Mapletree Commercial Trust (SGX: N2IU) is a REIT which was listed in the Singapore Stock Exchange in April 2011. They invest in assets primarily used for retail and office purposes.

Similar to Mapletree North Asia Commercial Trust, they are one of the few REITs which is sponsored by Mapletree Investment Pte Ltd (MIPL) which happen to be a leading real estate development and property management company headquartered in Singapore. MIPL has an asset under management of SGD 60.5 billion as at 31 March 2020 comprising of various asset type across 13 markets globally.

| Investment Properties | SGD in 000s | % |

| VivoCity | 3,148,000 | 36% |

| Mapletree Business City | ||

| – MBC 1 | 2,189,000 | 25% |

| – MBC 2 | 1,534,000 | 18% |

| PSA Building | 761,000 | 9% |

| Mapletree Anson | 747,000 | 9% |

| Bank of America Merill Lynch Harborfront | 338,000 | 4% |

| Total | 8,717,000 |

Looking at the asset of Mapletree Commercial Trust, the valuation of its properties is valued at SGD 8.7 billion as at 30 September 2020. There is a slight drop from the last valuation due to COVID-19 impact. All its assets are located in Singapore with Vivocity and Mapletree Business City accounting for a bigger proportion of their entire portfolio.

With the recent release of the half-yearly report, we will be looking into a few key things you need to know of its 1st half FY20/21 performance.

1. Stable Occupancy Rate

| 31-Mar-17 | 31-Mar-18 | 31-Mar-19 | 31-Mar-20 | 30-Sep-20 | |

| Vivo City | 99.0% | 93.1% | 99.4% | 99.7% | 97.9% |

| MBC I | 99.0% | 99.4% | 97.8% | 98.7% | 98.2% |

| MBC II | – | – | – | 100.0% | 100.0% |

| PSA Building | 98.3% | 96.1% | 96.4% | 92.7% | 87.9% |

| Mapletree Anson | 100.0% | 86.6% | 96.8% | 100.0% | 100.0% |

| MLHF | 79.2% | 100.0% | 100.0% | 100.0% | 100.0% |

| MCT Portfolio | 97.9% | 96.1% | 98.1% | 98.7% | 97.7% |

The average occupancy rate of Mapletree Commercial Trust has been fairly stable between the range of 96% to 99% over the last 4 years. This is mainly due to its assets’ strategic location in both the Greater Southern Waterfront (HarbourFront and Alexandra Precincts) and Central Business District. Among its asset, Mapletree Business City continues to remain resilient among the other portfolio.

The uncertainty of COVID-19 has slightly affected Mapletree Commercial Trust operational performance in the last 1H FY20/21. If were to look at its latest average occupancy rate, it has dropped from 98.7% in 31-Mar-20 to 97.7% in 30-Sep-20. This dropped are mainly driven by Vivo City and PSA Building performance.

Vivo City, a retail asset is impacted by the 10 weeks mandatory business closure and prolonged COVID-19 restrictions. As a result, the traffic and tenant sales has been affected.

Going forward, the management is expecting a progressive recovery of Vivo City with the Phase Two of Singapore’s re-opening whereby rebound in tenant sales has outpaced shopper traffic.

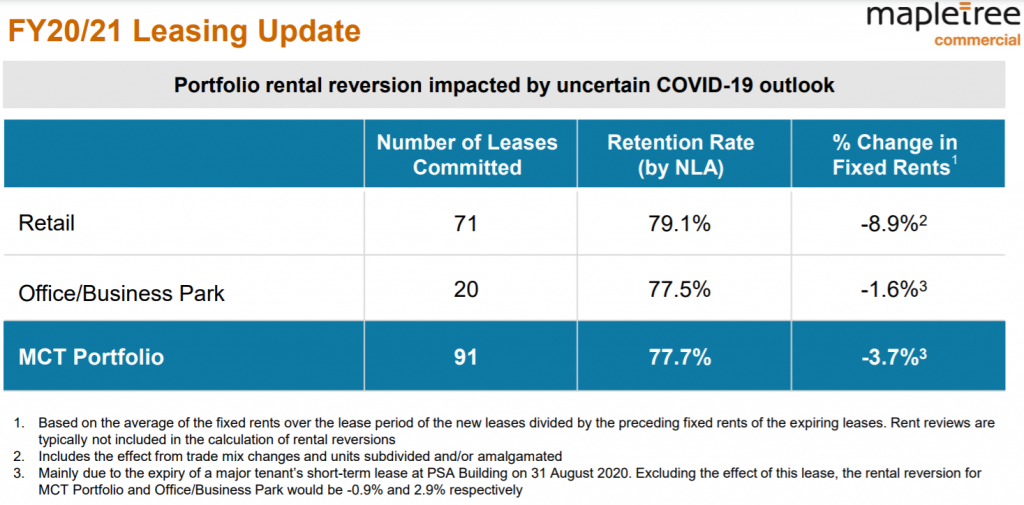

2. Negative rental reversion in 1H FY20/21

In the first 6 months of FY21, Mapletree commercial trust has reported a overall negative rental reversion of – 3.7%. The retail sector got a bigger hit with a negative rental reversion of – 8.9% with the mandatory business closure and prolonged COVID-19 restrictions.

| FY18/19 | FY19/20 | 1H FY20/21 | |

| Retail | 3.5% | 6.7% | -8.9% |

| Office/Business Park | 10.3% | 0.7% | -1.6% |

| MCT Portfolio | 5.5% | 5.0% | -3.7% |

If we were to compare this to the historical rental reversion, the rental reversion for both FY18/19 and FY19/20 has been positive historically. It is only in 1H FY20/21 that they have reported a negative rental reversion. Echoing the point shared earlier, this is possibly due to the lower rental given to the tenants to retain them in the midst of the pandemic.

