Too busy to run through the announcements made by Singapore REITs? In this segment of Singapore REITs Happenings, we will be summing up some of the key happenings in Singapore REITs in March 2021.

1) ESR REIT entered into an SGD 320 million unsecured loan facility

ESR REIT has entered into a SGD 320 million unsecured loan facility arrangement with UOB Bank, Maybank, RHB Bank and HSBC. It consists of 2 separate facilities with SGD 160 million under each facility with 60 months and 48 months maturity respectively. The newly entered loan facility will be used for general corporate funding exercise such as:

- The refinancing of existing debt

- Financing of future asset acquisitions, enhancements and improvement of assets owned

- Other general working capital purposes.

2) CapitaLand Integrated Commercial Trust raised SGD 460 million through a fixed rate note due 2028

CapitaLand Integrated Commercial Trust has announced that they have raised additional financing through the issuance of SGD 460 million fixed-rate note. This is a 2.1% fixed rate note due 8 March 2028 payable semi-annually. The proceeds raised will be used for the refinancing of existing borrowings of CICT. They will also be using the proceeds to finance any new investments and for general working capital purposes.

3) Completed private placement exercise by Cromwell European REIT

In March 2021, Cromwell European REIT has completed its private placement exercise. The exercise involves the issuance of 232,558,100 new units at an issue price of €0.430 per unit. With the completion of the private placement, this would increase Cromwell European REIT total units to 2,788,638,656 units as of March 2021. The proceeds raised will be used to:

- Partially replenish working capital in connection with the recently completed acquisition of an intermodal freehold logistics park located in Italy.

- Partially fund the acquisition of certain properties located in the Czech Republic and Slovakia.

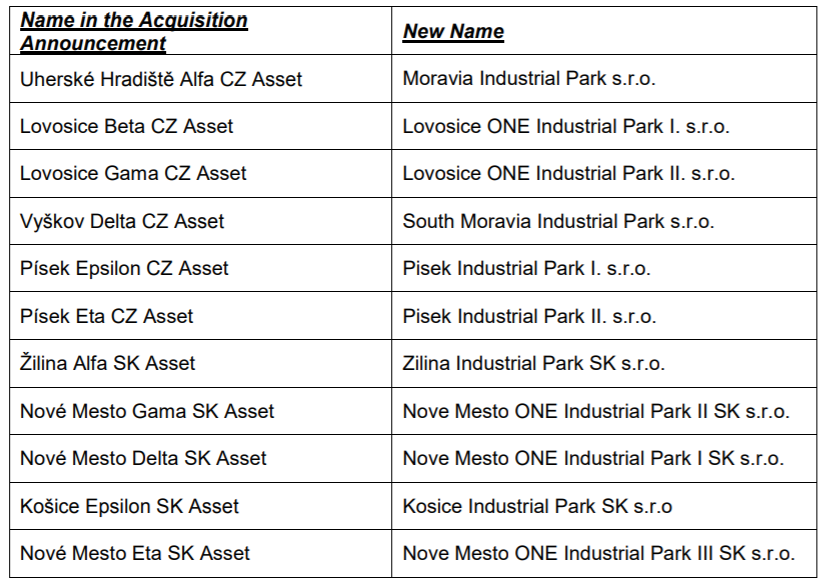

4) Cromwell European REIT completed its acquisition of 11 assets in Czech Republic and Slovakia

Another key happening in regards to Cromwell European REIT is in regards to its latest acquisition. In March 2021, they have successfully completed their acquisition of 11 assets in the Czech Republic and Slovakia. These acquisitions are partially funded by the proceeds raised through the private placement. Refer to the breakdown of the newly acquired assets.

Following the completed acquisition, their portfolio comprises 107 properties in Denmark, Finland, France, Germany, Italy, the Netherlands, Poland, the Czech Republic and Slovakia.

