Sentral REIT or formerly known as MQREIT is a Malaysian-based REIT with 10 properties located across Malaysia. They were listed in the Bursa Malaysia exchange in January 2007 with investment primarily in the office and retail sector. You can read more on our previously written analysis of MQREIT 2019 and 3Q20 performance.

Read more:

- 5 Key Things You Need To Know Of MQREIT 2019 Performance

- 4 Key things to know of MQREIT 3Q20 Performance

Since then, there have been a number of developments. As such, let’s dive into Sentral REIT FY20 performance to see how it has performed in FY20.

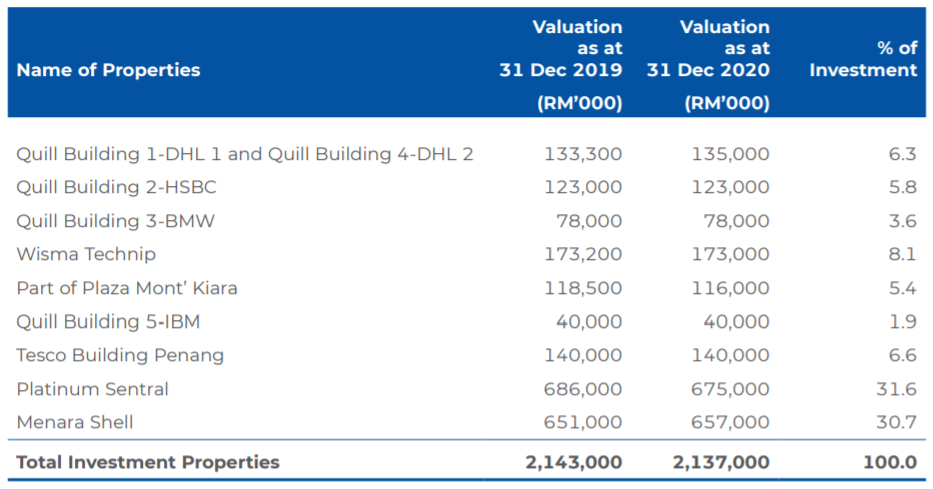

1) Huge concentration on 2 properties

Despite owning 10 properties across Malaysia, Sentral REIT has a huge property concentration across 2 properties. Platinum Sentral and Menara Shell which are located in the central region account for c.62.3% of the total. This would be adverse to Sentral REIT in the case of any unfavorable event. For instance, Festival Walk which accounts for a huge proportion of MNACT REIT portfolio was hugely affected during the Hong Kong protest. This is not necessarily a bad thing but definitely, an area investor should pay close attention to.

2) Overall portfolio occupancy rate remains fairly stable

| FY18 | FY19 | FY20 | |

| Quill Building 1 – DHL 1 | 100% | 100% | 100% |

| Quill Building 4 – DHL 2 | 100% | 100% | 100% |

| Quill Building 2 – HSBC | 100% | 100% | 100% |

| Quill Building 3 – BMW | 91% | 91% | 91% |

| Wisma TechnipFMC | 100% | 90% | 83% |

| Part of Plaza Mont’ Kiara | 91% | 88% | 90% |

| Quill Building 5 | 56% | 0% | 0% |

| TESCO Building Jelutong Penang | 100% | 100% | 100% |

| Platinum Sentral | 87% | 84% | 84% |

| Menara Shell | 93% | 95% | 99% |

As at 31 December 2020, Sentral REIT overall occupancy remains stable at c.90% similar to the occupancy in FY19. Based on its individual properties occupancy rate, almost all its properties recorded either a stable or increasing occupancy with the exception of Wisma TechnipFMC which recorded a decline from 90% in FY19 to 83% in FY20. This is not surprising given the uncertainty of the COVID-19 pandemic.

What is great however is the improvement in Menara Shell occupancy rate from 95% in FY19 to 99% in FY20. If we look back at the portfolio composition, Menara Shell accounts for c.30.7% of the total properties composition. This improvement is no doubt a plus to Sentral REIT overall performance.

Another point worth pointing out is the disposal of Quill Building 5 which was completed in April 2021. This is definitely a plus given that the building has been vacant for 2 years.

3) Increased in finncial performance in FY20 fueled by improvement in occupancy

| MYR in 000s | FY18 | FY19 | FY20 |

| Revenue | 172,527 | 162,066 | 165,692 |

| Net Property Income | 132,802 | 121,748 | 126,120 |

If you have read our previous analysis, Sentral REIT overall performance has been on a decline from FY17 to FY19. However, looking at its recent performance, there has been a slight turnaround where it has reported an increase in net property income from MYR 121.8 million in FY19 to MYR 126.1 million in FY20. This increase is mainly from the higher revenue generated from Menara Shell, and Tesco.

4) Increased in distribution per unit in FY20 given investors a yield of 8.09%

| MYR in cents | FY18 | FY19 | FY20 |

| Distribution per unit (DPU) | 8.1 | 6.8 | 7.1 |

In line with its operational and financial performance, Sentral REIT has reported an increase in distribution per unit from 6.8 cents in FY19 to 7.1 cents in FY20. Based on its closing traded price, this would give investors a yield of 8.09%. We will let you decide if this is worth investing.

Read More: Why you should never buy a REIT just because they have a high dividend yield

5) Healthy gearing level within permissible limit

As at 31 December 2020, Sentral REIT has a total borrowing of MYR 844.9 million which translates to a gearing of 37.9%. This is well below the permissible limit imposed in Malaysia giving them ample debt headroom for further asset acquisition and enhancement initiatives. The disposal of Quill Building 5 would further unlock capital and increase Sentral REIT overall debt headroom to better increase value for shareholders.

Of the total borrowings as at 31 December 2020, 54% of them are floating rate in nature. This would subject Sentral REIT to interest rate risk. Depending on how you view it, this would also be favorable to Sentral REIT in a low-interest-rate environment.

Summary

Based on our overall analysis, Sentral REIT has performed fairly well in FY20 in the midst of the COVID-19 uncertainty. This has been their greater performance in the last 3 years operationally and financially. The disposal of Quill Building 5 is no doubt a great move as this would unlock more capital for future growth opportunities.

Nevertheless, with the recent spike in COVID-19 cases, it will be interesting to keep a look out on how the management fare through the uncertainty.

What are your thoughts on Sentral REIT FY20 Performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.