With the progressive recovery and reopening, it would be interesting to see if the rental reversion would improve. Despite the negative rental reversion, the management ability to maintain a stable occupancy rate is commendable.

3. Steady increase in net property income

| SGD in mil | FY16/17 | FY17/18 | FY18/19 | FY19/20 |

| Gross Revenue | 377.7 | 433.5 | 443.9 | 482.8 |

| Net Property Income | 292.3 | 338.8 | 347.6 | 377.9 |

Looking at its financial performance over the last 4 years, Mapletree Commercial Trust has reported a consistent increase in both revenue and net property income. The increase is mainly driven by the positive operational performance of its properties (i.e stable occupancy rate with a positive rental reversion).

Furthermore, there have a number of acquisitions to which contributes to the growth of the REITs. Mapletree Business City which was acquired in both 2016 and 2019 has been one of its resilient assets.

4. Drop in distributable income in FY19/20 due to higher retention

| SGD in mil | FY16/17 | FY17/18 | FY18/19 | FY19/20 |

| Distributable Income | 227.2 | 260.4 | 264.0 | 243.2 |

Similar to the net property income performance, the distributable income has been growing on an increasing trend from SGD 260 million in FY16/17 to SGD264 million in FY18/19. The decline in FY19/20 despite its positive increase in net property income is due to retention of SGD 43.7 million by way of capital allowance claims and capital distribution retention to cater to the uncertainty of COVID-19.

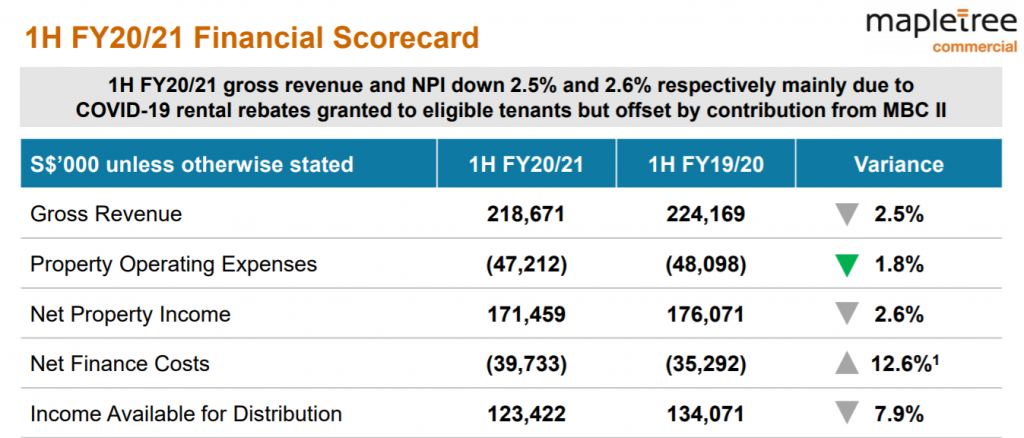

5. Dropped in 1H FY20/21 Performance

With the recent release of 1H FY20/21 report, we note a dropped in the overall financial performance of Mapletree Commercial Trust when compared to the previous half. Revenue declined by 2.5% whereas the net property income declined by 2.6%.

The decline is due to the 10 weeks mandatory business closure and prolonged COVID-19 restrictions. This has impacted the performance of Vivo City. However, the decline in Vivo City performance has been offset by the income from MBC II which was only acquired late 2019.

6. Stable distribution per unit (DPU) with a drop in FY20/21

Echoing the previous few points, the DPU has been on an increasing trend from 8.13 cents in FY15/16 to 9.14 cents in FY18/19. The dropped in FY19/20 is due to the retention by the REIT manager to cater to the uncertainty of COVID-19.

In the event where no retention is made, the DPU would likely be higher. Nevertheless, this is still a fairly commendable performance given the uncertainty of COVID-19.

7. Healthy Gearing Level

| 31-Mar-20 | 30-Sep-20 | |

| Gearing | 33.30% | 33.80% |

The gearing level of Mapletree Commercial Trust is at a healthy limit way below the permissible limit. As at 30 September 2020, the gearing is 33.8% giving them ample headroom for further growth opportunities.

Summary

From our overall analysis, Mapletree Commercial REIT has been delivering a strong performance over the past few years. The operational performance has been commendable with a stable occupancy rate over the years coupled with a positive rental reversion.

The decline in 1H FY20/21 performance is mainly driven by the COVID-19 pandemic which in our view would be a short to medium-term decline. It will be very much dependent on the REIT manager to fare through this uncertainty.

What are your thoughts on Mapletree Commercial REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.