One of the common question investors often asked is how does a REIT work. We often read that an investment in REITs is an investment in a pool of properties owned by the REIT. In return, you will be entitled to dividend distribution declared by the REIT. That is entirely true. However, if you were to look into the REIT structure closely, you will then notice that there are many other parties that play a huge role in running the REIT.

In this article today, we will be looking into the REIT structure and to look into the underlying expenses of these REITs. By understanding the structure, it will help you understand REITs better.

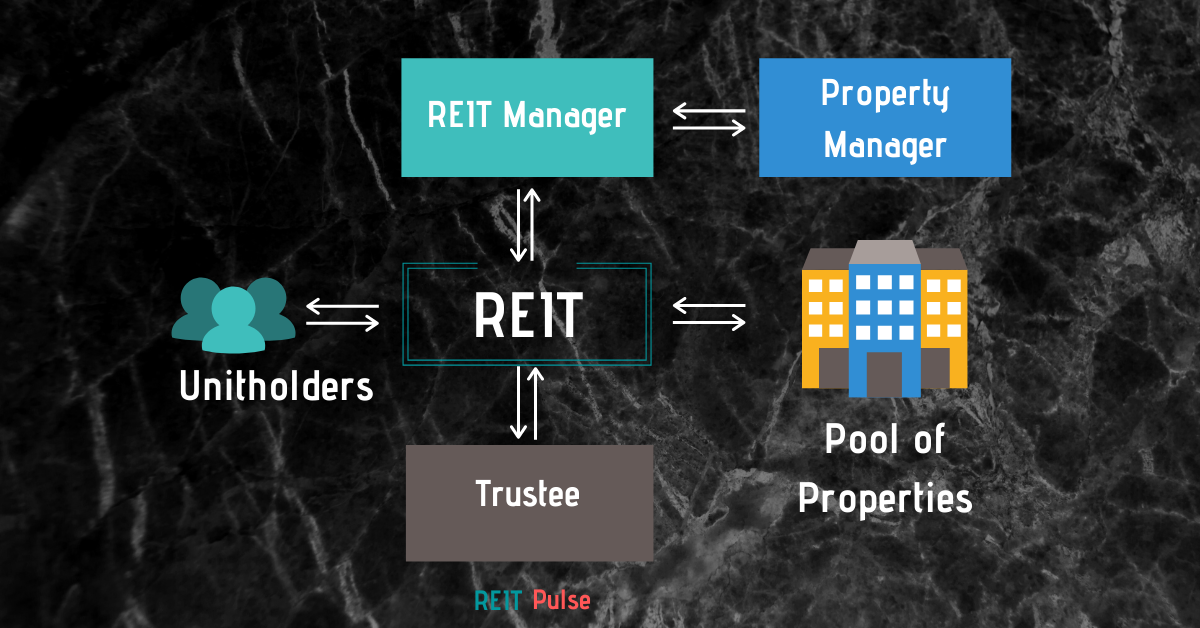

Typical REIT Structure

To help illustrate how a typical REIT structure looks like, we will be looking at 4 different REITs. The 4 REITs which we will be looking at are Atrium REIT, Al-Aqar REIT, Suntec REIT and Capitaland Mall Trust. These REITs that we will be discussing are diverse in which there is a mixture of:

- REITs in both Malaysia and Singapore

- REITs which are both Shariah and Non-Shariah compliant

- Healthcare REITs, Retail REITs, Industrial REITs, and Office REITs

What we are trying to achieve here is to show that most of the REITs have a relatively similar structure despite their diverse background.

