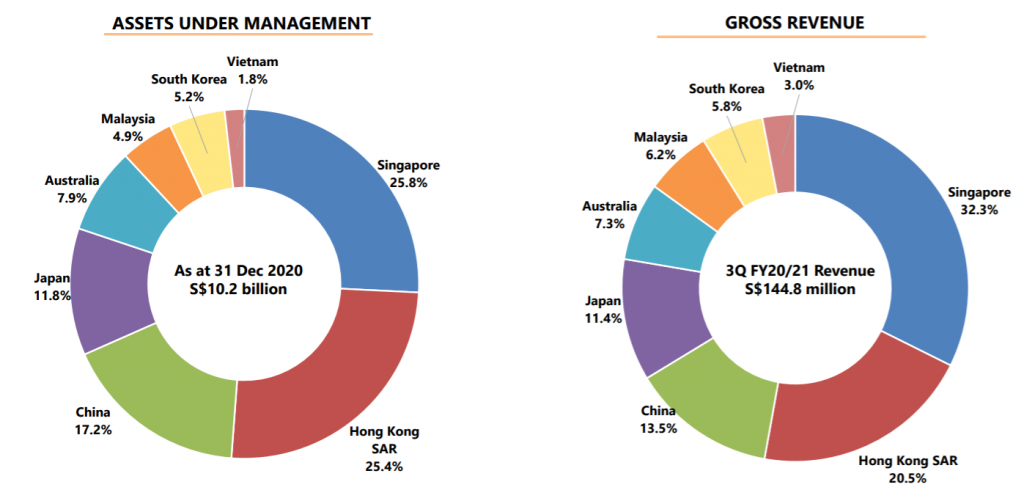

Mapletree Logistics Trust is REIT listed in the Singapore Exchange in 2005. It invests mainly in logistics focussed assets and has a diversified portfolio across Singapore, Malaysia, Vietnam, Hong Kong, China, Japan, South Korea and Australia.

Similar to Mapletree North Asia Commercial Trust and Mapletree Commercial Trust, they are sponsored by Mapletree Investment (MIPL), which is a leading real estate company headquartered in Singapore. MIPL has an asset under management of SGD 60.5 billion as at 31 March 2020 comprising of various asset type across 13 markets globally. Hence, it is without a doubt that they have a fairly strong backing.

| Countries | No. of Properties |

| Singapore | 52 |

| Hong Kong | 9 |

| China | 30 |

| Japan | 18 |

| Australia | 12 |

| Malaysia | 15 |

| South Korea | 13 |

| Vietnam | 7 |

| Total | 156 |

As at December 2020, Mapletree Logistics Trust has a total of 156 properties with an AUM of SGD 10.2 billion. In this post today, we will be looking into Mapletree Logistics Trust 9M21 performance.

1) Completed the acquisitions of 11 properties across a few geographical regions

The first key event in the year summing up 9M21 is the completed acquisition of 11 properties. This includes 7 properties in China, 1 in Vietnam, 2 in Australia and 1 in Japan.

Upon the completion of these acquisitions, this increases the total number of properties from 145 in March 2020 to 156. Similarly, the asset under management of Mapletree Logistic Trust increase to SGD 10.2 million in 9M21.

2) Overall Occupancy Rate Remain Stable

| Occupancy Rate | FY19 | FY20 | 3Q21 |

| Singapore | 97.4% | 97.2% | 98.1% |

| Hong Kong | 98.8% | 99.9% | 98.7% |

| China | 95.5% | 96.3% | 94.5% |

| Japan | 100.0% | 99.9% | 95.9% |

| Australia | 100.0% | 100.0% | 100.0% |

| Malaysia | 100.0% | 100.0% | 100.0% |

| South Korea | 99.1% | 96.0% | 96.8% |

| Vietnam | 100.0% | 100.0% | 100.0% |

| Average | 98.0% | 98.0% | 97.1% |

In terms of occupancy rate, Mapletree Logistics Trust remained fairly stable at 97% to 98% range since FY19. This is a fairly commendable performance given the uncertainty of the COVID-19 pandemic. Looking at its occupancy rate by region, there is no major drop in one single region which is a plus.

The biggest revenue contributor is no doubt Singapore of which the occupancy rate has improved. Based on the 3Q21 report, the overall leasing demand for warehousing space has stayed resilient to date despite the COVID-19 pandemic. But nevertheless, Mapletree Logistic Trust is working closely with affected tenants to support them.

In our opinion, this is a commendable move as this has driven the positive result as seen from the stable occupancy rate.

3) Growth in overall net property income

| SGD in million | FY19 | FY20 | 9M21 | Extrapolated 12M21 |

| Gross Revenue | 454.3 | 490.8 | 404.1 | 538.8 |

| Net Property Income | 389.5 | 438.5 | 362.4 | 483.2 |

The next area we will be looking at is the overall financial performance of Mapletree Logistics Trust. By looking at its net property income, it has improved to SGD 362.4 million in 9M21. If we were to extrapolate the results, this is an increase from SGD 389.5 million in FY19 to an estimated SGD 483.2 million in FY21E.

The increase is attributed by a few factors:

- Higher revenue from its existing properties

- Revenue from its 11 new acquisitions

- Completed redevelopment of Ouluo Phase 2 in Q121.

The growth is however offset by partial rental rebates granted to eligible tenants impacted by the COVID-19. With that, we would expect that the reported financial performance to be higher post-COVID-19 uncertainty. It is no doubt that the REIT manager is doing an amazing job at retaining the tenants amidst the uncertain environment.

4) Increase in distribution per unit in 9M21

| SGD in cents | FY19 | FY20 | 9M21 | Extrapolated 12M21 |

| Distribution Per Unit (DPU) | 7.941 | 8.142 | 6.165 | 8.220 |

For the period making up 9M21, Mapletree Logistics Trust has reported a distribution per unit of 6.165 cents. This is an increase from 7.941 cents in FY19 to 8.22 cents in 12M21 when extrapolated. Increased is mainly attributable to the solid financial performance amidst the COVID-19 pandemic.

Based on its latest trading price of SGD 1.94 and extrapolated 12M21 dividend, this would give investors a dividend yield of 4.2%. We will let you decide!

With the roll-out of vaccine and with the newly acquired properties, hopefully, this will further boost its overall distribution per unit.

Read More: Why you should never buy a REIT based on purely on its dividend yield.

5) Gearing declined from 39.3% in March 2020 to 36.8% in December 2020

Mapletree Logistics Trust has reported a lower gearing in December 2020. This is from a drop of 39.3% in March 2020 to 36.8% in December 2020 which is still below the permissible limit. Which is a plus as it would give them ample debt headroom for future acquisition and asset enhancement initiatives.

Another area to note is that 79% of its total debt is hedged into a fixed rate. This would reduce its overall interest rate risk. Nevertheless, this would also mean that they would not greatly benefit from any further interest cut.

Read More: How does Interest Rate affect REITs

Summary

Based on our summary, Mapletree Logistics Trust remains fairly resilient despite the COVID-19 uncertainty. Its operational performance has remained stable throughout with various support given to affected tenants. As a result, its financial performance has improved alongside mainly driven from a couple of acquisitions made during the year making up 9M21.

However, if we were to look at its price to book ratio, it is at 1.5. This is based on its latest trading price of SGD 1.94 and its December 2020 NAV of SGD 1.28. We will let you decide if this is worth investing in.

What are your thoughts on Mapletree Logistics Trust? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.