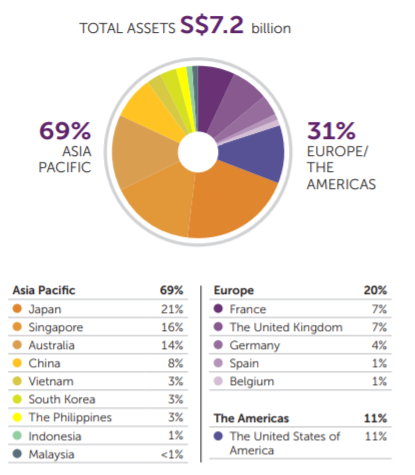

Ascott Residence Trust or also known as Ascott REIT is the largest hospitality trust in Asia Pacific. It was listed on the Singapore Exchange in March 2006 with investments predominantly in serviced residences, rental housing properties, student accommodation and other hospitality assets in any country in the world.

As at 31 December 2020, Ascott REIT’s asset comprises of 86 properties across 15 countries in the Asia Pacific, Europe, and the United States. They are mainly located in key gateway cities such as Barcelona, Berlin, Brussels, Hanoi, Ho Chi Minh City, Jakarta, Kuala Lumpur, London, Manila, Melbourne, Munich, New York, Paris, Perth, Seoul, Singapore, Sydney, and Tokyo.

Singapore, Japan and Australia account for approximately 51% of the overall composition with the remaining 49% spreading across 12 other countries. With the uncertainty of COVID-19 affecting every aspect of businesses and our lives, it is without a doubt that hospitality sector will be heavily affected. In this post, we will dive deeper into the performance of Ascott REIT in FY20.

1) Massive decline in overall portfolio occupancy

The portfolio occupancy rate of Ascott REIT has declined in FY20 which comes as no surprise with the closure of border as a result of the uncertainty of COVID-19. Unlike REITs from other sectors, the revenue model of hospitality REIT is slightly different. Generally, Ascott REIT’s properties can be generalized into 2 categories:

- Properties under master leases

- Properties under master contracts

35 of Ascott REIT’s properties were entered via a master lease agreement. 17 of it in France, five in Germany, five in Japan, four in Australia, two in South Korea, and two in Singapore. The weighted average remaining tenure of Ascott REIT’s master leases as at 31 December 2020 is about seven years.

As for the remaining 49 properties, these are entered via management contracts. There are 2 types of contracts entered. The first being a management contract with a minimum guaranteed income and the second being a management contract without minimum guaranteed income. 4 out of 49 of the properties have a minimum guaranteed income featured built-in which provides Ascott REIT a stable stream of income. The remaining 45 properties are fully dependent on the revenue per available unit of the properties.

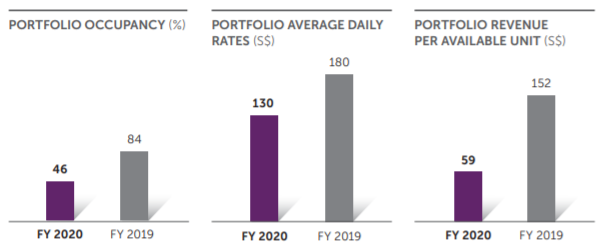

Looking at the chart above, this has been on a decline dropping from $152 per available unit in FY19 to $59 per available unit in FY20.

2) 28% decline in revenue in FY20

| SGD in mil | FY17 | FY18 | FY19 | FY20 |

| Revenue | 496.3 | 514.3 | 514.9 | 369.9 |

| Gross Profit | 226.9 | 239.4 | 252.6 | 149.6 |

Revenue of Ascott REIT has likewise declined from SGD 514.9 mil in FY19 to SGD 369.9 mil in FY20. This 28% decline is in line with the overall drop in overall operational performance. With the occupancy rate declined from 84% to 46% in FY20, the average daily rate declined from SGD 180 to SGD 130 in FY20, and revenue per available unit decline from SGD 152 to SGD 59 in FY20, this comes as no surprise that revenue declined as well.

This is without a doubt the impact of COVID-19 with borders closure discouraging travels globally. Pre-COVID, the performance of Ascott REIT has been impressive with overall revenue increasing from SGD 496.3 in FY17 to SGD 514.9 in FY19.

3) Decline in distribution per unit in FY20

| FY17 | FY18 | FY19 | FY20 | |

| Distribution per unit (DPU) | 7.09 | 7.16 | 7.61 | 3.03 |

Distribution per unit of Ascott REIT has declined from 7.61 cents in FY19 to 3.03 cents in FY20. This decline is in line with its overall financial and operational performance. Based on the closing price as at 31 December 2020, this would give investors a yield of 2.81%. In the short to medium term, we are in view that the hospitality sector will continue to be affected.

Read more: Why you should never buy a REIT just because they have a high dividend yield

4) Healthy gearing level below the permisible limit

| FY17 | FY18 | FY19 | FY20 | |

| Gearing | 36.20% | 36.70% | 33.60% | 36.30% |

A positive aspect worth noting is the debt profile of Ascott REIT which is fairly healthy from its gearing perspective. As at 31 December 2020, its gearing is at 36.3% which is slightly higher than its 33.6% in FY19. Nevertheless, this is still within the permissible limit giving them ample debt headroom for future asset acquisition and enhancement initiatives.

Read more: How Does Interest Rates Affect REITs

5) Slow but a gradual pickup in operating performance

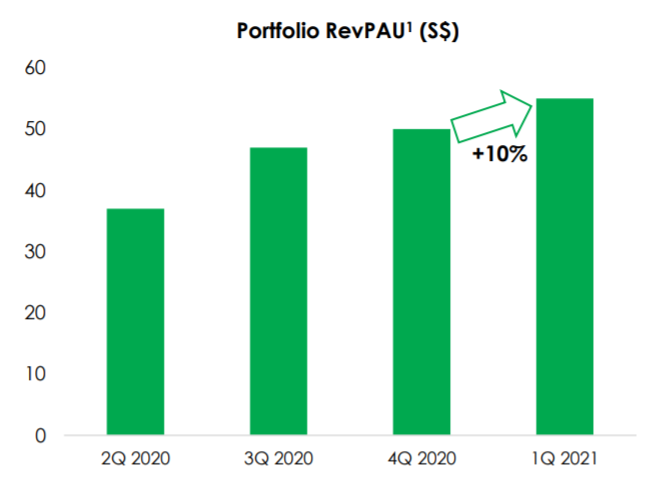

Diving briefly into the performance in 1Q21, Ascott REIT’s operating performance has gradually improved. The portfolio revenue per unit increased 10% quarter on quarter to SGD 55 in 1Q21. This is mainly contributed by a strong domestic leisure demand and corporate activity gradually picking up in March 2021. Nevertheless, the road to recovery to the pre-COVID level is still a long way to go.

Summary

From our overall analysis, Ascott REIT being a REIT in the hospitality sector is no doubt heavily impacted. However, with the vaccine rollout globally and countries gradually opening up by phases, this might be slightly positive for Ascott REIT.

What are your thoughts on Ascott REIT performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.