Some of the questions people often asked prior to their REITs investment journey is how to get started in REIT investment? Where can I find information relating to REITs? The list goes on.

Investment is a subjective matter where everyone has a different opinion and take on the company performance. If you are new to REIT investment, it is perfectly normal to have countless questions as you are investing your hard-earned money.

By knowing each REITs in and out, you can better make an informed investment decision. In this post, we will be showing you where you can get all the necessary information to help you get started in the REITs investment journey.

1) Trading information

Let’s begin with the basic. The first thing you need to know is of course where to find trading information. Trading information are information such as latest trading price, trading volume, stock code, stock chart and etc.

What you need to know:

For educational purpose, let’s take a look at SUNREIT trading information from Bursa Malaysia interface.

Last Done: The most recent traded price (1.620) of the SUNREIT as at the period we are looking at.

Stock Code: Ticker symbol for SUNREIT.

Volume: Traded volume for the day.

High/Low: Market fluctuates throughout the day. These are indicators of the highest and lowest price for the day for SUNREIT.

Change: Change signifies the difference between the last done price and the open price (opening traded price).

Apart from Bursa Malaysia, these pieces of information can also be obtained from other sites such as Yahoo Finance and KLSE Screener to name a few.

2) REIT Performance

Whether or not a REIT is worth buying very much depends on their performance. Though we cannot predict how a REIT would perform in the future, we can certainly analyse a REIT based on their historical performance and get a gauge on how it might perform going forward.

Here are some of the sources you should look at:

a) Annual Report:

Each of the listed REIT will publish their audited annual report upon the completion of the audit of the accounts. The annual report would give us detailed information on REIT performance throughout the year. You can find information on the management comments, industry outlook, the challenges they face and etc.

In this report, you are also able to obtain a clear view of the company financial performance and position as at the end of the year. Details such as the occupancy rate of each of the property, information on earnings and the balance sheet position as at the financial year-end just to name a few are available here as well. Generally, 80% of the information on the REIT performance for the year can be obtained from the annual report.

b) Quarterly report

On a quarterly basis, most of the REIT will announce their quarterly unaudited results. This is where investors can get a glimpse of how the REIT has been performing in each of the quarter. They are less comprehensive compared to the annual report but still a piece of information which is fairly important. Investors can expect to obtain crucial updates on key things such as whether an expired lease has been renewed etc.

Where to find the annual report and quarterly report information

Annual report and quarterly report can be easily obtained via the REIT respective website. Similarly, you can obtain the information as at when the announcement is made over at Bursa Malaysia.

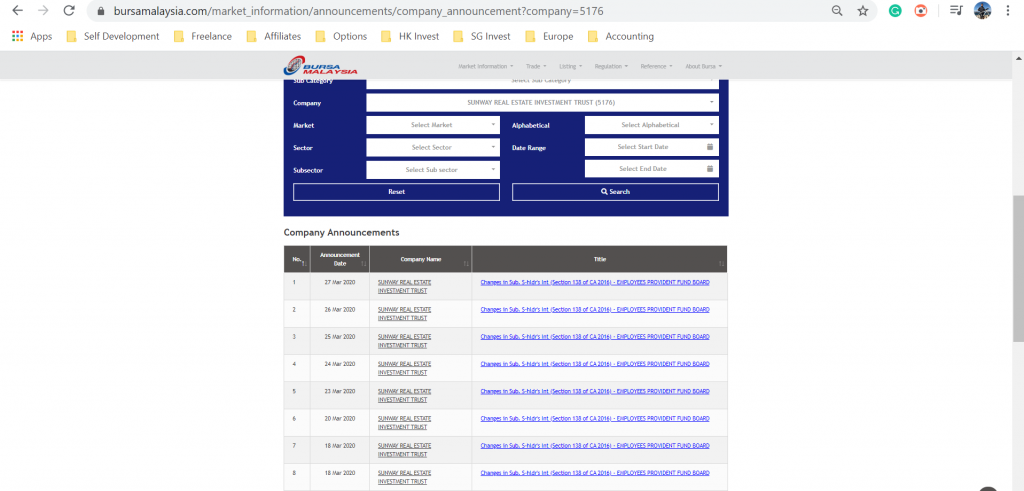

3) Company Announcement

The next piece of information we would like to draw to your attention is the company announcement. Company announcement is a public announcement made by the public REIT of your interest. Here are some of the announcements which are common:

- Announcement of publication of the annual report

- Unaudited quarterly report announcement

- Change in shareholding of shareholder and directors

- Issuance of right issue

- Proposed acquisition

- Dividend distribution announcement

The list goes on but you get the idea. Any information the public REIT wishes to announce publicly will be available here. Company announcement are important as it allows investors to re-evaluate their take on the REIT. You can get a list of all the announcement over at Bursa Malaysia.

4) Other news/sources

Apart from the 3 main sources of information listed above, here are a few places to help you get more information:

a) Daily News

Is catching up daily news important? Not all news is of importance but certain news will have have a direct or indirect impact on your REIT. News such as reduction/increase in the interest rate or even news regarding one of the REIT’s major tenant. All this news may affect the REIT. Keeping yourself up to date with the latest news is a good way to evaluate how your REIT is affected.

b) Analyst/Research Report

An analyst report is prepared by an investment analyst of the investment research team to recommend whether to buy, hold or sell a certain stock. We always advise investors that this report should act as a piece of supplementary information to your own research. Never take the analyst report as a basis of your decision.

The one key reason this report is helpful is the fact that the analyst often gets greater access and information from the management. As such, the report may contain in details insights which may be of great help.

That’s it on the few crucial sources of information you can start with on your REIT research. Do share with us on your various place to perform research on REITs.

You can also read more of our REIT investment guide and REIT analysis.