IREIT Global is a Singapore listed REIT with assets presence in Europe predominantly in Germany and Spain. IREIT Global is managed by IREIT Global Group Pte. Ltd. which is an entity jointly owned by City Development Limited and Tikehau Capital. Both Tikehau Capital and City Development Limited (“CDL”) are no stranger to many. Both are listed company in Paris Stock Exchange and Singapore Stock Exchange respectively.

Tikehau Capital is an asset management group with asset under management of €25.8 billion as at 31 December 2019. They invest in various asset classes such as private equity and real estate with presence globally. City Development Limited, on the other hand, is a leading global real estate company with a network spreading across 29 countries.

As the properties are located in the Europe region, it will be interesting to see how it has performed given the outbreak of COVID-19. For those who are not familiar with IREIT Global, they have a total of 9 properties valued at approximately €574.9 million as at 31 December 2019. Out of the 9 properties, 5 of it is located in Germany with the remaining 4 located in Spain.

Before we dive into a number of key things you need to know about IREIT Global FY19 and 2020 performance, it is important to note that the financials are denominated in Euros.

Historical Performance (FY17 to FY19)

1. Acquisition of Spanish Portfolios

On December 2019, IREIT Global has completed its acquisition of 4 properties in Spain (“Spanish Portfolios”). This acquisition is made through a 40:60 joint venture with Tikehau Capital in which IREIT Global hold a 40% interest. The acquisition is funded through a term loan from CDL.

These 4 acquisitions upon completion brings IREIT Global total properties to 9 properties.

From our point of view, we view this acquisition a plus as it gives greater diversification to IREIT Global overall portfolio which is heavily concentrated in Germany.

2. Improvement in occupancy rate throughout FY17 to FY19 with a huge tenant concentration risk

| FY17 | FY18 | FY19 | |

| Berlin Campus | 99.2% | 100.0% | 100.0% |

| Born Campus | 100.0% | 100.0% | 100.0% |

| Darmstadt Campus | 100.0% | 100.0% | 100.0% |

| Munster Campus | 93.3% | 93.3% | 100.0% |

| Concor Park | 96.9% | 97.1% | 98.2% |

| Germany Portfolio | 98.3% | 98.6% | 99.7% |

| Delta Nova IV | n.a | n.a | 93.6% |

| Delta Nova VI | n.a | n.a | 94.5% |

| Il-lumina | n.a | n.a | 69.2% |

| Sant Cugat Green | n.a | n.a | 77.1% |

| Spain Portfolio | n.a | n.a | 80.7% |

IREIT Global has portfolios in both Spain and Germany. As such, we will be looking at the overall portfolio occupancy rate by region. The Germany portfolio which consists of 5 properties has been performing well. Its overall occupancy rate increased from 98.3% in FY17 to 99.7% in FY19. This is definitely a plus point to IREIT Global.

The Spanish portfolio which was recently acquired late 2019 has an overall occupancy rate of 80.7% which is way below the performance of Germany portfolio. Nevertheless, the newly acquired portfolios is not a material contributor to IREIT Global accounting only 0.4% (Note that it was only acquired late 2019) of its total rental in 2019.

An area which investors should pay close attention to is the huge tenant concentration risk of IREIT Global.

The top 2 tenants make up approximately 77% of the total portfolio composition with the remaining 23% spreading across various tenants. In our opinion, this is fairly high which will be detrimental to IREIT global in the event that the tenant default or terminate the lease. The positive aspect, however, is that there is no need to constantly manager small individuals tenants.

Definitely, an area investors should place closer attention to.

3. Overall increased in revenue and net property income from FY17 to FY 19

If we were to look into IREIT Global financial performance, there have been a mix in performance year on year. The net property income slumped from € 31.5 million in FY17 to € 30.6 million in FY18. This drop is due to the effect of the loss in rental income at Münster South building after the tenant vacated one floor with effect from April 2017.

The net property income however improved from slightly in FY19. The improvement is mainly attributable to the newly signed lease in Munster Campus in July 2019.

It is important to note that as the newly acquired building are only owned partially, their financial performance are not reflected as net property income but as other income.

Going forward, we would expect the overall financial performance to increase with the full rental income from the newly acquired portfolios kicking in. However, the effect of the COVID-19 outbreak would be an area investor would need to keep at eye on.

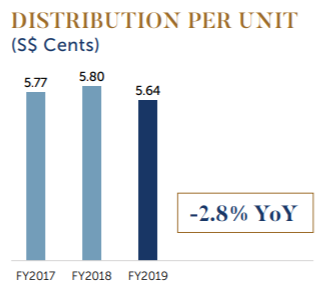

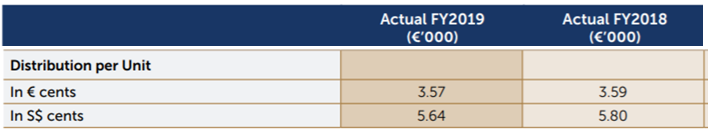

4. Slight decline in distribution per unit (DPU) in FY19

The distribution per unit of IREIT Global decreased slightly in FY19. The key reason for the dropped is due to the weaker EUR/SGD exchange rate. However, if we were to look at the DPU in €, the DPU remain fairly stable at 3.57 to 3.59 cents range. Do note that the distribution is made in SGD.

