Mapletree North Asia Commercial Trust or better known as MNACT is one of the REIT which are sponsored by Mapletree Investment (MIPL). They have assets across the North Asia region primarily in China, Hong Kong SAR, Korea and Japan. As at 31 March 2021, their total investment properties are valued at SGD 7.9 billion.

One of the notable event affecting MNACT in FY20 was the protest in Festival Walk which has heavily impacted MNACT. Uncertainty of COVID-19 has further impacted MNACT overall. In this post, we will look at its FY21 performance to see how it has performed.

Read More: 9 Key Things To Know Of Mapletree North Asia Commercial Trust (MNACT) 2020 Performance

1. Slight reduction in the reliance of Festival Walk on the overall portfolio

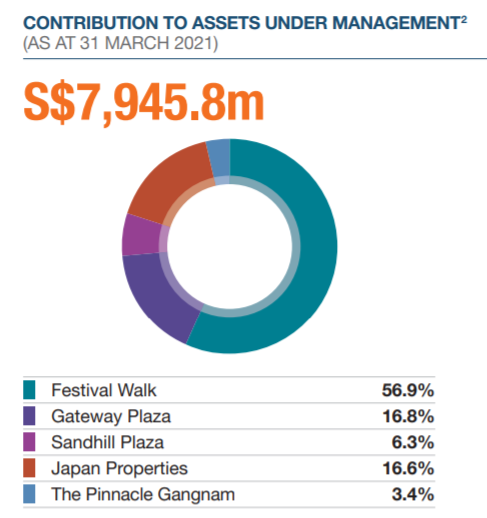

In our previous post on MNACT, we have shared how the closure of Festival Walk has affected MNACT overall performance. At that point of time, Festival Walk accounts for approximately 60% of the total portfolio. This poses a higher portfolio concentration risk whereby an adverse event on Festival Walk would be detrimental to MNACT.

As at 31 March 2021, Festival Walk still accounts for a huge proportion of the entire portfolio. The good news is that the overall concentration has slightly decreased from 60% to 57% in FY21.

2. Completed acquisition of 50.0% interest in The Pinnacle Gangnam in FY21

On 30 October 2020, MNACT has completed its acquisition of 50% interest in The Pinnacle Gangnam for SGD 276 mil fully funded by debt. The property is located in South Korea with an occupancy rate of 96.5% as at 31 March 2021. This acquisition is a plus as it allows MNACT to expand its property diversification into South Korea.

3. Overall Decline in Occupancy Rate

| FY19 | FY20 | FY21 | |

| Gateway Plaza | 100% | 92% | 93% |

| Sandhill Plaza | 99% | 98% | 98% |

| Festival Walk | 99% | 100% | 100% |

| Japan Properties | 100% | 95% | 98% |

| The Pinnacle Gangnam | n.a | n.a | 97% |

Looking at MNACT operational performance, the occupancy rate of MNACT has improved in FY21 as compared to FY20. There has been an improvement in occupancy rate in regards to 2 out of 4 of its existing properties. Likewise, there other 2 more properties achieve a stable occupancy rate. A favourable aspect in regards to MNACT in FY21 is the expansion of its portfolio into South Korea with the acquisition of The Pinnacle Gangnam.

4. Positive financial performance from FY17 to FY19 with a decline in FY21

| SGD in mil | FY18 | FY19 | FY20 | FY21 |

| Revenue | 355.0 | 408.7 | 354.5 | 391.4 |

| Net Property Income | 287.2 | 329.0 | 277.5 | 292.0 |

| Distributable Income | 201.9 | 240.7 | 227.9 | 210.2 |

There has been a turnaround in financial performance with an increase in revenue from SGD 354.5 mil in FY20 to SGD 391.4 mil in FY21. Revenue which has declined from SGD 408.7 mil in FY19 to SGD 354.5 mil in FY20 as a result of the protest in Festival Walk has slightly rebounded. The improvement is mainly driven by the full year performance of MBP and Aomori which was acquired in February 2020.

Nevertheless, the performance is still poorer than its performance in FY19 given the uncertainty of COVID-19 pandemic.

5. Distribution Per Unit (DPU)

| Cents | FY18 | FY19 | FY20 | FY21 |

| Distribution Per Unit | 7.5 | 7.7 | 7.1 | 6.2 |

The next aspect investor would be keen to look into is the distribution per unit. Its distribution per unit continues to decline from 7.7 cents in FY19 down to 6.2 cents in FY21. While the net property income in FY21 has improved slightly, its overall distributable income has continued to decline. This is mainly attributable to a sum of claims received from insurance for property damage in Festival walk which was used to repay external borrowings incurred.

6. Debt Composition

| 31 March 2019 | 31 March 2020 | 31 March 2021 | |

| Gross Debt | 2,878.0 | 3,383.0 | 3,439.9 |

| Leverage Ratio | 37% | 39% | 42% |

| ICR | 4.2 | 3.5 | 3.7 |

The overall debt of MNACT has continued to increase to partially finance the acquisitions of The Pinnacle Gangnam. Despite the increased in borrowing, the leverage ratio is at 42% which is still below the permissible limit. This would give them ample debt headroom for further acquisition and asset enhancement initiatives.

The interest coverage ratio, on the other hand, has slightly improved from 3.5 in FY20 to 3.7 in FY21.

7. Completed its new acquisition in June 2021

In 1Q2020, MNACT has further announced that it has completed its acquisition of a new property in Japan. This acquisition is at c.SGD 483 million for an effective interest of 98.47% in a freehold single-tenanted office building located at Tokyo, Japan, known as “Hewlett-Packard Japan Headquarters”.

This acquisition is a plus as it allows MNACT to expand its portfolio in Japan, capitalising on the 3rd largest economy in the world. Currently leased to Hewlett-Packard Packard, this property is currently 100% occupied.

Summary

Based on REIT Pulse analysis, there is both aspects we like and dislike about MNACT. MNACT has been a REIT that has been growing positively historically prior to the Festival Walk incident. Uncertainty of COVID-19 pandemic is not exactly favourable to MNACT in supporting its overall recovery. The favourable aspect is that its management has been seizing the opportunity in expanding its portfolio across other geographical regions.

What are your thoughts on MNACT FY20 and 1Q2020 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

If you are looking for a brokerage account, Tiger Brokers is currently offering a deal of a lifetime that you might not want to miss.

- Registration: 500 Coins

- Account Opening: 60 Commission-Free Trades within 180 Days (Applicable for U.S. stocks, H.K. stocks, Singapore stocks and Australian stocks )

- Funding your account with more than ≥ SGD 2,000: 1 FREE Apple(NASDAQ: AAPL)share

Do consider using our link and promo code “REITPULSE” as this will support our blog while earning some rewards. Likewise, you can read more on our reviews on Tiger Brokers.

Do join our community over at Facebook and Instagram.