United Hampshire REIT is a Singapore based REIT with retail properties located across the United States. They were listed on the Singapore Exchange on March 2020 which is close to one year now. One interesting fact about United Hampshire REIT is that they are Asia’s first U.S. Grocery-Anchored Shopping Center and Self-Storage REIT.

They have a relatively strong sponsors being UOB Global Capital LLC which is no stranger to many of us and The Hampshire Companies. The Hampshire Companies, is a privately held real estate firm with over 60 years of experience. They currently owns and operates a diversified portfolio of 275 properties across the United States. This is without a doubt beneficial to United Hampshire REIT given the amount of expertise they can leverage on.

Given that United Hampshire REIT is fairly new, let’s dive in to get to know them better.

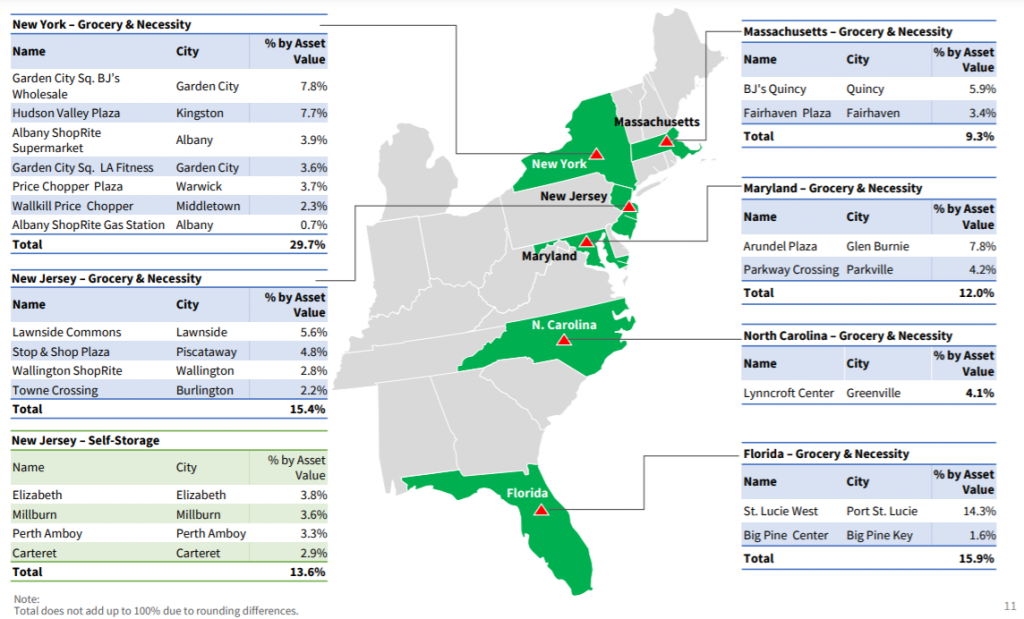

1) Portfolio consist of 22 assets across 6 States

Let’s start out by understanding the properties United Hampshire REIT owns. In general, the properties they owned can be categorise into two being (i) Grocery & necessity and (ii) Self Storage.

Grocery & necessity relates to properties which are leased out to tenants who operates in this industry such as Walmart and BJ’s Wholesale Club. There are 18 properties which are under this category which account for approximately 86.4% of the overall portfolio. These properties are spread across 6 different states across the United States.

Self Storage asset on the other hand account for 13.6% of the overall portfolio. United Hampshire REIT owns 4 self storage assets as at 31 December 2020.

