There are tons of information one can look into when it comes to reviewing the performance of their REIT. One key information which is often made available is the REIT quarterly updates report.

No doubt there are tons of information in a REIT quarterly updates which often time overwhelm investors. Rather than getting overwhelmed, we will discuss what investor should look out for when reviewing them in this post. The goal is to simplify and hopefully help you identify key aspect to look out for during the REIT quarterly updates.

Before we dive in, let’s look into some of the typical information which is often available during the REIT quarterly updates.

- Press Release (News to the press which we will not be discussing in this post)

- Financial Statements

- Presentation Slides

Depending on the location the REIT is listed, the level of information shared varies. For instance, Malaysia REIT typically shares only the financial statements as opposed to the 3 information pack listed above.

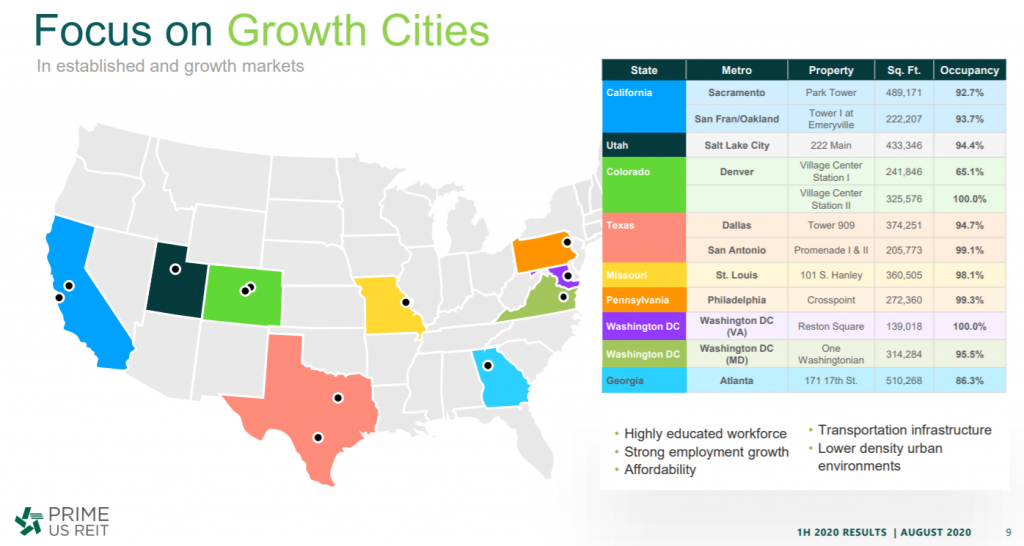

For illustration purpose, we will be looking into a REIT listed in Singapore to provide a more comprehensive run through. We will run through Prime US REIT Half Yearly Result ending 30 June 2020. For the benefit for those who are new, Prime US REIT is a Singapore listed REIT which focusses on office and real estate-related assets in the United States.

It was listed not too long ago. Hence, we figure that this will be a great example for a run-through. As this post is meant to give you a better insight on what to look out for, we would not be touching in-depth on the financials (will keep it for another post).

Presentation Slides

We will first start out with the presentation slides. You can treat this specific information as at a glance information pack. This piece information will give investors an overall idea of how the REITs have been performing. In this case of Prime US REIT, it contains high-level financial highlights, portfolio updates and the outlook for the REIT.

So what do you look out for?

1) Review through the REITs occupancy rate updates

The ability for a glove manufacturing company to grow is dependent on the total available capacity and of course the demand for gloves. Likewise for REITs, if everything remains constant, the growth of the REIT will then be dependent on the improvement in overall occupancy rate and the rental reversion.

Hence, it is important that investors review through the REITs occupancy rate.

As reported in Prime US REIT 1H20 Report, they have registered a 93% occupancy rate of 30 Jun 2020. If we were to look back at its occupancy rate in December 2019, the occupancy rate is higher at 95.8%.

While there is a dropped, this does not mean that the REITs is doing bad altogether. With this piece of information, investors can then decide if the drop is detrimental to the overall portfolio and find out what is the key reasons for the drop. An approach to consider is:

- Comparing the occupancy rate against the industry average

- Reviewing against its historical occupancy rate

The idea is to understand the reason for the drop and determine if that is detrimental to them.

2) Lookout for its rental reversion updates

Rental reversion is another aspect which would drive the growth of the revenue in a constant environment. Comparing this to a more relatable environment:

Occupany Rate (Sales Volume) * Rental Rate (Selling Price) = Gross Revenue (Sales $)

Looking at the equation above, it is then clear that for the REIT’s revenue to grow, there are two options. First being increasing the occupancy rate which has been shared earlier. The second is increasing the overall rent.

Hence, it is key to look out for rental reversion. There are two types of rental reversion; positive rental reversion and negative rental reversion. Ideally, we would anticipate a positive rental reversion. Which is the case for Prime US REIT whereby there is an 8.5% positive rental reversion in 1H20.

3) Review through their leasing activities

Looking at the screen capture from the previous point, leasing activity of the REIT is an aspect which is worth looking into as well. This would give investors an idea on lease management strategy. i.e renewal of lease which are close to expiry.

In the case of Prime US REIT, over 60% of the lease have been renewed by existing tenants giving them a WALE of 4.8 years.

4) Review its debt profile

REIT business model is capital intensive where they rely partially on debt and financing to invest in the assets. To avoid being over-leveraged, the regulatory body in respective countries have set gearing limit whereby they have to comply to. The limit is set at 50% in both Malaysia and Singapore.