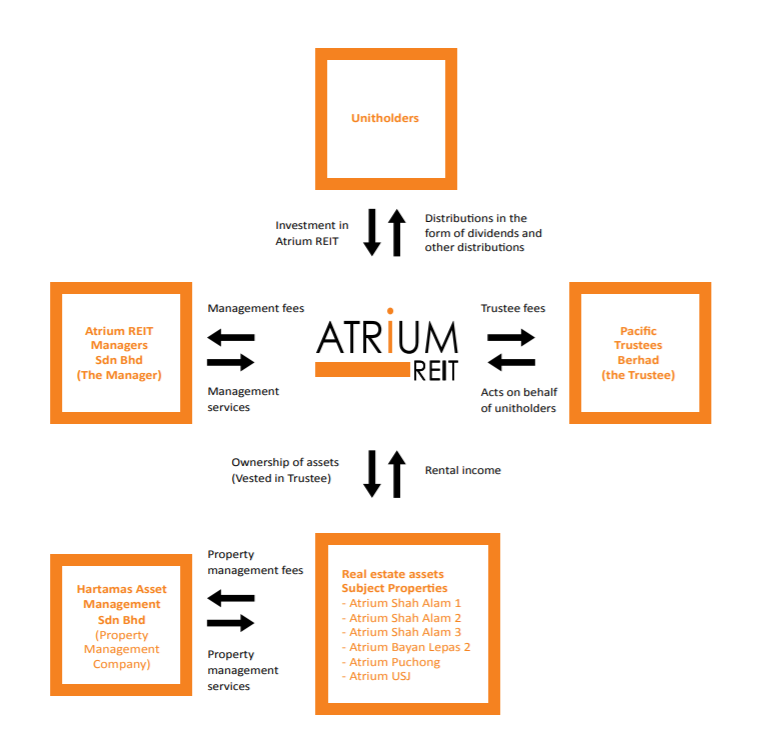

In layman terms, REITs is an investment in which hold a pool of properties. Investors who invest in REITs are essentially co-owner of these pool of properties. In actual fact, there are many other parties involved in the running of these REITs. If you were to look at the 4 structure illustrated above, you would have noticed the typical structure most investors would have already known of.

Unitholders -> REIT ->Pool of Properties

The other aspect investors should also know is that to run a REIT and to manage these pool of properties, it involved multiple other parties as well. Some of the common parties you would have seen from the structure of the 4 REITs above are REIT Manager, Property Manager and Trustee. The only special aspect is Al-Aqar REIT which is a shariah-compliant REIT. As such, there is a Shariah Committee on board to oversee this.

In the upcoming few points, we will be discussing the importance of these stakeholders to the REIT and the underlying expenses which will be incurred.

1. REIT Manager and Management Fees

The first aspect we will be looking at is the REIT Manager. The entire REIT is managed by the REIT manager in which they are responsible for setting out and executing the direction and growth of the company based on their investment strategy. Any strategic direction and decision will be made by them which includes the acquisition of new properties and divestment of properties. We would put them as the key management of any REIT similar to what you see in any other businesses.

In return for the active management, the REIT manager would charge asset management fees. Here are the typical fees which are part of the asset management fees:

- Base Fee

- Performance Fee

- Other one-off fees (acquisition or divestment)

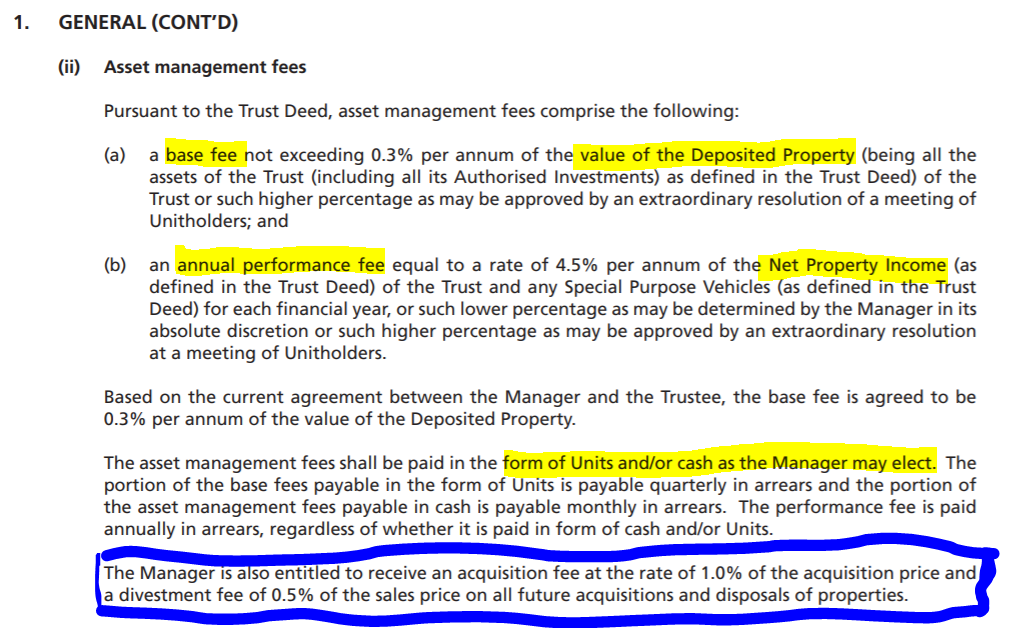

The quantum of fees charged by each REIT manager is different. As an investor, you can easily access the quantum of the fees in the annual report. The example below is an extract from Suntec REIT 2019 annual report.

