“Don’t pull all your eggs in one basket”. A term we often hear of when it comes to investing. The concept behind this is that if you pull all your eggs in one basket, you will lose all of it if something bad happens to that basket.

In investing terms, the concept is similar. The underlying meaning behind this concept is that if you invest a huge chunk of your money in one single stock, there is a 50/50 chance your stock will perform or flopped. If it performs, then good for you. But in the event that it flopped, then that would be bad. Hence, the importance of diversification (spreading your eggs across multiple baskets).

Diversification helps in minimizing and reducing risk. Notice that we use the word “minimize” and not completely removing the risk. There are always risks when it comes to investing. What you can do as an investor is to learn to manage it.

Why diversification and what does it achieve

Generally, there are two broad types of risk; systematic risk and unsystematic risk.

Systematic risk is a risk which affects the entire market and segment, not specifically on an investment vehicle or even industry. These are factors which are not controllable in nature (at least by us) given that various factors are involved. These are risks such as interest rate change, inflation rates, instability due to politics, and war.

Unsystematic risk, on the other hand, is risks which affect a specific industry, company or country. These are commonly known as business or financial risk.

While we cannot control systematic risk, as an investor, we can however reduce or minimize unsystematic risk. This is done through the process of diversification. Hence, the importance of diversification in investing.

Let’s say you invest 100% of your investment in company A which operates in the oil and gas industry. An adverse event such as a drop in oil price might severely impact the overall share in company A (say 30% dropped). Assuming that you have invested $100,000 purely in company A, your overall investment would have dropped by 30% down to $70,000.

| Co. | Sector | Invested Sum ($) | Market change | Profit/Loss ($) |

| Company A | Oil and Gas | 20,000 | -30% | (6,000) |

| Company B | REITs | 20,000 | 10% | 2,000 |

| Company C | Technology | 20,000 | 35% | 7,000 |

| Company D | Retail | 20,000 | 3% | 600 |

| Company E | Financial Service | 20,000 | 10% | 2,000 |

| Total | 100,000 | 5,600 |

Now let’s look at another scenario where we diversified the investment of $100,000 across 5 different sectors. You would have noticed that despite the decline in Company A, your overall portfolio would still achieve an overall positive return of $5,600 instead.

This is done purely by diversifying the unsystematic risk across different sectors.

How do you then apply this to your REITs portfolio?

When it comes to diversification, it is important that you diversify your investment across a various class of assets such as REITs, shares, precious metals, bonds and etc. This can be extremely in-depth and given that we are focussing on REIT specific content, we will discuss further on how you can apply this diversification concept into your REITs portfolio.

While we explain this, we will tap on various examples to help you understand why you should diversify in the following manner. The goal here is not to tell you what you should do but giving you greater insights so you can plan how to diversify your portfolio.

1) Diversification across different REITs sector

This is by far the most important diversification any investor should look into. REITs itself is a very broad class of assets whereby there are different type of REITs sectors such as retail REITs, hospitality REITs and etc.

Read More: Understanding the different type of REITs

To help you illustrate, we will use a real-life example from 3 Singapore REITs.

Let’s say you have $30,000 to invest in REITs around January this year.

Scenario 1: You invested all the $30,000 into Ascott Residence Trust at a price of $1.33. By end of the year, you would have made a loss of close to $5,639 ($30,000* -19%).

| Sector | Price at Jan 2nd 2020 | Price at Dec 31 2020 | Market change | Invested Sum | Profit/Loss | |

| Ascott Residence Trust | Hospitality REIT | 1.33 | 1.08 | -19% | 10,000 | (1,879) |

| Parkway Life REIT | Healthcare REIT | 3.33 | 3.87 | 16% | 10,000 | 1,621 |

| Ascendas REIT | Industrial REIT | 2.98 | 2.98 | No Change | 10,000 | – |

Scenario 2: You invested in 3 different types of REITs across the hospitality, healthcare and industrial REIT sector. By the end of the year, your loss would only be at $258.

Given the uncertainty of COVID-19 earlier this year, businesses are affected. This applies the same to REITs. Similarly, there are certain sectors which are rather more defensive such as healthcare and certain sector such as hospitality which are adversely affected.

