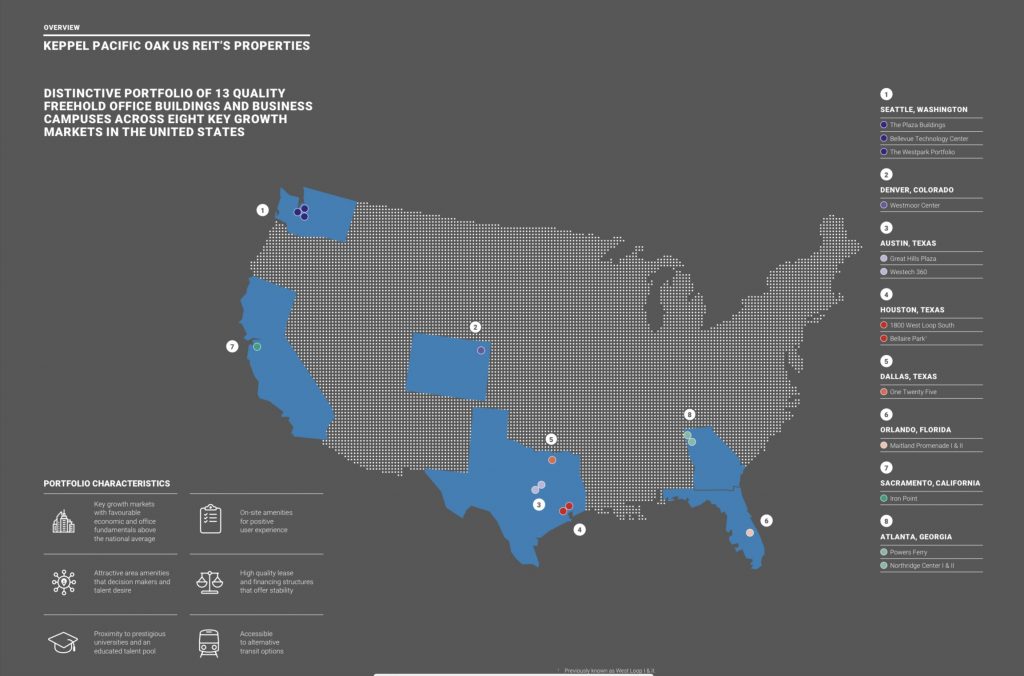

Keppel Pacific Oak REIT is one of the few REITs with office portfolio in the United States. That is alongside REITs such as Manulife US REIT and Prime US REIT. Listed in the Singapore Stock Exchange back in November 2017, they are jointly-owned by two Sponsors, Keppel Capital and KPA.

Keppel Capital is no stranger to most. They are the asset management arm of Keppel Corporation which is one of Singapore’s flagship companies with a geographical footprint in more than 20 countries. Keppel Capital has a diversified portfolio that includes real estate, infrastructure and data centre properties in some of the key global markets.

The other co-sponsor, KPA is owned by Peter McMillan III and Keith D. Hall. Both Peter and Keith are co-founder Pacific Oak Companies which is the holding company of Pacific Oak Capital Advisors LLC (US Asset Manager). Given the strong credibility and experience of both the sponsor, Keppel Pacific Oak REIT could benefit from this.

In terms of the assets holdings, Keppel Pacific Oak REIT owns 13 freehold office assets across eight key growth markets in the United States. In this post today, we will be looking into Keppel Pacific Oak REIT FY19 and 3Q20 performance.

Historical Performance (FY18 to FY19)

1) Acquisition of Maitland Promenade I and One Twenty Five

During the year making up FY19, there are two key events which are crucial to the growth of the REIT. The first is the acquisition of Maitland Promenade I January 2019. This acquisition is the addition to the existing Maitland Promenade I which was acquired back in November 2017.

The second key acquisition is One Twenty Five located in Texas. This acquisition consists of two Class A buildings and was completed in November 2019. Both these new properties have a strong occupancy rate of above 90% as at 31 December 2019.