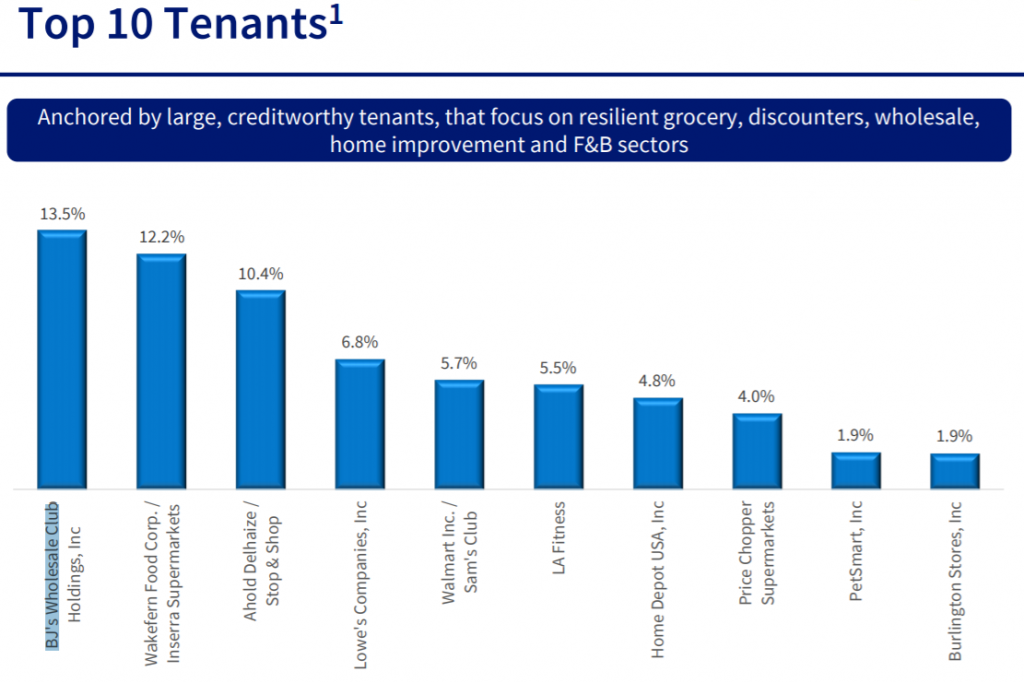

2) 3 of the tenants account for more than 10% of its total rental income

The next area we would like to highlight is the tenant concentration of United Hampshire REIT. In our opinion, this is expected given the industry they are operating in where grocery tenants tend to lease the entire building or a large space. Looking at the tenant profile, there are 3 tenants which account for more than 10% of the total rental income. They are BJ’s Wholesale Club Holding, Wakefern Food Corp and Ahold Delhaize.

The positive aspect is that the tenants are fairly reputable with a strong track record in the industry. Downside on the other hand is that the management can easily close down the stores they owned which are not operating as expected.

3) Strong occupancy rate for both its grocery& necessity properties and self storage properties

Looking at the occupancy rate of United Hampshire REIT portfolio, it has remained strong. The overall occupancy rate of its grocery & necessity properties reported a high occupancy rate of 94.7%. Its self storage portfolio on the other hand reported an median occupancy rate of 92% in Q4 2020. This is an increase as compared to its Q4 2019 occupancy of 90.9%.

4) Lower Financial Performance as compared to its IPO forecast

| USD in 000s | Actual | Forecast |

| Revenue | 41,617 | 42,558 |

| Net Property Income | 31,075 | 32,148 |

The next aspect we will look at is United Hampshire REIT financial performance. Given that United Hampshire is relatively new, there is no historical data to compare against. Hence, we will compare its FY20 performance against its IPO forecast.

Its net property income in FY20 is lower by USD 1.1 million as compared to its initial IPO forecast of USD 32.1 mil. This is mainly due to a lower net property income from self storage properties due to a drop in leasing activities as a result of the COVID-19 pandemic as well as the delay in the opening of the Perth Self Storage Property.

5) Distribution Per Unit (DPU) exceeds its IPO forecast

| USD in cents | Actual | Forecast | Annualized based on actual |

| Distribution Per Unit | 4.81 | 4.76 | 5.97 |

Likewise for United Hampshire REIT distribution per unit, we will be comparing it against its IPO forecast. Based on its initial forecast, the manager is expecting a distribution of 4.76 cents in FY20. However, the actual distribution per unit in FY20 is 4.81 cents. This is a slight increase as compared to the expected distribution.

It is worth pointing out that the actual DPU is based on results from 12 March 2020 to 31 December 2020. If we were to annualized the DPU, this would give investors an estimated DPU of 5.97 cents. Comparing this to its 31 December 2020 closing price of USD 0.66, this would give investors a yield of 9.0%.

Read More: Why you should never buy a REIT purely based on its dividend yield

6) Fairly healthy debt profile

As at 31 December 2020, United Hampshire REIT reported a gearing level of 36.2%. This is fairly healthy way below its permissible limit of 50%. This would give them ample debt headroom for future asset acquisitions and asset enhancement initiatives.

In addition to that, 100% of its debt are fixed rate in nature which means they would not be subject to interest rate risk. Depending how you view it, this would also mean they would not be able to benefit from interest rate drop.

Summary

Based on our analysis, United Hampshire REIT is no doubt new being listed just 1 year ago. There is not much historical track record to look at. Looking at the industry and its 1 year operational performance, they are doing fairly good especially in the midst of the COVID-19 pandemic.

What are your thoughts on United Hampshire REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.