REITs or real estate investment trust is an instrument which has been popular among investor. Particularly investors who are seeking stable dividend income. The business model of a REIT is fairly simple. REIT lease their buildings to tenants in return for rental income. As a REIT investor, you will then be entitled to this net earnings received distributed in the form of dividends.

Despite the simplistic form of the business model, there’s risk in every investment. One way an investor can minimize risk is through diversification which is a method to eradicate the unsystematic risk. As simple as the concept of diversification sound, the reality is that it is not that simple when it comes to individual REITs. Why do we say so?

Diversifying across a number of REITs portfolio can be a tough exercise for a number of reasons:

- Capital constraint. The minimum amount of shares you have to buy in SGX and Bursa stock exchange is 100 units. To diversify your REITs portfolio, you would need a certain amount of capital to fully leverage the power of diversification.

- Hefty commission charges. Assuming you have a huge capital to invest, you will incur brokerage fees each time you trade (i.e minimum SGD10). The fees will add up to a substantial amount.

- Not able to dollar cost average efficiently. Dollar-cost averaging is a method investors use to accumulate shares. The idea is to make regular purchase of the underlying stock regardless of the price. DCA on individual stock on a diversified basis is not going to be cheap given the fees you have to pay per trade.

Investing in REITs via an exchange-traded fund

Given the difficulties in diversification, a number of REITs focussed exchange-traded funds have been introduced. In the Singapore stock exchange itself, there are 3 REITs based ETF being Phillip SGX APAC Dividend Leaders REIT ETF, NikkoAM-StraitsTrading Asia Ex Japan REIT ETF and Lion-Phillip S-REIT ETF. The REITs sector in Malaysia is growing as well with the recent listing of TradePlus MSCI Asia ex-Japan REITs Tracker.

The introduction of ETFs based REIT is definitely a plus to passive investors who are looking into the diversification of their REITs portfolio. ETFs are essentially a basket of funds. By investing in a unit of ETF, you have exposure to the basket of stocks in the fund.

Let’s say you invest in NikkoAm-StraitsTrading Asia Ex Japan REIT ETF.

By investing in this REITs ETF, it allows you to gain diversification in REITs simply through purchasing a unit of the ETF. Investing in REITs ETF has its own pro and cons which we will not discuss in this specific post (maybe another time).

Despite the development of REITs ETF which now allow passive investors to leverage on diversification, there are two main problems. Firstly, ETFs are traded in the stock exchange. To buy them, you will still have to pay brokerage fees each time you trade. This would not be cost-effective for an investor who is looking to dollar cost average in the long run.

The second issue is given that ETFs are listed in the stock exchange, there is a minimum trading amount of 100 shares. Hence, you cannot exactly start with a small amount of capital. Even if you do, the brokerage fees will add up in the long run.

Syfe REIT+ Portfolio: Bridging the gap

This is where Syfe REIT+ bridge the gap in our opinion. Syfe REIT+ is the only Robo advisor that are REITs focussed. They track REITs in Singapore via iEdge S-REIT Leaders Index.

Syfe REIT+ solve two main problems. Firstly, investors pay lesser fees compared to investing in individual stocks (assuming that you diversify your portfolio) or even in ETFs. There is still management fees payable per annum but there are no brokerage fees. This would allow you to dollar cost average effectively. Also, there is no minimum investment amount which means practically anybody can start investing.

Features of Syfe REIT+

To a certain extent, Syfe REIT+ portfolio works almost the same as an ETF. Your investment exposure is spread across the REITs holding in the REIT+ portfolio. Assuming that you allocate SGD100 on a monthly basis to Syfe REIT+. The invested amount will be used to purchase all the underlying share.

1) Dividend Payout Option

One of the key reason REITs are attractive is from the regular dividend income stream. If you opt to invest through Syfe REIT+, you can opt for the dividend payout option but with a caveat. The payout option is only applicable to customers on the Black (min $20,000 portfolio) or above tiers.

For those below the black tier range, the dividend will be reinvested by default. A good thing actually in building your portfolio size.