If you have invested purely on scenario 1, you would have made a huge loss. Just by diversifying your overall REITs portfolio, your overall REITs portfolio loss is reduced to $258.

Hence, if you are looking to build a defensive REITs portfolio, it is important to explore diversifying across the different type of REITs sector.

2) Diversification across various geographical regions

The second REIT diversification you might want to consider is the diversification of your REITs portfolio across various geographical regions. There are a number of REITs listed in Singapore with properties exposure in different location globally. We often view the importance of geographical diversification as you will never be able to predict events that may impact your REIT or the geographical region.

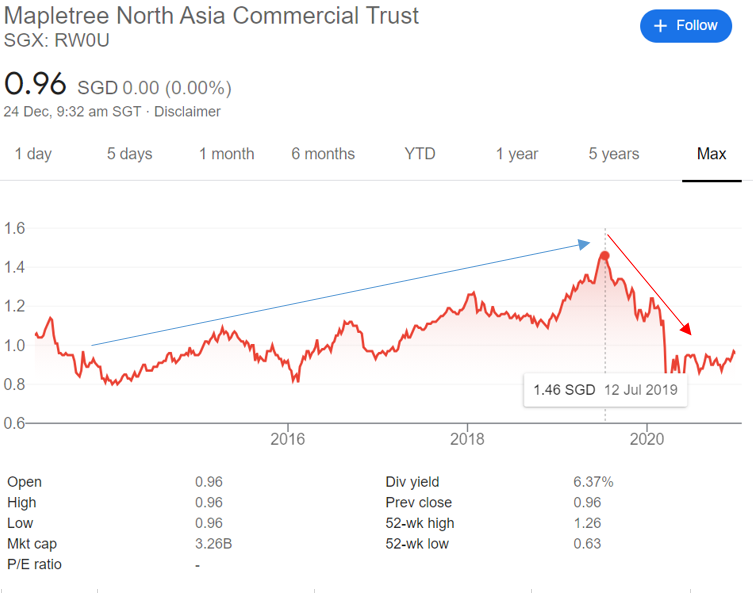

One good example is Mapletree North Asia Commercial Trust. MNACT has always been a strong and growing REIT.

Purely looking at its performance, it has been growing stably over the years till 2019 where the protest and the incident in Festival Walk result in the slow downfall of its shares. Coupled with the COVID-19 outbreak, MNACT share price went from its high of SGD 1.46 to SGD 0.96 as at December 2020.

The key point here is that if you would have purely invested in MNACT, your portfolio performance would have been severely affected. On the other hand, if you would have diversified across a number of REITs in a different geographical region, you would have reduced the overall risk.

Some perspective to share in regards to diversification across various geographical regions is that different countries handled things differently. Business in China has resumed way ahead of the rest of the countries. As an investor, you will benefit one way or another.

You will never be able to predict what would happen in the next 1-5 years but you can manage the risk you are exposed to.

Avoid over-diversification

Despite the strong importance of diversification, over-diversifying can be bad and should be avoided. Once unsystematic risk has been taken out, there is practically no more added benefit from further diversification. This is provided that you have diversified your portfolio correctly. I.e owning 5 different REITs in the same sector is a poor diversification.

There is no ideal number of shares you should own in your portfolio. The key principle to do it to an extent that helps you spread your risk but not overdo it. There are many arguments in regards to over-diversification.

Think about it from the perspective of managing and reviewing your REITs. Assuming you owned 15 individual REITs, will you be able to periodically reviewing all these 15 REITs?

Diversify smartly and focus on rebalancing your portfolio if there is a need.

Having said that, while this post is heavily centred on REITs portfolio, it is important that you also diversify various assets class given that REITs itself is a segment which may subject to risk.

One way you can diversify your portfolio hassle free is through REITs ETF or robo advisor such as SYFE REIT+. We will discuss more on this in other post but if you are keen, do consider using our referral code ‘SRPRM7S72’ and get 6 months fee waiver on your 1st $30,000 investment.

What are your thoughts on this? REIT Pulse is a platform launched to help individuals get started with REITs investing. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.