2) Improved in overall occupancy rate and positive rental reversion

| FY18 | FY19 | |

| The Plaza Buildings | 93% | 97% |

| Bellevue Technology Center | 98% | 99% |

| The Westpark Portfolio | 97% | 93% |

| Westmoor Center | 82% | 97% |

| Great Hills Plaza | 97% | 100% |

| Westech 360 | 97% | 99% |

| 1800 West Loop South | 76% | 75% |

| Bellaire Park (f.k.a West Loop I & II) | 90% | 89% |

| One Twenty Five | n.a | 96% |

| Maitland Promenade II | 98% | Merged below |

| Maitland Promenade I & II | n.a | 99% |

| Iron Point | 96% | 97% |

| Powers Ferry | 95% | 94% |

| Northridge Center I & II | 94% | 84% |

| Overall Portfolio | 92% | 94% |

In terms of its occupancy rate, Keppel Pacific Oak REIT registers an overall improvement in occupancy rate. Its occupancy rate increased from 92% in FY18 to 94% in FY19. This is contributed by 7 out of the 13 properties where there is an overall improvement in occupancy. Furthermore, the 2 newly acquired buildings also contribute to the overall performance.

Apart from the healthy occupancy rate, Keppel Pacific Oak REIT achieved a strong average rental reversion of 14.3%. This is fueled by strong leasing demand and rent growth across some of the key growth markets.

Despite the strong growth in occupancy rate and rental reversion, investors will still have to keep a close lookout at its performance in the upcoming years given the uncertainty of COVID-19 outbreak.

3) Increased in net property income in FY19

| USD in ‘000s | FY18 | FY19 |

| Gross Revenue | 93,525 | 122,886 |

| Net Property Income | 56,723 | 74,753 |

The next aspect which is commendable is its financial performance. Keppel Pacific Oak REIT’s net property income increased from USD 56.7 million in FY18 to USD 74.8 million in FY19. This is contributed from the newly acquired properties such as One Twenty Five and Maitland Promenade I. Furthermore, the overall improvement in occupancy and positive rental reversion has further fueled the increase in financial performance.

Given that the One Twenty Five was only acquired late 2019, we would expect that the financial performance in the following years to further improved.

4) Year on year increase in distribution per unit

| USD in cents | FY18 | FY19 |

| Distribution Per Unit | 5.4 | 6.0 |

Similar to the strong operational and financial performance, its distribution per unit has increased from 5.4 cents in FY18 to 6.0 cents in FY19. This is no doubt contributed by the strong leasing demand in the key growth markets as well as from the newly acquired properties.

Nevertheless, given the uncertainty of the COVID-19 outbreak in the United States, this would potentially affect the DPU in the short to medium term. Definitely, an area to pay close attention to.

5) Gearing limit within a healthy range

As at 31 December 2019, Keppel Pacific Oak REIT has a total gross borrowings of USD 480 million translating to an aggregate gearing of 36.9%. A fairly healthy range.

Furthermore, this is still below the permissible limit of 50% which would give them ample debt headroom for further acquisition and asset enhancement initiatives.

3Q20 Performance

6) Slight decline in overall occupancy rate but still within a healthy range

With the outbreak of COVID-19, there have been a number of businesses which have been severely affected. Hence, it only makes sense to look at how Keppel Pacific Oak REIT has performed in the last 9 months. Looking at Keppel Pacific Oak REIT operational performance, its overall occupancy rate dropped from 94% in December 2019 to approximately 93% in September 2020. Despite the drop, this is still a fairly healthy level.

The one favourable aspect noted is the 14.1% positive rental reversion fueled by strong demand from tech and professional services.

7) Solid financial performance despite COVID-19

In terms of financial performance, its net property income is 14.1% higher as compared to 9M19 figures. This increased in fueled by the positive rental reversion as well as the contribution of One Twenty Five which was only acquired late 2019.

Summary

Based on our overall analysis, Keppel Pacific Oak REIT has benefited from the strong leasing demand in the tech and professional service sector. This has allowed them to further grow despite the uncertainty of the COVID-19 pandemic which can be seen from its solid operational and financial performance. We will let you decide if this is worth investing in.

What are your thoughts on Keppel Pacific Oak REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.