With the full-year rental income kicking in for the Spanish portfolios, this would potentially increase the overall DPU in the medium term without factoring in the effect of COVID-19.

Read More: Why you should never buy a REIT just because it has a high dividend yield

5. Gearing of 39.3% within the permissible limit

As at 31 December 2019, the gearing of IREIT Global stood at 39.3%. This is an increase from 36.6% in FY18. Despite the increase, the gearing is still below the permissible limit of 50% which would give them ample debt headroom for further acquisition and asset enhancement initiative.

Of the total borrowings, 86.3% of it are fixed. This would reduce its interest rate risk. Depending on how you view it, this would also mean that they would not benefit in any interest rate drop environment.

Read More: How do interest rates affect REITs

1H20 Performance

Now that we have covered IREIT Global historical performance, let’s look at how it had performed in 2020. An area which is particularly interesting with the income from the Spanish portfolio kicking in as well as the impact from the COVID-19 outbreak.

6. Occupancy Rate in Spain Improved in 3Q20

| FY19 | Q320 | |

| Berlin Campus | 100.0% | 100.0% |

| Born Campus | 100.0% | 100.0% |

| Darmstadt Campus | 100.0% | 100.0% |

| Munster Campus | 100.0% | 100.0% |

| Concor Park | 98.2% | 97.50% |

| Germany Portfolio | 99.7% | 99.60% |

| Delta Nova IV | 93.6% | 93.70% |

| Delta Nova VI | 94.5% | 94.50% |

| Il-lumina | 69.2% | 77.10% |

| Sant Cugat Green | 77.1% | 90.20% |

| Spain Portfolio | 80.7% | 86.80% |

In terms of its overall occupancy rate, its Germany portfolio which accounts for the biggest proportion of the total remains stable which is a good sign. The 4 newly acquired properties in Spain on the other hand is doing better than expected with an overall increase in occupancy rate from 80.7% end of Dec-19 to 86.8% in 3Q20.

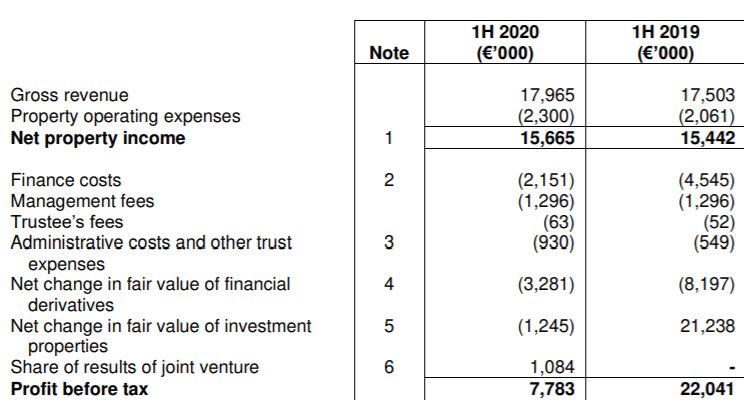

7. Increased in net property incomes and income from the joint venture in 1H20

The net property income of IREIT Global in 1H20 has increased to € 17.9 million when compared to € 17.5 million in 1H19. The increase is mainly from the contribution of the new lease which was signed in July 2019 in Munster Campus in which was not reflective in 1H19.

Other income from the joint venture is another aspect which is new in 1H20. This income of € 1.1 million is not part of 1H19 financials given that the acquisition was only made in December 2019.

8. Acquisition of the remaining 60% of the Spanish Portfolios

On 22 October 2020, IREIT Global completed its acquisition of the remaining 60% of the 4 properties previously acquired partially in December 2019. Upon the completion, they owned 100% of the Spanish portfolios.

The acquisition is funded through a rights issue in which a portion of the fund is used to repay the loan taken from CDL to fund the initial 40%.

Given the improved operational performance of the Spanish Portfolios, the acquisition of the remaining 60% might potentially be favourable to IREIT Global.

Summary

From REIT Pulse point of view, IREIT Global has been performing fairly well over the last 3 years. There are some slight hiccups but performance in FY19 proves the management ability in managing the REIT. 1H20 performance itself is commendable with an overall increase despite the COVID-19 outbreak. The REIT active acquisition over the last 1 year is also a good indicator of the REITs ability to further growth.

The only area we find risky is the over-reliant on 2 major tenants which cumulative account for close to 77% of the total.

What are your thoughts on IREIT Global? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.