almost all of its assets experienced a slight decline in occupancy rate except for KIPMall Melaka and KIPMall Bangi. The biggest drop is from KIPMall Tampoi and KIPMall Masai where a decline of 8.9 and 6.5 percentage points respectively was seen. This is due to a transitionary period for fitting out works conducted by the anchor tenants during the financial year.

While the occupancy rate has slightly dipped, KIP REIT is currently focussing on its leasing strategies to bring in new and exciting partnerships.

2. Decline in revenue but overall increase in net property income

| MYR in 000s | FY19 | FY20 | FY21 |

| Revenue | 63,065 | 74,540 | 74,249 |

| Net Property Income | 41,953 | 56,018 | 56,662 |

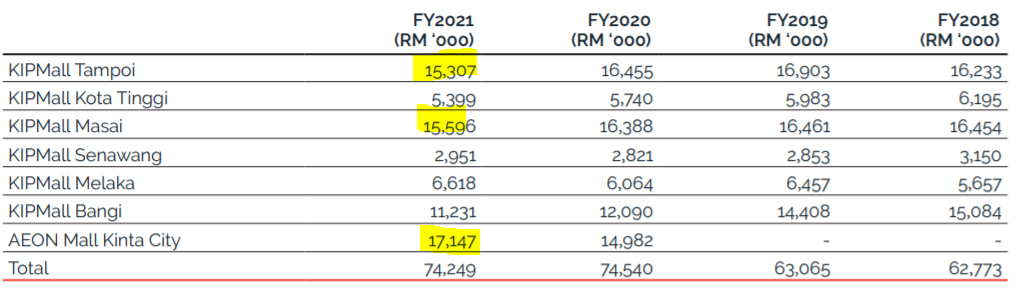

In terms of its financial performance, KIP REIT reported a slightly interesting financial performance. While its revenue has declined from MYR 74.5 mil in FY20 to MYR 74.2 mil in FY21 due to the impact of COVID-19, its overall net property income saw a marginal increase. This is due as a result of greater operational efficiencies driven by tighter fiscal management, a 10% discount on electricity expenses granted to the properties as part of the Covid-19 package, and a decrease in reimbursements costs following the streamlining of workflow and structuring of headcount at the property management level.

From an individual property standpoint, AEON Mall Kinta City, KIP Mall Tampoi and Masai are the top revenue contributors. AEON Mall Kinta City continues to be one of the top contributors with KIPMall Tampoi and Masai reporting a continuous year-on-year decline in overall revenue.

3. Year on year increase in distribution per unit

| MYR in cents | FY19 | FY20 | FY21 |

| Distribution Per Unit | 6.03 | 6.18 | 6.84 |

Distribution per unit has increased from 6.03 cents in FY19 to 6.84 cents in FY21. This is a fairly commendable performance given that most REITs has suffered a decline in distribution due to the pandemic. This growth is fairly in line with its overall improvement in overall financial performance. Having said that, the decline in occupancy rate and revenue will definitely be an area investors need to keep a close lookout on.

Based on its closing traded price, this will give investors a dividend yield of c.8%.

Read More: Why you should never buy a REIT just because they have a high dividend yield

4. Fairly healthy debt profile

| % | FY19 | FY20 | FY21 |

| Gearing | 15.9% | 37.10% | 37.0% |

As at 30 June 2021, KIP REIT has a total borrowings of MYR 313 million. This translates to a gearing level of 37% which is below the permissible limit giving them ample debt headroom for further acquisition and asset enhancement initiaitves. Its recent acquisition of AEON Mall Kinta City has no doubt benefited KIP REIT as a whole.

Of its total borrowings, 68% of its debt are fixed-rate in nature with the remaining 32% subject to interest rate risk Given the current low-interest-rate environment, this will be beneficial to KIP REIT overall.

5. Proposed placement of 101,060,000 units in KIP REIT

On the 13th August 2021, KIP REIT has announced its proposed placement of 101,060,000 units in KIP REIT to raise MYR 80.8 mil. These funds will be used mainly for future acquisition needs whenever opportunities arise.

Summary

Based on REIT Pulse overall analysis, KIP REIT has performed fairly okay compared to other REITs in Malaysia. Its financial performance and distribution have increased over the years. The downside is that its revenue and occupancy are on a slight decline. In FY21 itself, AEON Mall has been a huge contributor to KIP REIT overall performance.

Comparing the NAV per unit as at 30 June 2021 of MYR 1.02 to the latest traded price of MYR 0.83, it would give investors a price to book of approximately 0.81. As usual, we will let you decide if this is worth investing it.

What are your thoughts on KIP REIT FY21 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

If you are looking for a brokerage account, Tiger Brokers is currently offering a deal of a lifetime that you might not want to miss.

- Registration: 500 Coins

- Account Opening: 60 Commission-Free Trades within 180 Days (Applicable for U.S. stocks, H.K. stocks, Singapore stocks and Australian stocks )

- Funding your account with more than ≥ SGD 2,000: 1 FREE Apple(NASDAQ: AAPL)share

Do consider using our link and promo code “REITPULSE” as this will support our blog while earning some rewards. Likewise, you can read more on our reviews on Tiger Brokers.

The form you have selected does not exist.

Do join our community over at Facebook and Instagram.