Keppel DC REIT is one of the few REITs that is sponsored by Keppel Telecommunications & Transportation Limited. They are the first and only pure data centre REIT in Singapore having listed in the Singapore stock exchange on December 2014. Keppel DC REIT invest primarily in data centre assets which have seen a huge interest over the years.

In this post, we will look at Keppel DC REIT FY20 and 1H21 performance to see how it has performed.

1) Acquisition of 2 new properties and remaining interest in KDC Dublin 1

In FY20, Keppel DC REIT has completed 3 acquisitions in Europe. The first acquisition is the remaining interest in KDC Dubin 1, a 2-storey facility that was acquired from Dali Properties Limited at an agreed value of EUR 30 mil. In addition to that, Keppel DC REIT has also acquired 2 new properties over in Germany and Netherlands.

These acquisitions is no doubt a plus allowing Keppel DC REIT to expand given then increasing demand of data centre.

2) Continual improvement in growth and occupancy rate in FY20

| FY18 | FY19 | FY20 | |

| No. Of Properties | 15 | 17 | 19 |

| Occupancy Rate | 93.10% | 94.90% | 97.80% |

From an operational performance standpoint, Keppel DC REIT has been growing its asset base over the years from 15 properties in FY18 to 19 properties in FY20. This is a clear proactive inorganic growth plan of Keppel DC REIT which is a plus to investors. The manager has been able to seize upon the growing demand of data centers globally.

Likewise, Keppel DC REIT has been able to organically grow its occupancy rate from 93.1% in FY18 to 97.8% in FY20. From REIT Pulse’s standpoint, this is no doubt a strong point in terms of its operational performance growth.

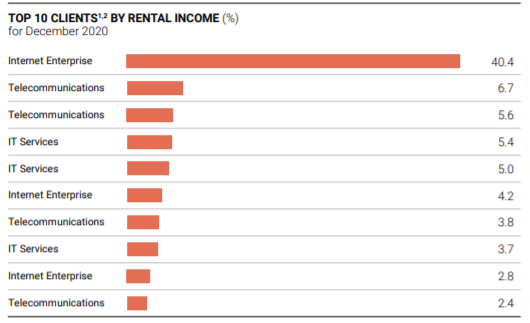

Having said that, the one aspect we do not like is the high tenant concentration risk. Looking at its client rental income as at 31 December 2020, approximately 40% of the rental income is contributed by one single tenant. This poses tenant concentration risk where a major disruption by that client would be adverse to Keppel DC REIT as a whole.

3) Year on year growth in financial performance driven by demand for data centre

| SGD in 000s | FY18 | FY19 | FY20 |

| Gross Revenue | 175,535 | 194,826 | 265,571 |

| Net Property Income | 157,673 | 177,283 | 244,166 |

Revenue of Keppel DC REIT has been increasing year on year from SGD 175.5 mil in FY18 to SGD 265.6 mil in FY20. The pandemic which has pushed companies towards digitalization has resulted in an increase in demand for data centers. As such, the year-on-year improvement comes to no surprise especially with the proactive growth plans by the REIT managers.

4) Increase in distribution per unit in FY20

| Cents | FY18 | FY19 | FY20 |

| Distribution per unit | 7.32 | 7.61 | 9.17 |

Now diving into the aspect investors is keen on. Distribution per unit in FY20 has surge rising from 7.32 cents in FY18 to a staggering 9.17 cents in FY20. While this is amazing growth in DPU, the yield may not be as attractive given that Keppel DC REIT is very much traded at a premium.

Based on its closing traded price of SGD 2.810 as at 31 December 2020, this would give investors a yield of 3.26%. Not exactly bad but fairly low for a REIT. We will let you decide if this is worth investing.

Read More: Why you should never buy a REIT just because they have a high dividend yield

5) Overall healthy gearing level

As at 31 December 2020, Keppel DC REIT has a total borrowings of SGD 1.2 billion. From a gearing perspective, this would translate to a gearing of 36.2% which is fairly healthy overall. The current gearing is still below the permissible limit of giving them ample debt headroom for further acquisition and asset enhancement initiatives.

6) Financial performance continue to improve in 1H21

With the year on year improvement in both operational and financial performance, investors would wonder if the performance would continue to be favourable in FY21. Looking at its 1H21 performance, its overall revenue has increased by 9% from SGD 124.0 mil in 1H20 to SGD 135.1 mil in 1H21. This was mainly contributed by the full period contribution from Kelsterbach DC, the acquisition of Amsterdam DC and the additional income from the asset enhancement initiatives at Singapore and Dublin assets.

Not only that, its 1H21 DPU has also increased by 12.5% as compared to 1H20.

Summary

While REITs in some segment has been affected by the COVID-19 pandemic, Keppel DC REIT has been performing tremendously well. Both its operational and financial performance have been on an increasing trend driven by the demand of data centre. One point we like about Keppel DC REIT is the proactive acquisition by the REIT manager in seizing up the opportunities.

What are your thoughts on Keppel DC REIT FY20 and 1H21 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

If you are looking for a brokerage account, Tiger Brokers is currently offering a deal of a lifetime that you might not want to miss.

- Registration: 500 Coins

- Account Opening: 60 Commission-Free Trades within 180 Days (Applicable for U.S. stocks, H.K. stocks, Singapore stocks and Australian stocks )

- Funding your account with more than ≥ SGD 2,000: 1 FREE Apple(NASDAQ: AAPL)share

Do consider using our link and promo code “REITPULSE” as this will support our blog while earning some rewards. Likewise, you can read more on our reviews on Tiger Brokers.