Sabana REIT is an industrial REIT listed in the Singapore Exchange in November 2010 with a diversified property portfolio of SGD 0.9 billion as at 31 December 2020. These comprise of 18 properties in 4 main industrial segments strategically located across Singapore. An interesting aspect of Sabana REIT is that they are Singapore first certified Shariah-compliant REIT.

Read More: Understanding REITs structure and the underlying expenses

1) Slight improvement in operational performance in FY20

Sabana REIT reported a slight improvement in operational performance in FY20 when compared to the previous year. The occupancy rate has improved slightly from 75.4% in FY19 to 76.5% in FY20. Likewise, rental reversion in FY20 is at positive 0.9% as compared to the negative reversion in FY19.

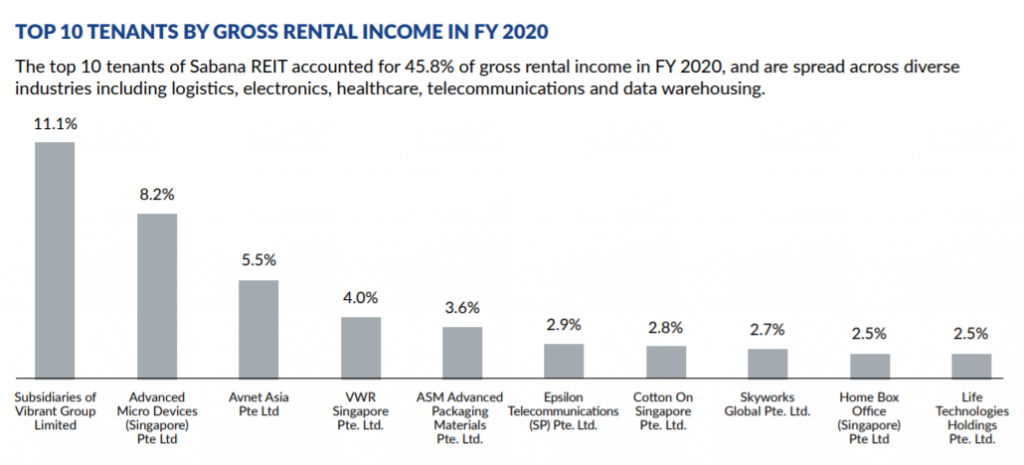

Deeper dive into the tenant profile exposes Sabana REIT to tenant concentration risk whereby the top 3 tenants account for 1/4th of Sabana REIT gross rental income in FY20.

An adverse event such as default or non-renewal by these cohorts of tenants can be detrimental to Sabana REIT. Having said that, it is part of the nature of industrial REITs to have a higher tenant concentration which is not something alarming but worth keeping an eye on.

2) Year on year decline in financial performance

| SGD in 000s | FY18 | FY19 | FY20 |

| Revenue | 80,961 | 76,338 | 71,701 |

| Net Property Income | 52,790 | 51,612 | 44,643 |

Despite the improvement in overall operational performance, the net property income of Sabana REIT declined from SGD 51.6 mil in FY19 to SGD 44.6 mil in FY20. This drop is mainly from a lower revenue recorded from 10 Changi South Street 2 due to the termination of a master lease. Likewise, the decrease is due to a higher impairment made for a certain cohort of tenants across the portfolio.

One could argue that this decline is due to the uncertainty of COVID-19. However, an area that would be concerning is that its financial performance has been declining year on year since FY18. It will be interesting to see how this would play out with the vaccination initiatives in place.

3) Year on year decline in distribution per unit

| SGD in cents | FY18 | FY19 | FY20 |

| Distribution per unit | 3.18 | 2.92 | 2.76 |

Distribution per unit has likewise declined from 3.18 cents in FY18 to 2.76 cents in FY20 in line with the overall drop in financial performance. Based on the closing price as at 31 December 2020, this would give investors a yield of c.6.0% which is not too bad. However, as we have always pointed out, a high yield does not always mean that the REIT is ideal. You can read more on this topic where we have shared on why you should never buy a REIT just because they have a high dividend yield.

Read More: Why you should never buy a REIT just because they have a high dividend yield

We will leave it to you to decide if this is worth investing in.

4) Overall healthy debt profile

The one positive aspect of Sabana REIT we like about is its overall debt profile. As at 31 December 2020, Sabana REIT has a total borrowings of c.SGD284 million. This translates to an overall gearing of 33.5% which is way below the permissible limit given them ample debt headroom for future acquisition and asset enhancement initiatives.

From its total debt borrowings, c.50% of its is variable in nature. Depending on how you view it, this could be both bad and good. Bad as 50% of its debts would be subject to interest rate risk. However, given the low-interest rate climate, this is favorable to Sabana REIT overall where the average financing cost has declined from 4.2% in FY18 to 3.1% in FY20.

Summary

Purely looking at Sabana REIT overall operational and financial performance, there has been a slight mix in results. On one end, Sabana REIT operational performance has improved slightly in FY20 as compared to FY19. However, its financial performance and distribution to investors have overall declined. What caught our attention is the fact that this has been a year-on-year decline from FY18.

Investors who are purely looking at yield might be leaning towards Sabana REIT and we will let you decide if this is a REIT worth investing into.

What are your thoughts on Sabana REIT performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.