In our last post, we have discussed a little on Parkway Life REIT and its performance in the midst of COVID-19 pandemic. We have talked about how healthcare REITs are relatively more defensive in nature as compared to REITs in other sectors.

While there are approximately 60 REITs in Malaysia and Singapore, there are only a total of 3 REITs which are wholly in the healthcare sector. The questions we often get is which healthcare REITs are better? Are all healthcare REITs defensive in nature and etc.?

As such, in this article today, we will be looking into these 3 healthcare REITs to see how they have been performing in comparison to one another. Most importantly, how they perform amidst Covid-19 pandemic.

Historical Performance (Last 3 Years)

Similar to our previous post, we will be looking into the historical performance of these 3 REITs in comparison to one another. Our goal is to look at the fundamental of the REITs operations in the past to get a gauge of the REITs overall performance. This will give investors a view of the REITs performance under normal circumstances.

Operational Performance

Due to the nature of the healthcare industry, they are typically more defensive in nature. The performance of healthcare REITs are dependent on the healthcare group/healthcare tenants they lease the assets too.

To look at how each of these healthcare REITs has performed against one another, we will look into its operational performance. There are many operational aspects we can look into when it comes to evaluating the performance of the REIT performance. In this segment, we will cover 2 key factors being (i) historical occupancy rate and (ii) ability to command a positive rental reversion.

1) Historical Occupancy

| FY17 | FY18 | FY19 | |

| Al-Aqar REIT | 100.0% | 100.0% | 100.0% |

| First REIT | 100.0% | 100.0% | 100.0% |

| Parkway Life REIT | 99.9% | 99.9% | 99.7% |

Looking at the historical occupancy, all 3 properties have been able to maintain a strong occupancy rate over the last 3 years. There is a slight decline in occupancy for Parkway Life REIT mainly from the properties in Malaysia. Nevertheless, the properties in Malaysia only account for approximately 0.2% of the total composition.

2) Ability to command a positive rental reversion.

In the aspect of their ability to command a positive rental reversion, all 3 REITs have been favourable.

- Al-Aqar REIT: Looking at the historical occupancy rate of 100% throughout the last 3 years, we would expect the rental income to remain stagnant. The only way for it to grow organically is through a positive rental reversion which is what that have managed to attain. Looking at the growth in revenue (excluding new asset acquisition), it has been growing from MYR 99.6 mil in FY17 to MYR 106.0 mil in FY19.

- Parkway Life REIT: Similarly, Parkway Life REIT has been able to command a positive rental reversion throughout. The key contributor to the positive rental reversion is from their build in rental revision model from their two key regions being Singapore and Japan. In Singapore, the leases were entered in such a way that they can command a positive only rental reversion yearly. For the Japan region, their model is based on an “up only’ rental revision. This is indeed a plus point for investors.

- First REIT: First REIT, on the other hand, has a decline in revenue despite a 100% occupancy rate. Similarly, they have a built-in rental escalation which is a positive aspect. The dropped is, however, attributed to the decline in the variable component of the rent of its Indonesian properties.

Financial Performance

3) Year on Year Financial Performance

As for the financial performance of these 3 REITs, Al-Aqar REIT and Parkway Life REIT has grown steadily year on year. This is attributed to its strong occupancy rate and its ability to command a positive reversion.

First REIT, on the other hand, has a mixed performance. It grew from SGD 111.0 mil in FY17 to SGD 116.2 mil in FY18 and further declined to SGD 115.3 mil in FY19. The decline is from the decline in the variable component. The variable component is dependent on the performance of the tenants. This is not necessarily a bad thing but a short term fluctuation.

Given the uncertainty Covid-19 pandemic, we would expect that the demand for healthcare to be high or at least stable.

4) Historical distribution per unit (DPU)

| DPU (Cents) | FY17 | FY18 | FY19 |

| Al-Aqar REIT (MYR) | 7.70 | 7.70 | 7.75 |

| First REIT (SGD) | 8.57 | 8.60 | 8.60 |

| Parkway Life REIT (SGD) | 13.35 | 12.87 | 13.19 |

The next aspect we will look at is the distribution per unit (DPU). Looking at the DPU over the past 3 years, both Al-Aqar REIT and First REIT has a stable/growing year on year DPU. Parkway Life REIT at a high-level glance appears to dip in FY18 before picking up in FY19. As explained in our previous post, the higher DPU in FY17 is due to a one-off distribution to investors from the divestment its four Japan assets in December 2016 which was equally distributed over the four quarters in FY17.

Excluding that one-off gain, Parkway Life REIT would have a rather stable and growing DPU as well.

At a historical glance, all these 3 healthcare REITs appear to be fundamentally strong in the aspect discussed above. The question now would then be how do they perform amidst the COVID-19 pandemic.

How do these 3 healthcare REITs perform amidst the pandemic?

To help us better navigate on these, we will be looking at the latest unaudited result to the extent available. Over the course of the next few discussion, we will be looking at the REITs individually. While there are many other aspects to cover (growth, gearing, etc.), we will only be looking at the operational performance to see if the operations are affected by the Covid-19 pandemic.

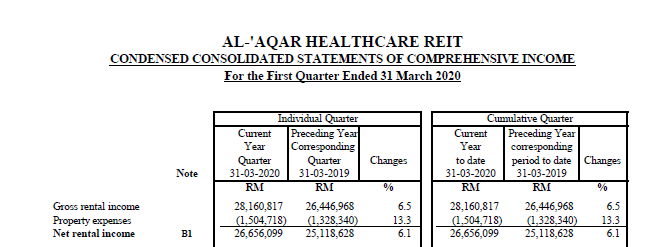

Al-Aqar REIT

The latest available result of Al-Aqar REIT is the 31 March 2020 result which is a reflection of the performance before the movement control order. Looking at the performance up to the net property income, the Q1 has remained rather positive. This is however contributed by the newly acquired KPJ Batu Pahat Specialist Hospital.

