Keppel DC REIT is the first and only pure data centre REIT in Singapore. It was listed in the Singapore stock exchange on December 2014 with a primary focus on investing in assets which are used primarily for data centre purposes.

They are sponsored by Keppel Telecommunications & Transportation Limited (Keppel T&T). For those who do not know, Keppel T&T is a Singapore listed company with operations in Asia Pacific and Europe.

As at 30 September 2020, Keppel DC REIT has a total of 18 data centre assets spanning across 8 different countries. Given that Keppel DC REIT is the only pure data centre REIT in Singapore, we will be looking into a few key things you need to know of its FY19 and 3Q 2020 performance.

Historical Performance (FY17 to FY19)

1. Acquisition of Keppel DC Singapore 4 and DC1

One significant event in FY19 is the acquisition of Keppel DC Singapore 4 and DC1. Both these acquisitions are located in Singapore with it the acquisitions completed in Q4 2019 2019.

This is a positive sign as it allows Keppel DC REIT to tap into the increasing demand for data centres. Furthermore, these 2 acquisitions will further contribute to the organic growth of the REIT.

Also happened in Q4 2019 is the announcement of the proposed acquisition of Kelsterbach Data Centre in Germany. This acquisition is expected to be completed in 2020.

2. Overall year on year improvement in occupancy rate but high reliance on a few key tenants

| FY17 | FY18 | FY19 | |

| No. Of Properties | 13 | 15 | 17 |

| Occupancy Rate | 92.60% | 93.10% | 94.90% |

In terms of its operational performance, investors can clearly see the proactive organic growth plan of Keppel DC REIT. They have grown from 13 properties in FY17 to 17 properties in FY19.

Not only that, it’s overall occupancy rate has been improving year on year from 92.60% in FY17 to 94.90% in FY19. This is a strong point in favour of Keppel DC REIT strategy in terms of both organic growth and inorganic growth.

If there is one aspect we would find less attractive is its tenant concentration. Based on December 2019 total rental income, approximately 41% of the rental income is contributed by one single tenant. This posses tenant concentration risk where a major disruption by that client would be detrimental to Keppel DC REIT as a whole.

3. Increased in net property income

| SGD in 000s | FY17 | FY18 | FY19 |

| Gross Revenue | 139,050 | 175,535 | 194,826 |

| Net Property Income | 125,119 | 157,673 | 177,283 |

As expected, the net property income grew year on year from SGD 125 mil in FY17 to SGD 177 mil in FY19. This increased is mainly from the full-year contribution of Maincubes Data Centre and Keppel DC Singapore 5.

Furthermore, the improvement in overall occupancy rate since FY17 also contributes to the increased in overall net property income. Looking into FY20, we would expect the financial performance to further improved with the full-year contributions of Keppel DC Singapore 4 and DC 1 kicking in.

4. Year on Year increase in distribution per unit

| Cents | FY17 | FY18 | FY19 |

| Distribution per unit | 7.12 | 7.32 | 7.61 |

Distribution per unit has been increasing year on year in line with its operational and financial performance. The distribution per unit improved from 7.12 cents in FY17 to 7.61 cents in FY19.

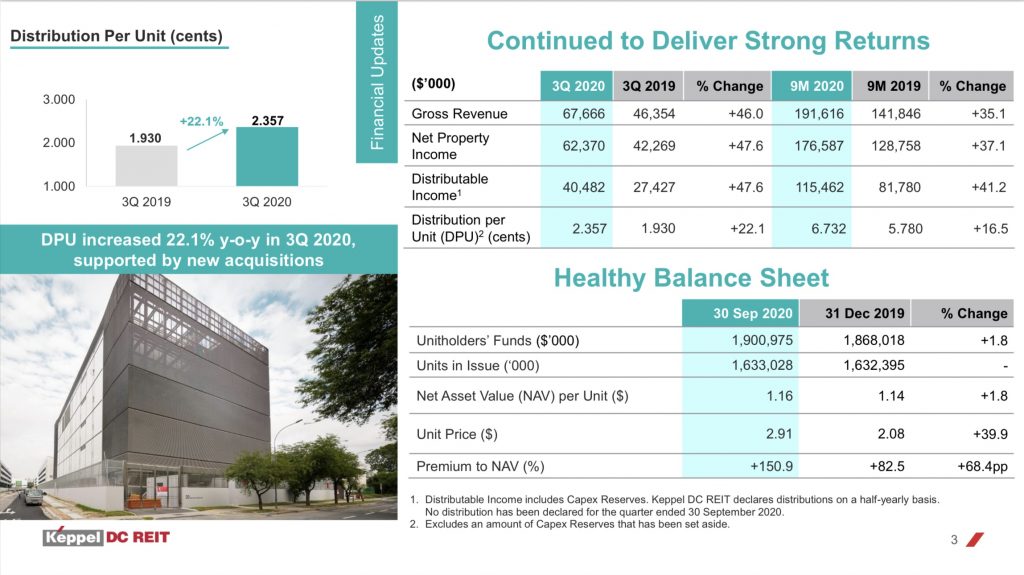

One point investors would want to consider despite the strong operational and financial performance is whether the dividend yield is attractive. Based on its closing price in December 2019 of SGD 2.08, as compared to FY19 full-year distribution, this would give investors a yield of 3.66%.

Read More: Why you should never buy a REIT just because it has a high dividend yield

5. Gearing level of 30.7%

As at 31 December 2019, Keppel DC REIT has a total borrowings of SGD 870 million. This would translate to a gearing of 30.7% which is still below the permissible limit of 50% giving them ample debt headroom for further acquisition and asset enhancement initiatives.

3Q20 Performance

6. Acquisition of 2 additional assets in Q2 2020

Further to the 2 acquisitions in FY19, Keppel DC REIT completed another 2 additional acquisitions Q2 2020. Keppel DC Dublin 1 which is located in Ireland is completed in March 2020 whereas Kelsterbach Data Centre in Germany is completed in May 2020.

Upon the completion of these acquisitions, this brings their asset under management up to SGD 2.8 billion.

7. Improved in overall occupancy rate

As shared in the earlier few points, the occupancy rate of Keppel DC REIT has been improving year on year from FY17 to FY19. Looking at its 3Q20 performance, its overall occupancy rate continues to improve from 94.90% in December 2019 to 96.7% in September 2020.

This is definitely something commendable given the economic outlook as a result of the COVID-19 outbreak.

8. Strong financial performance in 3Q20

The third-quarter financial performance has also improved. Gross revenue and net property income increase by 46% and 47.6% respectively. This lead to a YTD increase of 37.1%. The increase is mainly from the full-year contribution of Keppel DC Singapore 4 and DC1 which was acquired late FY19 as well as contributions from Keppel DC Dublin 1 and Kelsterbach Data Centre which was acquired in March and May 2020 respectively.

We would expect the full-year performance of FY20 to be better than FY19 with the contributions of the newly acquired properties.

Summary

Based on our overall analysis, Keppel DC REIT has been performing well both historically and in the recent months. Operationally, the occupancy rate has been increasing year on year despite the COVID-19 pandemic. On the financial aspect, its performance has been increasing as well mainly fueled by proactive acquisitions.

Investors would appreciate the REIT manager initiatives in growing the REIT. The only downside we see is the high tenant concentration risk it has.

Based on its current traded price of SGD 2.79 and it latest NAV of SGD 1.16 as at 30 September 2020, this would give investors a price to book ratio of 2.4. Investors would then have to decide if Keppel DC REIT is worth investing given the price premium to the NAV.

What are your thoughts on Keppel DC REIT REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.