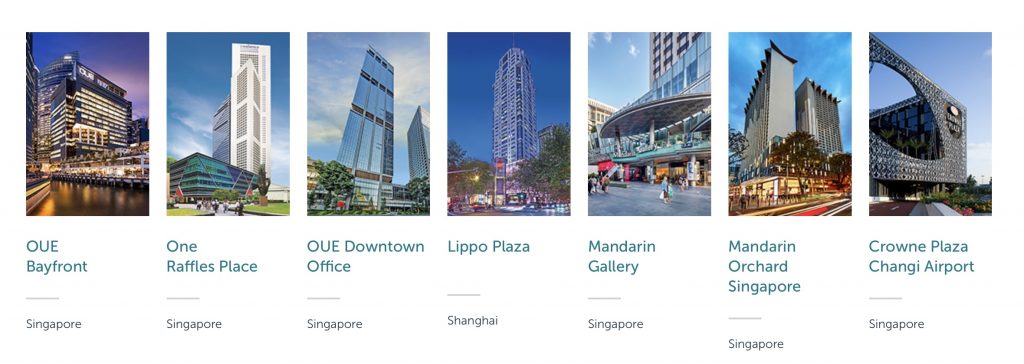

OUE Commercial REIT is Singapore based REIT listed on the Singapore Exchange since January 2014. They are a diversified REIT with 7 properties located across Singapore and China as at December 2020. One key event worth noting in the past was their merger with OUE Hospitality Trust which hold the hospitality and retail assets. Upon the merger, this brings their total portfolio up to 7.

Post-merger till December 2020, their assets consist of 4 Grade A office properties of which 3 are located in Singapore and 1 in China. They are OUE Bayfront, One Raffles Place, OUE down toward and Lippo Plaza. In addition to that, they own two hotels in Singapore being Mandarin Orchard Singapore and Crowne Plaza Changi Airport as well as 1 retail asset being Mandarin Gallery.

In this post, we will be looking into OUE Commercial REIT FY20 Performance to see how it has performed.

1) Overall decline in commercial asset occupancy rate

| FY19 | FY20 | |

| OUE Bayfront | 99.4% | 100% |

| One Raffles Place | 95.6% | 92.1% |

| OUE Downtown Office | 93.8% | 92.1% |

| Lippo Plaza | 91.3% | 86.5% |

| Mandarin Gallery | 98.3% | 91.1% |

The occupancy rate of their commercial assets segment which consists of both office and retail portfolio have been declining overall. This is an exception for OUE Bayfront which achieve a 100% occupancy rate in FY20 up from 99.4% in FY19. Their remaining 2 Singapore based office asset being One Raffles Place and OUE Downtown office has declined compared to FY19. Both these assets occupancy rate is below the average CBD occupancy rate of 96.1%.

Occupancy rate for Lippo Plaza which is located in china declined as well from 91.3% in FY19 to 86.5% in FY20. Nevertheless, the occupancy rate is still slightly above Shanghai CBD market average of 85.1%

Likewise, their retail property has declined as well from 98.3% in FY19 down to 91.1% in FY20. With the rollout of the vaccine and gradual move of going back to the office, hopefully, this would be a positive sign for OUE Commercial REIT assets.

2) Revenue per available room for hospitality segment decline in FY20.

One of the key metrics in evaluating assets in the hospitality segment is by looking at their revenue per available room. This represents the revenue earned from the respective room in the hospitality assets. Purely looking at the revenue per available room in FY20, it has declined from SGD 209 in FY19 to SGD 90 in FY20. This is due to the impact of border closure and circuit breaker measure in FY20. Nevertheless, the gradual loosening measure has definitely benefited the hospitality industry as a whole.

Initiatives such as staycation in Singapore and pledging hotels for stay home notice stay has benefited the sector as a whole. This is evident from the improvement in the Q420 results growing from revenue per available room of SGD 88 in Q320 to SGD 95 in Q4 20.

3) Overall increase in financial performance in FY20

| SGD in 000s | FY19 | FY20 |

| Revenue | 257,329 | 292,007 |

| – Commercial | 225,045 | 224,507 |

| – Hospitality | 32,284 | 67,500 |

| Net Property Income | 204,951 | 231,890 |

| – Commercial | 175,324 | 171,075 |

| – Hospitality | 29,627 | 60,815 |

In terms of the overall financial performance of OUE Commercial REIT, it has improved overall. However, if we were to dissect into the respective segment, the performance has actually declined but appear to be improving due to the merger with OUE hospitality trust.

Its commercial assets which consist of both the office portfolios and the recently added Mandarin Gallery has declined slightly. The drop is from SGD 175.3 million in FY19 to SGD 171.1 million in FY20. This is due to rental rebates and other relief measures granted to tenants. The loss in income is however partially offset by the inclusion of income from Mandarin Gallery upon completion of the merger in September 2019.

Likewise, for the hospitality segment, the net property income has increased from SGD 29.6 million in FY19 to SGD 60.8 million. The increase is due to the full-year contribution of the hospitality assets which was only completed in late 2019.

4) Declined in distribution per unit in FY20

The distribution per unit of OUE Commercial REIT has declined from 3.31 cents in FY19 to 2.43 cents in FY20. Despite the overall improvement in financial performance, the distribution per unit has still declined. This is due to an increase in number of units which are entitled to distribution from 5,392,459,363 units to 5,427,850,366 units.

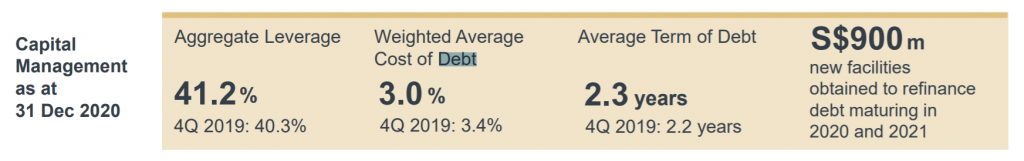

5) Leverage of 41.2% with weighted average cost of debt of 3%

As for OUE Commercial REIT debt profile, they have approximately SGD 2.7 billion in borrowings. This represents a leverage ratio of 41.2% which is a slight increase from the prior year ratio of 40.3%. This is nevertheless still below the permissible limit of 50%. Though this is below the permissible limit, it is relatively high when compared to other Singapore based REITs.

It has a weighted average cost of debt of 3% with 68.1% of its debt being fixed interest rate in nature.

6) Completed 50% divestment of OUE Bayfront

On 31 March 2021, OUE Commercial REIT has announced that they have completed the divestment of 50% of OUE Bayfront to Allianz Real Estate Asia Pacific. The divestment is at an agreed value of SGD 1.27 billion representing a 7.3% premium to book value as at December 2020 and 26.1% premium to their initial purchase consideration at listing. The divestment would allow OUE Commercial REIT to realise some of the capital gain in OUE Bayfront while retaining half of the ownership in OUE Bayfront which currently has a 100% occupancy rate.

The net proceeds from the divestment will be used to repay their outstanding borrowings and this would be estimated to reduce the overall leverage ratio of OUE Commerical REIT from 41.2% to 34.5% on a pro forma basis.

Summary

Based on our overall analysis, OUE Commercial REIT operational and financial performance has been overall impacted by the COVID-19 pandemic. Its hospitality sector is no doubt heavily impacted. However, with the gradual recovery and easing measure, this might be a positive sign to OUE Commercial REIT with is evident from the improvement in their q-o-q results.

What are your thoughts on OUE Commercial REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.