As per the prospect highlighted by the management, the REIT manager is expecting a slowdown in the private healthcare sector. This is due to the delay of non-emergency treatments and healthcare tourism has come to a halt with foreign tourists being banned from entering the country.

Nevertheless, Al-Aqar REIT is still rather defensive compared to REITs in other sectors.

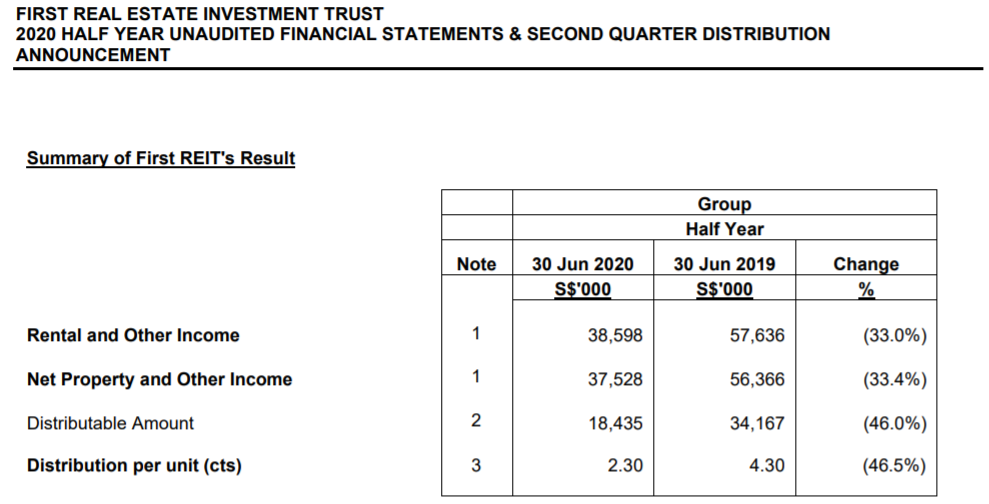

First REIT

Based on the 1H 2020 result of First REIT, there has been a dip of 33% in the rental income. This is mainly attributed to the two-month rental relief extended to all tenants to alleviate the economic distress caused by the COVID-19 pandemic. This is definitely an applauded move.

However, as compared to Al-Aqar REIT and Parkway Life REIT, First REIT is the only REIT which has announced a decline in financial performance. The uncertainty lies on what will happen to the existing leases which are due for expiry in the near term as previously shared here. This will definitely be an area worth looking into for investors who are interested in First REIT.

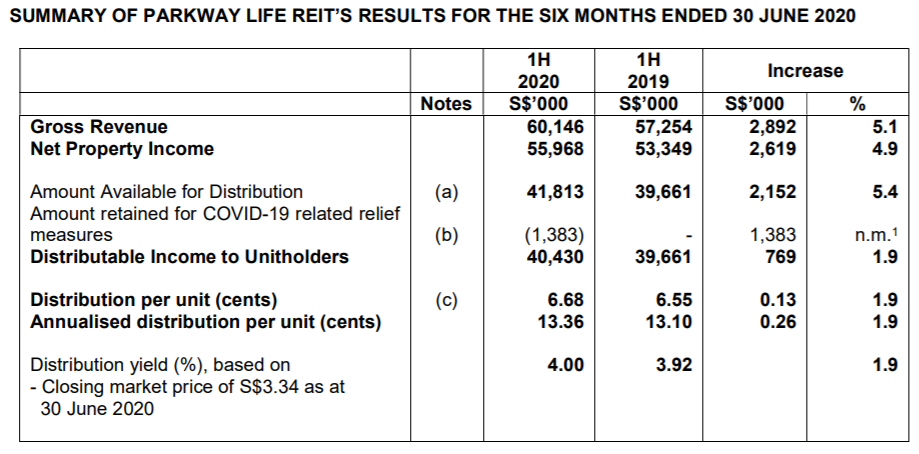

Parkway Life REIT

As we have covered this in the last post, we will summarize what we have previously shared. For Parkway Life REIT, we have gotten hold of its Q2 2020 Unaudited Result. Based on that unaudited result, Parkway Life REIT has been performing well amidst the Covid-19 pandemic. Both revenue and net property income has increased respectively as compared to the similar 1st half in FY19. The growth is mainly attributed to revenue contribution from the Japan property acquisitions late FY19, higher rent from the existing properties and appreciation of the Japanese Yen.

Even with retention of SGD 1.4 million as part of the COVID-19 relief measure, they have still managed to distribute 6.68 cents, a 1.9% increase in DPU to the investors.

Takeaway

No doubt healthcare REITs are deemed to be much more defensive compared to REITs in other sectors. That does not mean that they are prone to economic risk. One of the takeaways you would have noticed throughout is these 3 REITs remain cautious in this economic uncertainty such as giving rebates to tenants.

Our verdict is that COVID-19 will not add much pressure to these REITs but the ongoing problems it already had before the pandemic would be the factor investors should look out for.

Like what we have said earlier, investing is a subjective matter. Hence, it is important that you do your own due diligence before investing. If you are interested in healthcare REITs, you can check out other posts we have written previously on First REIT Performance and Al-Aqar REIT Performance.

Do follow us on Facebook and Instagram to stay updated.