Investment is a topic everyone should be exposed to at a certain point in life. The earlier the better. Growing up, we were well taken care of by our family. Those who were privileged were being introduced to financial literacy while many of us are brought up not exposed to such.

The topic of finance is surely a sensitive topic but a topic which needs pressing focus. Regardless of the phase of life you are at now, investing and money management is something everyone would have to look at. While there are many aspects when it comes to financial literacy, but the focus of this article is more on the investment side. But of course, prior to any investment, it is important that you invest in your self by equipping yourself with the necessary knowledge and skills. In this post today, we would like to discuss more on the few reasons you should start investing early.

1. Time allows you to take risks

One of the key reasons you should start investing early is that starting early give you time to take on more risk. The risk here is, of course, calculated risk. An individual who is in their 20s to 30s can take on more risk by investing more in the equity market.

Whereas if you were to look at an individual who is in their 50s or 60s, the risk that should be taken by them will then reduce by a lot (i.e investing in a more stable instrument such as bonds). Simply because a decline in the market would severely impact their overall portfolio and if you start early in your 20s, you have time to stay invested for the market to pick up again.

Like the saying, higher risk (calculated risk) equals higher return. The earlier you start the more opportunity you will have in building your wealth. The fact is that you will never be able to avoid losing money investing. There are times where you lose being on the wrong side of the economic cycle. But by starting early, it gives you the time to learn and the opportunity to grow your wealth.

A good gauge of how much you have in the equities market is by using the age rule of thumb. This is done by subtracting your age by 100. If you are 30 years old, you should have approximately 70% invested in the stock market and the remaining in a stable instrument such as bonds and fixed deposit. Likewise, if you are 60 years old, the ratio of stock investment to a stable instrument would then drop to 40%.

2. Your spending habits will improve

Investing early would help instil a good spending habit. A survey by OCBC shows that only a third of Singaporeans/PRs have enough funds to last them for more than six months. Likewise, a survey by RinggitPlus shows that as many as 59% of Malaysians do not have enough savings to last them for more than 3 months. We are not even talking about retirement planning.

Living from paycheck to paycheck is a common practice of many. Most people tend to spend their monthly income and save the remaining (if there is any left). By shifting your mindset from a “saving whatever that is left” to “spend after whatever I have saved and invested“, it would not only instil a positive spending habit but also help in reaching your retirement goal.

By having a fixed saving and investment fund in mind, you would then have a lesser amount left to spend. As compared to the “saving whatever that is left” mindset, you will then learn to spend more frugally.

3. Power of compounding

One of the famous quotes you would have heard from Albert Einstein is that “compounding interest is the 8th wonder of the world. He who understands it earns it; he who doesn’t pay it.” While there is a debate on whether he really say it or whether this was intended in the investing context, we got to agree that compounding interest is indeed a brilliant thing.

For those who are not familiar with what compounding is, let’s us quickly take you through. The power of compounding interest simply means the reinvestment of interest at the same rate of return to growing the principal amount consistently year after year.

Looking at the simple table where we compare the similar amount invested at a return of 5% p.a; one with compounding effect and another without. You will see that by the end of year 10, it will result in a massive difference of $129. This is simply done by compounding the return earned.

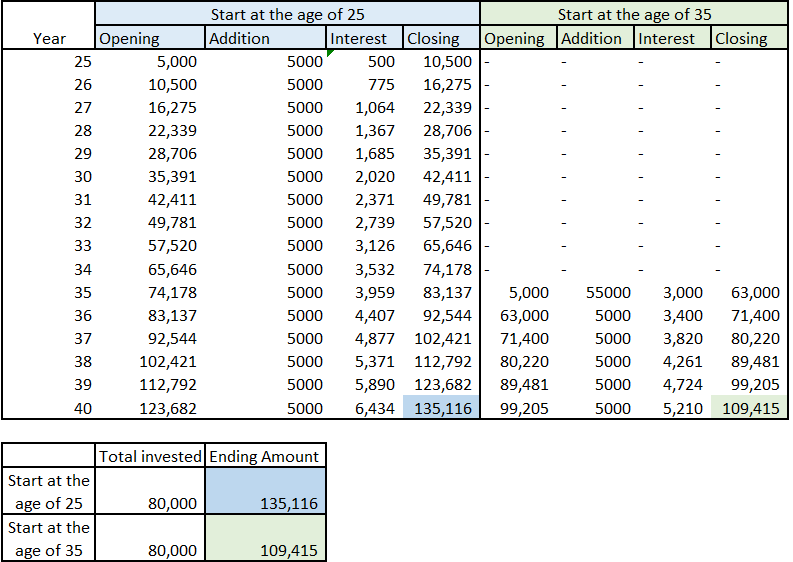

Now that you see the power of compounding, then you will better appreciate that the earlier you start, the better the compounding effect will be. We illustrate by comparing 2 individuals invested at a different timeline (25 vs 35 years old). The invested sum is the same being $80,000 at a rate of 5%.

Just by letting the power of compounding play its part, you will notice a massive difference in the ending amount. Hence, it is always wise to start investing early.

4. Low-interest rate environment

Another point that is more relevant to the current context is on interest rates. Just 2 weeks ago, Bank Negara Malaysia has announced a further cut in interest rate to 1.75%. That is the lowest record since 2004.

Looking at Malaysia context, the interest rate cut would mean that the favourite fixed deposit is no longer an option. For those invested in fixed deposit in the past, you would probably see a return ranging from 3% to 4%. However, if you look at the rate now, you will notice that the rate has declined to an all-time low.

Given the inflation rate in Malaysia, savings and merely keeping cash in the fixed deposit is no longer enough. This is one of the reasons why we love REITs which give an average return of 5% to 7%.

5. Plan for retirement

The last point and possibly something Millenials should focus on is the retirement fund. It is easy to live paycheck to paycheck while we are still are capable of doing so. You will reach a point in life where you would eventually retire. That is when having a retirement fund saved up will help you live comfortably. Yes, there are savings in the CPF (Singapore) and EPF (Malaysia) but one should consider evaluating if that would be sufficient.

Investing early allows you to build up your portfolio of which you will be thankful for in the future. All it takes is to start.

What’s next

There are many other reasons why one should start investing early. Investing has never been easier now. All it takes is some time off every week to work on analysing stocks and kick start your journey. Even if you think active investing is not your thing, there are various other passive investment option now such exchange-traded funds and Robo-advisor.

One of the financial instrument which we think everyone should consider adding their portfolio is REITs which is why we launched this platform in the first place. REITs is not something new and have been around for some time.

Read more:

REIT Pulse is a platform that aims to share more about REITs investment and hopefully inspire and help you get started in your investment journey. Let us know how you invest and manage your money down at the comment below. If you are interested to learn more about REITs, be sure to check out our REIT Guide and REIT Analysis.

Do join our community over at Facebook and Instagram.