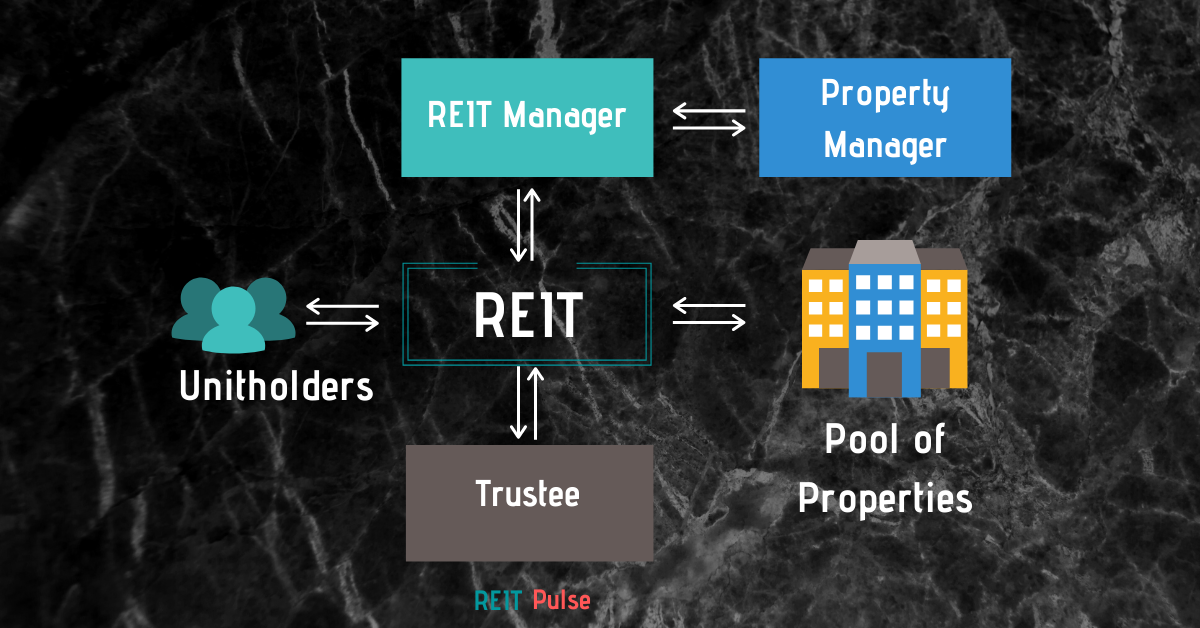

Investing in REITs is no different from investing in any business. The best way to look at your REIT is to view it as though you are running a business. We all know that REITs investment is essentially investing in a pool of real estate properties. But do all REITs perform the same?

We have previously shared that depending on the sector the REITs are operating in, different macro events may have different impact to the REITs. In this article today, we will be sharing why is that so.

Simple Illustration

To help us elaborate further, allow us to illustrate with a simple example.

Assuming that you physically own two separate shop house. The first shophouse A is leased to a mask retailer whereas the second shophouse B is leased to a family-owned cafe. Everything is going well till one day, a pandemic hit and the country you are operating in have decided to imposed restricted movement. (A relatable scenario)

No dine-in are allowed. The only movement permitted is for grocery shopping and gathering of essential items. Which of this shophouse you own will then be impacted? It is obvious that shophouse A will continue to operate and business will continue as normal whereas shophouse B will be forced to close down during this period.

The tenant from shophouse B which suffers from negative cash flow might sought to defer the rental payment till business is back to normal or even negotiate for a waiver of rent. As a landlord, you can be sensitive to the condition and support them throughout. Alternatively, you can stand firm and continue demanding for rental which might squeeze them dry and ultimately resulting in them closing down.

Either way, as a landlord, you will be affected.

Option to grant them waiver: You will lost out rental income in the short term. The plus side is that the tenant might be able to continue operations once the closure is lifted.

Option to continue demanding: Tenant might close down and default on rental. As a landlord, you will then lose a tenant leaving the shophouse vacant.

REITs Perform Differently Across Sectors

The above scenario is closely related to our REITs sector. Shophouse A represents healthcare REITs which are slightly defensive whereas Shophouse B represents a retail F&B REIT.

From the simple illustration above, you will notice that you are not able to completely eliminate the risk for shophouse B. During this time of crisis, the REIT manager plays a huge role is managing this sort of risk. In the scenario above, they would then have to decide to continue demanding for money or offer short term assistance. These are risks that are inevitable and very much dependent on how the REIT manager fare through the adversity.

There are two takeaways:

- The first takeaway is that not all sectors are equal. With that, there are different risk depending on the sectors.

- Secondly, some risk is inevitable. REIT Manager then plays a huge role in faring through the adversity.

Understand the risk in each sector

While we can’t completely eliminate risk, we can, however, evaluate each REIT sectors risk. By understanding these risks, we can then better make a decision when certain events occur.

Here’s a quick insight into some of the REITs sector:

- Healthcare REITs are typically more defensive compared to other REITs given their nature. Regardless of the economic cycle, healthcare is a necessity. Hence, you will notice that healthcare REITs are usually traded at a premium.

- Hospitality REITs on the other hand are more seasonal. They are heavily reliant on the tourism sector as well as business travellers. One good example you would have noticed during the COVID-19 pandemic is the closure of borders which have resulted in a sell-off of hospitality REITs. For a simple reason, lesser tourist means lesser earnings.

- Retail REITs are driven by the rental they charged the tenants. Their performance is highly correlated to the retailers’ performance. If they are facing cash flow problems or experiencing a disruption in business, these would result in a delay in payment or even default.

Read More: Understanding the different type of REITs

Just looking at the 3 REITs sector, you will notice that REITs will never perform the same. COVID-19 pandemic is a great example. Throughout this period, REITs in the healthcare REITs remain rather stable. However, the retail and hospitality sector are very much affected with the hospitality sector taking a bigger hit with a drop in the tourism sector.

Summary

Investment is a subjective matter. Different investor perceive risk differently. One investor might see a risk of investing in hospitality REIT during the COVID-19 pandemic while another investor might see it as an opportunity to accumulate the REITs at a discount. There is no right or wrong when it comes to investment. The important aspect is that you understand the risk and conduct proper due diligence prior to investing in any.

We have often emphasized the need to perform a proper check on individual REITs for a simple reason. Even if the sector is performing well, that does not mean that all REITs in the sector will be performing equally well.

Read More: 3 Ways To Evaluate the Performance of Your REIT

Let us know how you evaluate your REITs portfolio. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.