Hence, the debt profit is another aspect investor should pay close attention to. Looking at the Prime US REIT debt profile, their gearing level has slightly dropped. This would give them ample debt headroom for further initiatives. The debt maturity is at 4.6 years and 90% of the loan are fixed rate in nature.

5) Scan through its financial performance

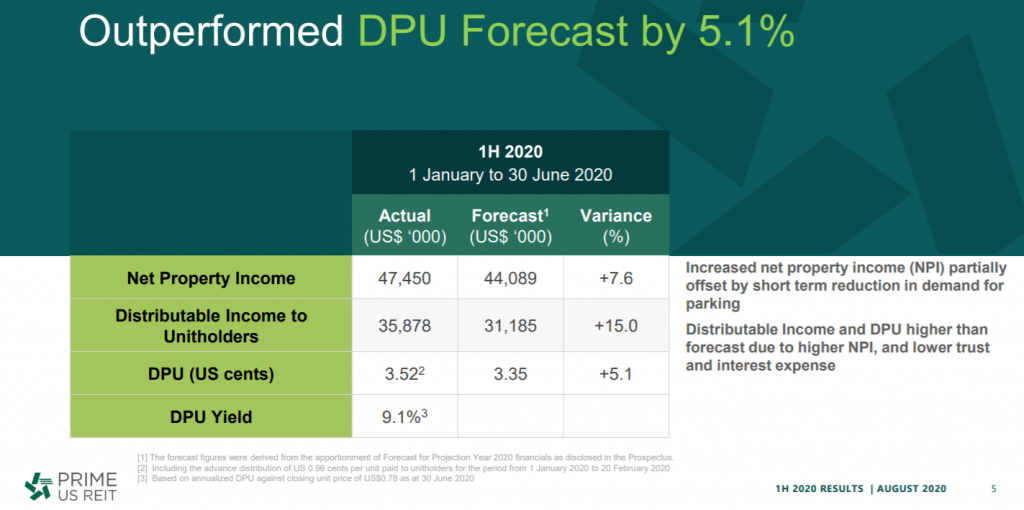

The next aspect of the presentation slide to look into is its financial performance. This would give investors a glance at how the REIT has performed against its previous quarter. In the case of Prime US REIT, the comparison is against its forecast given that they have just recently been listed.

This should be a quick exercise as the financials shared in the presentation slides are often a summary of the detailed financial statements. If you are a passive investor and do not want to dwell into the financials statements, this would be the perfect summary.

Regardless, we would encourage investors to run through the financial statement.

Financial Statements

Now that we have run through the presentation slides, we will dive into the financial statements. This is an in-depth run-through of the financial performance of the REIT itself.

The key idea is to review what matters to you as an investor. While there are various things you can consider looking into such as free cash flow and etc, we will not be going in detail in this post given how long this can go. We will keep that for a separate post but we will give you an example on why it is important to review financial statement.

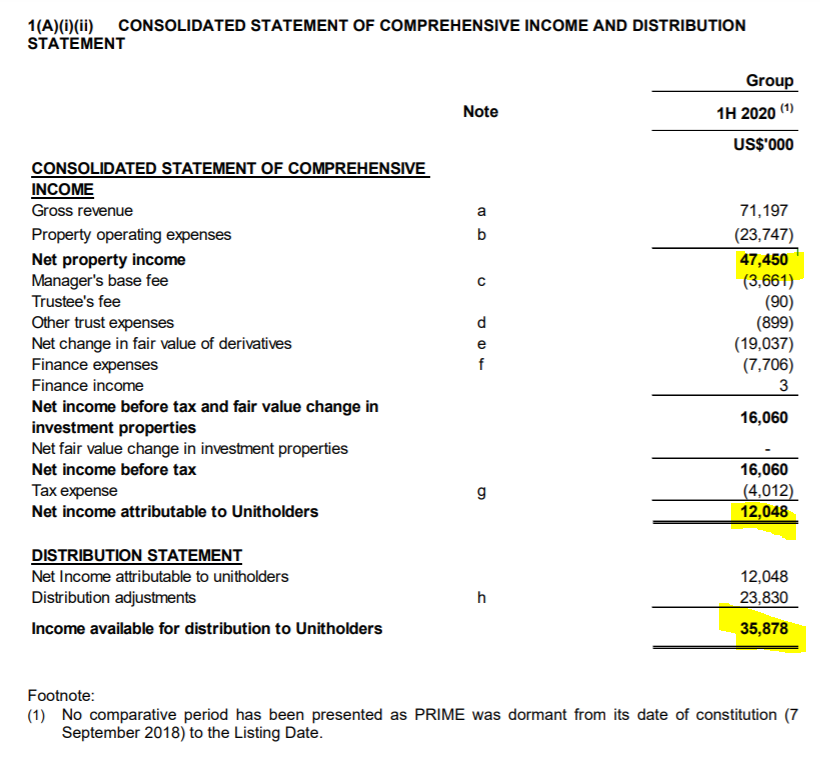

6) Understand the fluctuation in the income statement and how it translates to distributions

While the presentation slides show a high-level glance of the REIT performance, the financial statement will allow investors to analyze them in-depth. For instance, the bridge between net property income or net income to distribution. Net Income typically includes non-cash items which are often not distributed to investors cause they are not cash. These are items such as unrealised fair value changes in property, depreciation and etc.

By reviewing through these statements, an investor can have a better idea of what are some of the adjustment making up the distribution.

Summary

That pretty sums of an overview on what to look out during a REIT quarterly updates. Do note that each REITs are different whereby some REITs would disclose more information than the other. Hopefully, this post gives you some insights on some of the key things to look out for in the next quarterly updates.

If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.