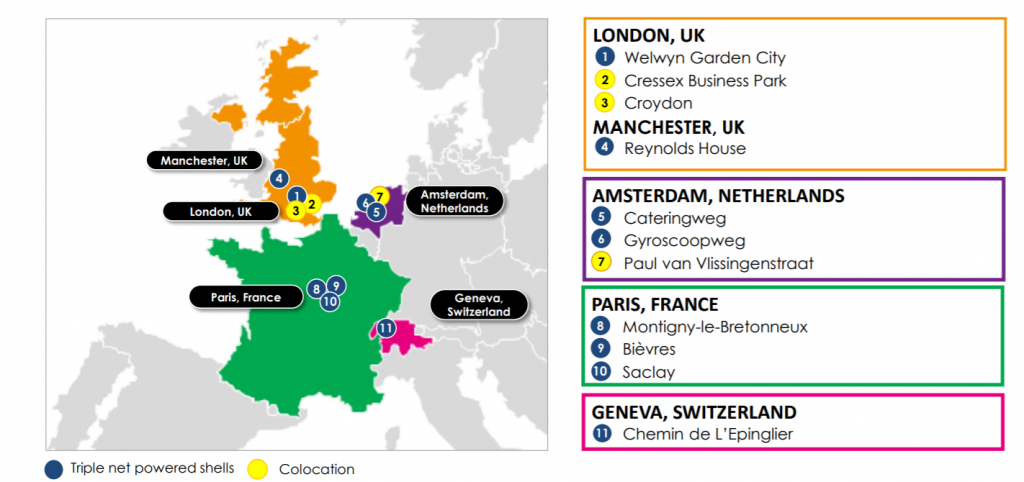

5) Ascendas REIT completed the acquisition of 11 data centers in Europe

Ascendas REIT has proposed and completed its acquisition of 11 new assets in the European region. The assets are located in Tier 1 cities across Europe with 4 assets located in the United Kingdom, 3 in the Netherlands, 3 in France and 1 in Switzerland. Its is acquired at a total consideration of SGD 959.96 million. These acquisition is currently occupied at a healthy range with an average occupancy of 97.9%.

These acquisition is a plus as it does not only extend Ascendas REIT reach in the European market, but also help reduces the property concentration in Singapore.

6) Completed divestment of Anchorpoint for SGD 110 million by Frasers Centrepoint Trust

Pursuant to our latest post on Frasers Centrepoint Trust, the REIT Manager has announced that they have completed the divestment of Anchorpoint Shopping Centre for SGD 110 million. Anchorpoint was initially acquired back in 2006 at a price of SGD 36 million. Based on the representation by the management, Anchorpoint has reached a stage where its divestment is in the interest of Unitholders, and they are looking to redeploy the proceeds into the new acquisition of properties.

7) Frasers Centrepoint Trust proposed divestment of Yew Tee Point

Yew Tee Point is a retail mall with net lettable area of approximately 6,844 square metres and comprises two retail levels. They have a total of 70 tenants and key tenants such as NTUC FairPrice and Koufu food court. In March 2021, Frasers Centrepoint Trust has proposed the divestment of Yew Tee Point for SGD 220 million. The divestment would be expected to be completed by end of May 2021.

8) Private placement by Keppel REIT with the issuance of 238,939,000 new units

In March 2021, Keppel REIT has completed its private placement exercise with the issuance of 238,939,000 new units. These units are issued at an issue price of SGD 1.13 per unit raising approximately SGD 270 million. The gross proceeds raised will be mainly used to partially fund the acquisition of Keppel Bay Tower.

9) Completed acquisition by Mapletree Industrial Trust of a Data Centre in the United States

The following relates to a freehold property consisting of data centres and office space which was acquired in line with the increasing demand for data centre related assets. This acquisition would be acquired at approximately USD 207.8 million fully funded by debt.

The plus point in our opinion of this acquisition is that it allows Mapletree Industrial Trust to leverage the increasing demand of data centres. In addition to that, this acquisition would enjoy a 100% occupancy rate.

10) Mapletree Logistics Trust completed 7 acquisition in India and South Korea

In March 2021, there are two key happenings in regards to Mapletree Logistics Trust. The first being its acquisition of 5 logistics assets in South Korea for a consideration of SGD 335 million. These assets enjoys a 100% occupancy rate with a weighted lease expiry of 1.7 years.

The second being its acquisition of 2 logistics properties in India for an approximate consideration of SGD84.2 million. These assets enjoy a 98.2% occupancy rate with a weighted lease expiry of 2.2 years.

With these acquisitions, Mapletree Logistics Trust portfolio would increase to 163 properties comprising 52 properties in Singapore, 9 in Hong Kong, 18 in Japan, 30 in China, 18 in South Korea, 15 in Malaysia, 12 in Australia, 7 in Vietnam and 2 in India.

Summary

We hope our new segment of Singapore REITs Happenings will be value adding to your REITs investment journey. Do let us know if we miss out on any key Singapore REITs Happenings in March 2021.

REIT Pulse is a platform launched to help individuals get started with REITs investing. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.