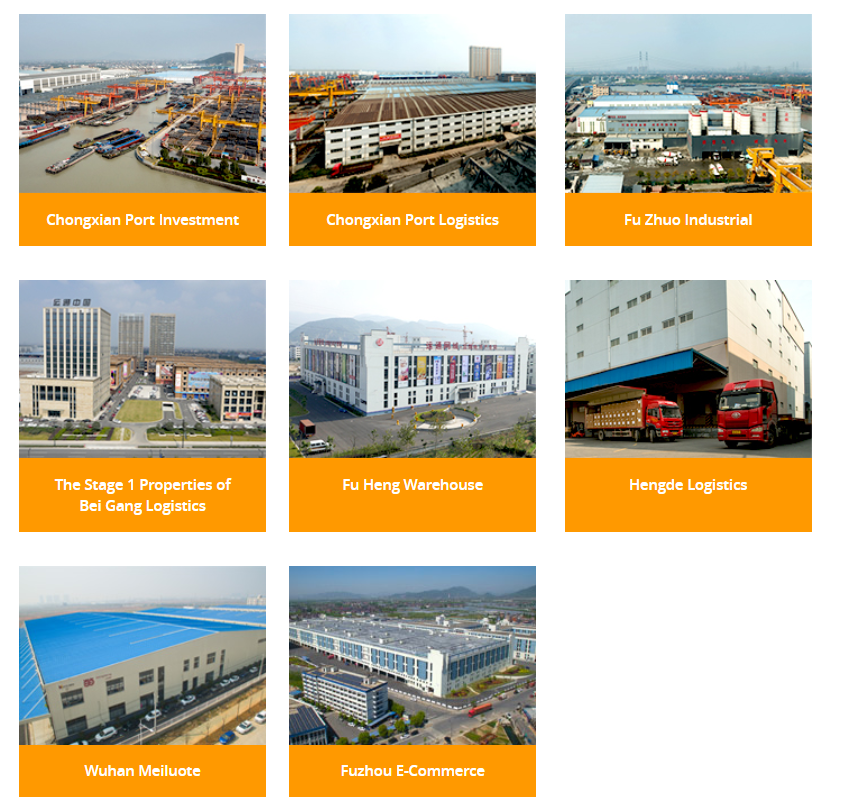

EC World REIT is Singapore based REIT listed on the Singapore Exchange with properties presence across China. As at the date of writing, they own a total of 8 assets mainly in the industrial sector. The portfolio comprises 7 quality properties located predominantly in Hangzhou and one property in Wuhan.

In this post, we will be looking into EC World REIT FY20 Performance to see how it has performed.

1) Strong and healthy occupancy rate

| FY17 | FY18 | FY19 | FY20 | |

| Fu Heng Warehouse | 100.0% | 100.0% | 100.0% | 100.0% |

| Stage 1 Properties of Bei Gang Logistics | 100.0% | 100.0% | 100.0% | 100.0% |

| Wuhan Meiluote | n.a | 88.7% | 99.4% | 86.5% |

| Fuzhou E-Commerce | n.a | n.a | 100.0% | 100.0% |

| Hengde Logistics | 100.0% | 100.0% | 100.0% | 100.0% |

| Chongxian Port Investment | 100.0% | 100.0% | 100.0% | 100.0% |

| Chongxian Port Logistics | 100.0% | 100.0% | 100.0% | 100.0% |

| Fu Zhuo Industrial | 100.0% | 100.0% | 100.0% | 100.0% |

EC World REIT enjoys a fairly strong and stable occupancy rate throughout the years. 7 out of 8 of its properties have reported a consistent 100% occupancy rate. Wuhan Meiluote’s occupancy rate on the other hand decline from 99.4% to 86.5%. This is nevertheless still fairly great given the uncertainty in the COVID-19 pandemic in late FY19 and FY20 itself. Given that Wuhan Meiluote is a multi tenanted asset, there is a possibility for the REIT manager to source for new tenants given the improved economic activity in China. Definitely an area to keep a lookout for.

Most of the lease expiry of the assets are fairly spread out with most expiry in the range of 2023 to 2029. This would secure EC World REIT a stable income for the next 2 to 8 years.

2) Built-in rental escalation for almost all its properties

The next aspect of EC World REIT worth pointing out is the built in rental escalation. Fu Heng Warehouse, Bei Gang Logistics, Wuhan Meiluote, Fu Zhou E-commerce, Chongxian Port Investment and Chong Xian Port Logistics has rental escalation build up in the lease agreement respectively. What this mean is that in a constant and stable occupancy rate environment, EC World REIT would still be able to grow organically.

Fu Zhou Industrial asset on the other hand has a 7.5% rental escalation every 3 years starting April 2021. The only asset without a build in rental escalation is Hengde Logistics.

Given that EC World REIT assets are mainly industrial and logistics assets, their tenants are typically master tenants consisting a 1 or a small number of tenants. Depending how you view it, it can be positive and negative. The positive aspect is that there is no need to constantly manage the tenants and have the need to constantly source for new tenants. The negative aspect however is that this pose a huge concentration risk and reliance on the 1 major tenant. In this event where they default or decided to not continue leasing, this might impact the overall performance of the REIT.

3) Year on Year Increase in Financial Performance

| SGD in 000s | FY17 | FY18 | FY19 | FY20 |

| Revenue | 91,368 | 96,229 | 99,128 | 109,726 |

| Net Property Income | 82,704 | 87,336 | 89,737 | 100,307 |

In terms of its financial performance, EC World REIT financial performance has been growing steadily. This comes to no surprise given their strong occupancy rate as well as the build-in rental reversion shared in the previous 2 points. In FY20 itself, their net property income grew from SGD 89.7 million in FY19 to SGD 100.3 million. This increase is mainly attributable to the acquisition of Fuzhou E-Commerce in August 2019. As such, there is an increase given the full-year revenue from that asset itself.

Apart from that, EC World REIT stong occupancy and built in rental reversion is a huge contributing factor of the positive performance. This increase is however offset by the one-off rental rebates given to tenants to mitigate the adverse impact of the COVID-19 situation.

4) Decline in distribution per unit from FY18 to FY20

| SGD in cents | FY17 | FY18 | FY19 | FY20 |

| Distribution Per Unit | 6.025 | 6.179 | 6.047 | 5.359 |

Distribution per unit have been declining throughout the years from 6.025 cents in FY17 to 5.359 cents in FY20. The decline in FY20 is mainly due to a higher retention amount for retention of distributable income and due to rental rebates given in Q120.

Comparing its FY20 DPU to its closing price of SGD 0.72 as at 31-Dec-202, this would give investors a yield of 7.4%. We will let you decide if this is worth investing in.

5) Gearing level of 38.1% within a healthy range

As at 31 December 2020, EC World REIT has a total borrowings of SGD 683 million. This translates to a gearing level of 38.1% which is below its permissible limit of 50%. In a way this would give them a small debt headroom for further asset acquisition and enhancement initiatives to further grow their asset.

Summary

Based on our analysis, EC World REIT has a fairly great operational outlook. The occupancy rate has been stable historically along with a build-in rental reversion in most of its properties. Likewise, its financial performance has been growing steadily in the past which is another positive aspect for EC World REIT. The downside is the year on year declining distribution per unit. Another area we view as unfavourable is the high tenant concentration given the industry they are operating in.

What are your thoughts on EC World REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.