2) Regulated by the Monetary Authority of Singapore

The next feature which of Syfe REIT+ is that they are regulated by The Monetary Authority of Singapore. They are licensed under the Capital Markets Services License for retail fund management complying with all stringent standards set by MAS for financial and investment services companies.

3) Low fee structure

Another key benefit we like about Syfe REIT+ is its overall low fees structure. With a portfolio of $10,000, the annual management fee p.a is $65. That is an all in price. You can enter into as many separate positions as you want and the price is fixed based on the tier.

Comparing this to a traditional REIT ETF, you will have to pay the management fee PLUS brokerage fees each time you trade.

4) Risk Management Option

Automated Risk-managed Investments (ARI) strategy is Syfe proprietary investment methodology, combining the best of two approaches – Global Market Portfolio (GMP) and Risk Parity Portfolio (RP). If you are keen, you can read more on the ARI strategy here.

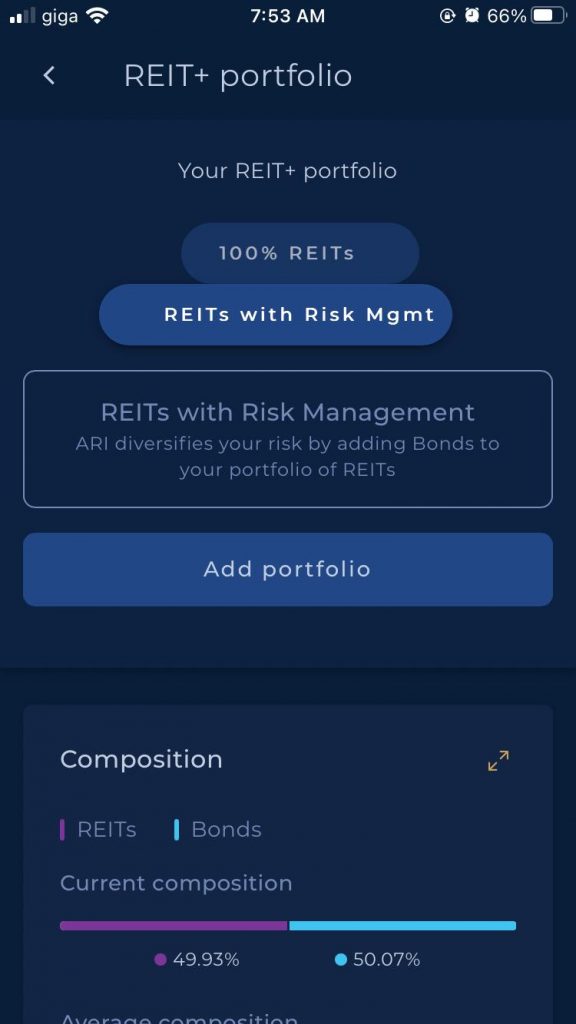

Essentially, there are 2 main options in regards to the REIT+ portfolio, 100% REITs and REITs with Risk Management. The latter option is more defensive suitable for investors who are more risk-averse.

Looking at the screenshot above, 100% REITs options are purely invested in REITs. The REITs with risk management option have a mix composition of both bonds and REITs.

Who is Syfe REIT+ for

There is no doubt that the introduction of Syfe REIT+ addresses a number of gaps in the market. The question is, should you then consider Syfe REIT+.

In our opinion, nothing is more rewarding from handpicking your own REITs and building your REIT portfolio. This exercise, however, requires an extensive amount of work. If you fall under one of the categories below, Syfe REIT+ might appeal to you.

- You are a passive investor

- Have no time to research and conduct proper due diligence on REIT

- Looking to diversified your REITs portfolio but find it costly to do so on individual REITs on a periodic basis

- You intend to dollar cost average your position on a regular basis (i.e monthly or bi-weekly)

- You are intending to start small with a small sum of investment.

Note: The admin of this post personally invested in Syfe REIT+.

Here is a link to sign up for Syfe REIT+. If you use our referral code “SRPRM7S72“, you will receive a fee waiver for the next 6 months on your first $30,000 investment. (Disclaimer: We would also earn a small referral fee if you sign up using this link).

REIT Pulse is a platform launched to help individuals get started with REITs investing. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.