Amanah Raya REIT is a diversified REIT listed in the Bursa Malaysia. As shared in our previous post on Amanah Raya REIT, they are managed by AmanahRaya-Kenedix REIT Manager Sdn. Bhd which is a joint venture between AmanahRaya-REIT Managers and Kenedix Asia through its local subsidiaries, KDA Capital Malaysia. This is a great partnership as it allows them to tap into the expertise of Kenedix Group management.

Read more: Understanding the REIT structure and its underlying expenses

Since our last post on Amanah Raya REIT, there have not been any change in their properties composition since FY19. In this post, we will look at its FY20 performance to see how it has performed.

1) Slight drop in the office and retail sector occupancy rate

| FY18 | FY19 | FY20 | |

| Hospitality | |||

| Ex-Holiday Villa Alor Setar | Vacant | Vacant | Vacant |

| Holiday Villa Langkawi | 100% | 100% | 100% |

| Education | |||

| Segi College, Subang | 100% | 100% | 100% |

| Segi College, Kota Damansara | 100% | 100% | 100% |

| Help University | 100% | 100% | 100% |

| Office | |||

| Block A&B South City Plaza (Prospective sale) | 50% | 50% | 50% |

| Toshiba TEC | 100% | 100% | 100% |

| Wisma Comcorp | 100% | 100% | 100% |

| Dana 13, Dana 1 Commercial Centre | 100% | 60% | 54% |

| Vista Tower | 70% | 68% | 63% |

| Contraves | 100% | 100% | 100% |

| Industrial | |||

| RHF Stone Factory | 100% | 100% | 100% |

| AIC Factory (Disposed on 26 June 2019) | Vacant | – | – |

| Gurun Automotive (Disposed on 16 December 2019) | Vacant | – | – |

| Silver Bird Factory (Disposed on 25 May 2018) | – | – | – |

| Retail | |||

| Selayang Mall | 100% | 100% | 95% |

Amanah Raya REIT is a diversified REIT which operates in the hospitality, education, office, industrial and retail sector. No doubt that most REIT in Malaysia are affected one way of another by the uncertainty of COVID-19. If we were to look at Amanah Raya REIT overall occupancy rate, it has declined slightly. Their education, hospitality and industrial sector maintains a stable occupancy rate similar to FY19. Office and retail sector on the other hand reported a decline. Dana 13, Dana 1 commercial centre and Vista Tower which have been on a declining trend historically continues to decline in FY20.

2) Decline in both revenue and net property income in FY20

| MYR in 000s | FY18 | FY19 | FY20 |

| Revenue | 97,244 | 96,876 | 92,005 |

| Net Property Income | 79,570 | 80,666 | 72,645 |

For the year ended 31 December 2020, both the revenue and net property income of Amanah Raya REIT declined as compared to the prior year. Their revenue declined from MYR 96.9 million in FY19 to MYR 92.0 million in FY20 whereas their net property income declined from MYR 80.7 million in FY19 to MYR 72.6 million in FY20. The decline is mainly attributable to lower rental income from Vista Tower and Dana 13, Dana 1 commercial centre aligned with the drop in occupancy rate in respect to these properties.

Furthermore, Dana 13 commercial centre which was previously entered via a triple-net lease arrangement have changed to a multi-tenant property. This has resulted in an overall higher property expenses. Another reason for the decline in net property income is due to the rental relief package such as rental rebates which was provided to affected tenants mainly in the education, hospitality and office sector.

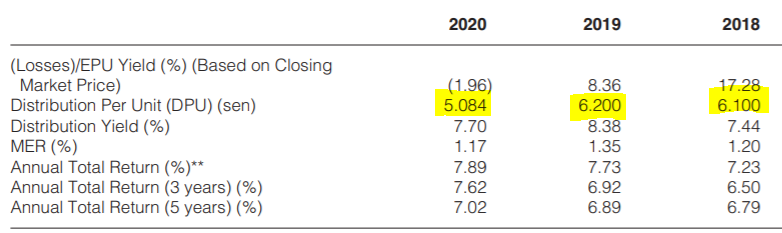

3) Distribution per unit decline from 6.20 cents in FY19 to 5.08 cents in FY20

As expected, Amanah Raya REIT recorded a decline in distribution per unit. DPU dropped from 6.20 cents in FY19 to 5.08 cents in FY20. This is in line with the overall drop in operational and financial performance. Comparing the distribution per unit of FY20 to its closing 31 December 2020 trading price, this would give investors yield of 7.70%.

This may seem like a good yielding opportunity but if we were to look closely at the underlying reason from the high yield, it is mainly a result of a decline in share price. We will let you decide if this is a good buy or a pass.

Read More: Why you should never buy a REIT just because they have a high dividend yield

4) Increased in gearing level from 43.8% in FY19 to 44.9% in FY20

| FY18 | FY19 | FY20 | |

| Gearing | 44.72% | 43.81% | 44.85% |

Last but not least, we will look at Amanah Raya REIT debt profile. As at 31 December 2020, Amanah Raya REIT has a total debt of MY 643.56 million. This translates to a gearing level of 44.85% which is within permissible range. An area which is worth looking out is the gearing level in FY20 which is an all time high in the last 3 years.

Summary

Based on our overall analysis, Amanah Raya REIT being a diversified REIT reported a mixed performance in its various sectors. Its operational and financial performance decline slightly in FY20 which comes to no surprise given the uncertainty of COVID-19 pandemic to their office, retail no hospitality sector. Given the rollout of vaccine and gradual easing measure, hopefully this would be favourable to Amanah Raya REIT.

What are your thoughts on AmanahRaya REIT FY20 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

o join our community over at Facebook and Instagram.