SPH REIT is one of Singapore listed REIT which invest primarily in real estate assets in Singapore and Australia. They are sponsored by Singapore Press Holdings which is one of the leading media organisation in Asia. In our previous post, we have dive a little into some of the key things you need to know SPH REIT FY20 performance.

Read More: 6 Key Things To Know of SPH REIT FY20 Performance

We have seen that the performance of SPH REIT in FY20 has been impacted by the COVID-19 pandemic. Hence, in this post, we will dive deeper into SPH REIT 1Q21 performance to see if the performance is improving.

Hopefully, you will gain greater insights into SPH REIT 1Q21 performance.

1) Stable Average Occupancy Rate of 97.9% in 1Q21

The average occupancy rate of SPH REIT 1Q21 remains stable at 97.9%. This is fairly close to its occupancy rate in FY20 performance. Just by looking at its Singapore assets performance, all 3 properties have improved slightly to a much favourable level. Paragon Mall which is the largest contributor has improved by 0.2% from 97.8% in August 2020 to 98.0% in November 2020. Similarly, the Rail Mall occupancy rate has improved from 92.2% in August 2020 to 100% in November 2020.

This is definitely a commendable performance for SPH REIT given the ongoing uncertainty in COVID-19 pandemic. Nevertheless, this is an indication that the performance is in a recovery phase.

In terms of its Australia assets performance, both Westfield Marion and Figtree Grove remains stable in 1Q21. A plus given that Westfield Marion is now the second biggest contributor post its acquisition. If we were to look in detail later, you will better understand why the acquisition of Westfield Marion has contributed to the improvement in performance in 1Q21.

2) Increase in revenue contributed by Westfield Marion

The next aspect we will dive into is SPH REIT 1Q21 financial performance. There is not much in detail information provided in its 1Q21 business updates, hence, we will only dive briefly based on its revenue.

Looking at its overall revenue, you will have noticed that SPH REIT 1Q21 revenue has grown to SGD 66.6 million as compared to its 1Q20 performance. While the overall revenue has increased, it is worth noting that the increase is mainly attributable to its Australian assets in which we will look into separately.

If we were to look at the overall occupancy rate of its Singapore assets shared earlier, it has actually improved but the revenue has declined for both Paragon Mall and Clementi Mall. This drop is largely attributed to the rental relief granted to assist tenants which were significantly impacted by COVID-19 pandemic. As such, the overall revenue of its Singapore portfolio has declined.

As for its Australian properties, the revenue from Westfield Marion has overall lifted SPH REIT total revenue to a favourable performance. This is due to its acquisition in 2Q20 and hence the performance of Westfield is not reflected in 1Q20.

Despite the drop in revenue of its Singapore assets, we view that this is a favourable move as it is mainly from the rental support given to the affected tenants. As a result, the occupancy rate of the Paragon Mall in particular still remains high.

3) Distribution per unit recovering but still below pre-COVID levels

If you have read our previous post on SPH REIT, you will have noticed that its distribution per unit has declined drastically in FY20. The drop was mainly from the:

- Rental waivers granted to eligible tenants in Singapore affected by COVID-19.

- A portion of the income available for distribution deferred as allowed under COVID-19 relief measures announced by IRAS.

Distribution per unit in 1Q21, on the other hand, has overall improved with a distribution of 1.20 cents. Though this is 13% lower than 1Q20 distribution (pre-COVID-19 level), this is an improvement close to its pre-COVID-19 levels. An indication of gradual recovery.

4) Improvement of tenant sales and traffic but still below pre-COVID levels

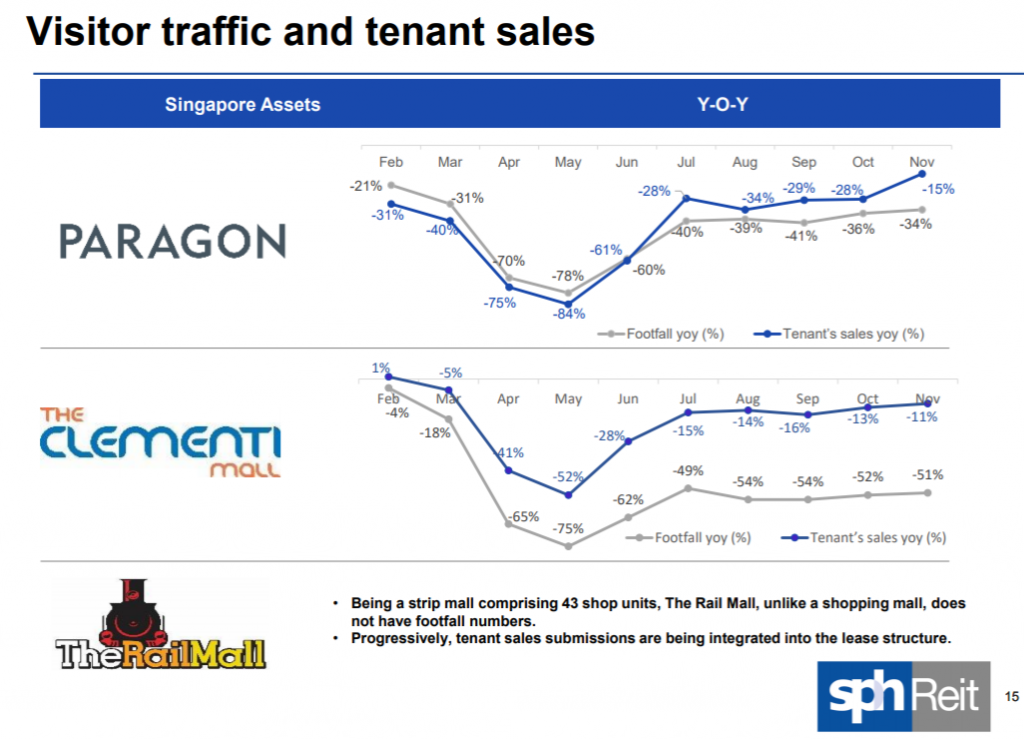

Last but not least, we will be touching a little on some data of its tenants’ sale and traffic given that it is a retail-driven sector. On a high-level glance, both Paragon and Clementi mall are still affected by the COVID-19 outbreak with the closure of the border and work from home arrangement. Nevertheless, its tenant’s sales and footfall are gradually improving.

Similarly, its Australian assets are also gradually improving as well. The recovery is less consistent with a slight in November for Westfield Marion compared to its previous month.

Summary

From our perspective, SPH REIT 1Q21 has gradually improved in terms of its operations. The closure of border and work from home arrangement is still a concern here for malls such as The Paragon Mall and Clementi Mall. But nevertheless, its overall occupancy rate has remained stable.

With the tenants sales and footfall gradually improving as well, this could potentially be favourable to SPH REIT. The positive aspect noted in 1Q21 is definitely the contribution of its newly acquired Westfield Marion which has pulled up its overall revenue.

What are your thoughts on SPH REIT 1Q21 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.