The annual fees investors should expect is the base and annual performance fee. For Suntec REIT case, the base fee is charged at a rate of 0.3% of the total value of the properties in the REIT portfolio. Annual performance fee, on the other hand, is charged at a rate of 4.5% of the net property income of the REIT.

The manager has the option to elect to be paid in the form of units or cash. To those who are new to the term payment in the form of units, it essentially means that instead of paying the manager in cash, we are giving them a certain additional unit in the REIT. What it means for investors is that it would enlarge the share base of the REIT.

Apart from base fee and annual performance fee, the REIT manager would also charge a fee for acquisition or divestment exercise (if any). In the case of Suntec REIT, a rate of 1% would be charged on acquisition price and 0.5% would be charged on divestment fee.

2. Trustee and Trustee Fees

The second aspect of a REIT structure is the trustee. A trustee is responsible for holding assets on behalf of the REIT and their duties usually include ensuring that the REIT is in compliance with all applicable laws, taking custody of the real estate assets, and protecting certain rights of unitholders.

In return, the trustee would then be paid a trustee fee for providing this service. We will look at Atrium REIT, an industrial REIT based in Malaysia for illustration purpose.

The Trustee typically charges a certain quantum of fees which differs from REIT to REIT. Pacific Trustee Berhad, the trustee of Atrium REIT charged a rate at a quantum of 0.08% per annum of the Net Asset Value. A point to note is that most trustee charges a minimum fee. For Atrium REIT case, it is RM40k per annum.

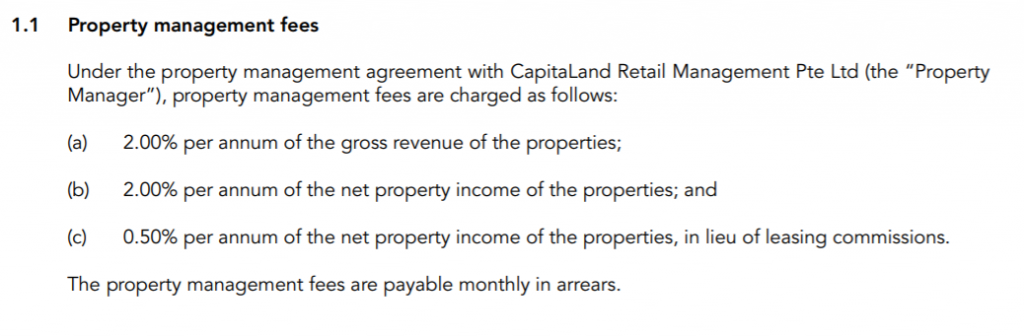

3. Property Manager and Property Management Fees

For those who own physical properties, you would probably know that managing a property is not easy. Not only in terms of finding tenants for your property, but you will also have to deal with tenant management. This is where a property manager comes in. A property manager is appointed to manage and run the underlying properties in the REIT portfolio. Their role includes managing the property in terms of keeping the property occupied through marketing and promotion events. Furthermore, their role also includes upkeeping the property in general.

In exchange, they would be paid a property management fee. Comparing this to owning physical properties, investors do not need to be involved in managing the property. But of course, this comes at a cost. To give you an idea of what these fees entail, we have extracted the excerpt in regards to property management fees from Capitaland Mall Trust annual report to help you understand the fees involved.

4. Shariah Committee and Shariah Advisor Fees

Since we are on this topic, we have decided to touch on this. Though this is not commonly seen in most REITs, this can be seen in some of the REITs in Malaysia which is Shariah Compliant. Shariah compliance is governed by the requirements of Shariah law and the principles of the Muslim religion. They are deemed to be a socially responsible investment.

One of the REIT in Malaysia which is Shariah-compliant is Al-Aqar REIT. There is usually a Shariah Committee on board to oversee and advice the REIT manager to ensure that the REIT is in compliance with the requirement. In return, Shariah Advisor fees would be charged.

Key Takeaway

As a REIT investor, it is always important to understand their structure as it would give you an idea of what are the typical expenses which will be incurred. This will be helpful during your analysis and due diligence process of your investment.

Hopefully, the following have been helpful in your REITs investment journey. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.

2 Comments