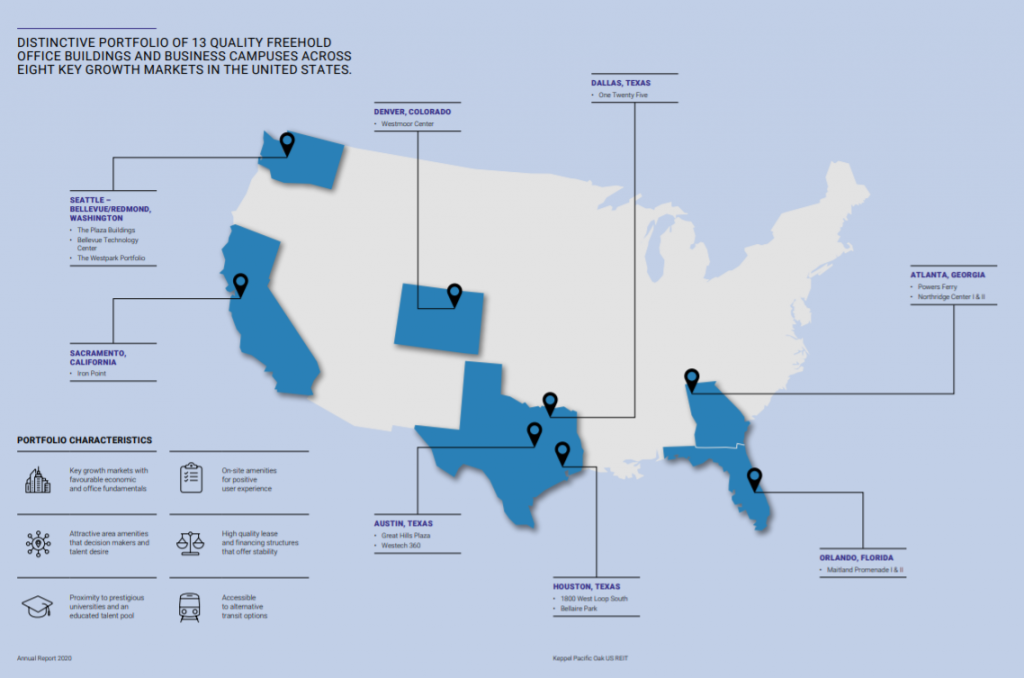

Keppel Pacific Oak REIT, alongside Manulife US REIT and Prime US REIT is one of the few REITs with office portfolio in the United States. They were listed on the Singapore stock exchange with 13 freehold office assets across eight key growth markets in the United States. In this post today, we will look at Keppel Pacific Oak REIT FY20 and 1H21 performance.

Read More: 7 Key Things to Know of Keppel Pacific Oak REIT FY19 and 3Q20 Performance

Historical Performance (FY19 & FY20)

1) Overall occupancy rate decline with an overall positive rental reversion

| FY19 | FY20 | |

| The Plaza Buildings | 97% | 92% |

| Bellevue Technology Center | 99% | 96% |

| The Westpark Portfolio | 93% | 95% |

| Westmoor Center | 97% | 97% |

| Great Hills Plaza | 100% | 100% |

| Westech 360 | 99% | 83% |

| 1800 West Loop South | 75% | 76% |

| Bellaire Park (f.k.a West Loop I & II) | 89% | 91% |

| One Twenty Five | 96% | 95% |

| Maitland Promenade I & II | 99% | 95% |

| Iron Point | 97% | 98% |

| Powers Ferry | 94% | 89% |

| Northridge Center I & II | 84% | 82% |

| Overall Portfolio | 94% | 92% |

Looking at the occupancy rate Keppel Pacific Oak REIT, they have reported an overall decline in occupancy from 94% in FY19 to 92% in FY20. The decline is mainly attributable to 7 out of 13 properties. Despite the overall drop in occupancy rate, Keppel Pacific Oak REIT has managed to achieve a strong average rental reversion of 10.2% across its portfolio. This is driven by strong rent growth from leasing activities in Seattle, Sacramento, and Austin.

Having said that, with a number of companies still encouraging working from home and gradually pivoting to hybrid work, investors would definitely need to keep a closer lookout on its overall operational performance. Keppel Pacific Oak REIT is not the only REIT on the receiving end, the occupancy rate of Manulife US REIT has likewise decline.

