One of the commonly asked question when it comes to investing in REIT is how often should you review your REIT. Sure you may have performed a comprehensive due diligence on the potential REIT before you invest in them. What’s next then?

Investing in a REIT should be treated as though you are invested in the business itself. As such, buying your very first REIT is just the first step. When it comes to reviewing them, there are often two extremes:

- The first extreme is where you buy the REIT and never look back at it again. You strongly believe in the initial due diligence check and the prospect of the REIT.

- The second extreme is where you look at the share price on a daily basis. Tracking it by the hour. You panicked at the smallest drop.

Often time, the first extreme will be a better approach compared to the second extreme. Nevertheless, if you belong to one of these two categories, we will be sharing on a better approach on how often you should review your REIT. Which come to no surprise is something along this line.

1. Annually upon the release of the Annual Report

At the very least, you should review your REIT once a year. This is as at when the audited annual report is made available. Annual report is the most comprehensive piece of information investor can get hold on as it contains practically all the information on the REIT you need.

Some of these information but not limited to are as follows:

- Financial information

- Operational information

- Portfolio Overview

- Commentaries by management

- Updates of key events throughout the year

- Market outlook

If you are a passive investor, this is a key piece of information which you should review at the very least. One distinctive feature of annual report as compared to other reports such as quarterly report is that they are audited. This would give investors a level of reasonable assurance.

Annual review is key as it allows you to review through the fundamentals of the business. You might have invested in the REIT due to its stable operational prospect. But things might change 1 year down the road. This annual review allow investors to review through to determine if they want to stay invested.

2. Quarterly as at when the quarterly report is released

Most REITs release their unaudited financial statements on a quarterly or half yearly basis. This report give investor the opportunity to review the REIT performance against the preceding quarters or YTD total. In a way, investors can have a gauge on the performance of the REIT on a periodic basis.

What differentiates a quarterly report compared to annual report is the frequency of the information where the information is released every 3 months as opposed to annually. If there is any potential red flags, investor will be able to pick it up on a timely basis. Ultimately, the information in the quarterly report will be consolidated as one in the annual report.

Often time, the REIT Manager will also released presentation material providing business updates to investors. This piece of information will be helpful in reviewing the operational performance of the REIT.

3. Whenever there is a key announcement

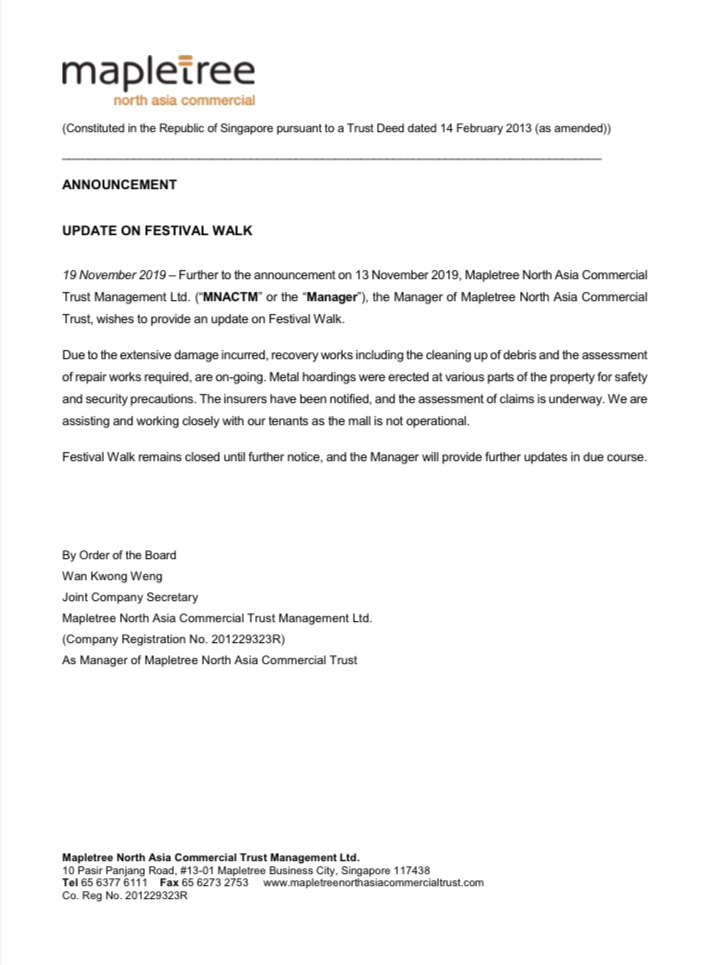

Apart from reviewing your REIT annually and on a quarterly basis, investor should also consider reviewing whenever there is a key announcement. The company announcement is whereby investors are notified on key events or important changes. As an investor, these announcements could be informative to investors for decision making.

Some of the examples of company announcement which might be key to investors are acquisition plans, divesting plans or even any key changes to the portfolio.

For instance, the announcement by MNACT on the incident in festival walk caused by the Hong Kong Protest. As a result of this incident, Festival Walk which is a key asset to MNACT is closed for a period of time. Through these announcements, investor will be better informed which allow them to review through their investments.

No doubt that all these will be shared in the annual report which is released once a year. By accessing the company announcement first hand, you will be timely informed.

Having said that, it is also important to note that not all announcements are important.

4. When you read up news in the media concerning your REIT

Another instance you should review your REIT is when you stumble upon news in the media concerning your REIT. There are a number of news categories investors should take note of such as:

- News directly concerning your REIT

- News concerning your tenants/industry

Of course there are other type of news to keep an eye of but the idea is to keep an eye of news which may affect your REIT. The idea of reading up on news is to keep yourself informed and updated. What you should not do is to react to every piece of news.

Summary

There is no right or wrong when it comes to reviewing your REIT. Reviewing your REIT by the hour will cause anxiety and will result in an emotional decision. This exercise is meant to give investors greater power with the available information for a better informed decision. You should never react to every piece of news.

Comment down below on how often you review your REIT. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.