2) Growh in overall financial performance of Keppel Pacific Oak REIT

| USD in 000s | FY18 | FY19 | FY20 |

| Gross Revenue | 93,525 | 122,886 | 139,590 |

| Net Property Income | 56,723 | 74,753 | 82,983 |

Despite an overall decline in the occupancy rate of Keppel Pacific Oak REIT, they have reported a fairly commendable financial performance. Revenue has increased from USD 122.9 mil in FY19 to USD 139.6 mil in FY20. The better year-on-year performance was driven by the contributions of One Twenty Five in Dallas which was acquired late FY19. In addition to that, proactive efforts to drive leasing, built-in rental escalations, and positive rental reversion has also contributed to the overall growth.

3) Year on year increase in distribution per unit

| USD in cents | FY18 | FY19 | FY20 |

| Distribution Per Unit | 5.4 | 6.01 | 6.23 |

While there has been a mixed performance in Keppel Pacific Oak REIT operational and financial performance, they have reported an overall favorable distribution in FY20. Distribution per unit has increased year on year from 5.4 cents in FY18 to 6.23 cents in Fy20. This is mainly contributed by the full-year contributions of One Twenty Five and overall positive rental reversion.

4) Gearing limit within a healthy range

| FY18 | FY19 | FY20 | |

| Gearing | 35.10% | 36.90% | 37.00% |

As at 31 December 2020, Keppel Pacific Oak REIT has a total borrowings of USD 506 million which translates to a gearing of 37% which is still within a fairly healthy range. While management is exercising a cautious approach in regards to acquisitions, its overall leverage ratio would still give them ample debt headroom for future acquisition and asset enhancement initiatives if they choose to do so.

1H21 Performance

5) Slight decline in overall occupancy rate but still within a healthy range

The overall volatile backdrop with the uncertainty of COVID-19 has continued to impact businesses globally. Occupancy rate of Keppel Pacific Oak REIT has continued to decline to 90.5% in 1H21 from c.92% just 6 months back. The good news however is that Keppel Pacific Oak REIT has reported a 5.4% overall positive rental reversion in 1H21.

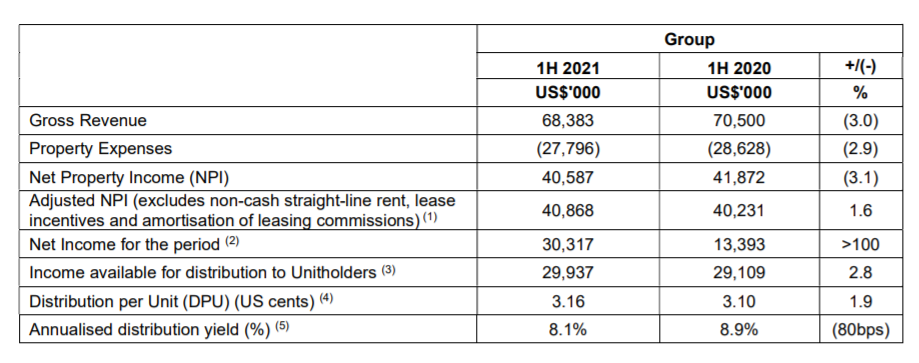

6) Decline in revenue but distribution remain stable

In 1H21, Keppel Pacific Oak REIT has reported a decline in revenue from USD 70.5 mil in 1H20 to USD 68.4 mill. This is largely due to lower car park income collected due to the Covid-19 pandemic. Apart from that, the drop in occupancy rate has also contributed to the decline but is partially offset by the overall positive rental reversion reported.

The good news is that the distribution per unit has increased from 3.10 cents in 1H20 to 3.16 cents in 1H21.

Summary

Based on our overall analysis, there has been a mixed in performance of Keppel Pacific Oak REIT. While its occupancy rate has declined, they have managed to maintain an overall positive rental reversion. As a result, distribution per unit has been on a stable and increasing trend.

While performance has been stable so far, it will be interesting to see how sustainable its growth will be given the uncertainty of COVID-19 pandemic in the United States.

What are your thoughts on Keppel Pacific Oak REIT FY20 and 1H21 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

If you are looking for a brokerage account, Tiger Brokers is currently offering a deal of a lifetime that you might not want to miss.

- Registration: 500 Coins

- Account Opening: 60 Commission-Free Trades within 180 Days (Applicable for U.S. stocks, H.K. stocks, Singapore stocks and Australian stocks )

- Funding your account with more than ≥ SGD 2,000: 1 FREE Apple(NASDAQ: AAPL)share

Do consider using our link and promo code “REITPULSE” as this will support our blog while earning some rewards. Likewise, you can read more on our reviews on Tiger Brokers.

Do join our community over at Facebook and Instagram.