PAVREIT or Pavilion REIT (KLSE: 5212) is one of the largest retail-focused REIT in Malaysia which was listed in Bursa Malaysia in December 2011. As at the date of this analysis, there are trading at RM1.66.

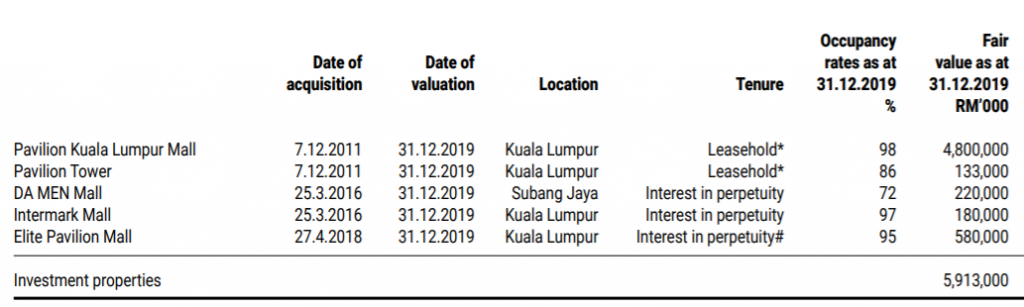

Based on the snapshot as at 31st December 2019, PAVREIT’s properties were valued at approximately RM5.9 billion consisting of 4 retail properties and 1 office property. In this article today, we will be discussing on 5 key things you need to know on PAVREIT 2019 performance:

Operational overview

In terms of the operational performance, PAVREIT registered a full 12 months performance for Elite Pavilion Mall which was acquired in April 2018. This has been the main contributor to the increase in financial performance in FY19.

Improvement in occupancy rate and the management ability to increase the rental rate is crucial for the growth of any REIT. Looking at the occupancy rate of the various assets held by PAVREIT, there is a mixture of performance. Overall, we see a drop in occupancy for 4 out of its 5 properties. The only asset which has an improvement in occupancy is Intermark Mall where we see an increase from 94% in 2018 to 97% in 2019.

Pavilion Kuala Lumpur Mall which is the largest asset in PAVREIT remain resilience. Despite a slight decline in occupancy rate from 99% in 2018 to 98% in 2019, the financial performance have improved. This is due to the commendable performance by the mall where the leases that were due were substantially renewed with positive rental reversion averaging 4-5%.

Looking at the performance FY20 onwards, the movement control order which was implemented in Malaysia will definitely impact PAVREIT adversely. Investors should definitely pay attention to this area.

Financial Performance

PAVREIT has been one of the REITs in Malaysia which have been growing positively in the past 5 years. Not only in terms of revenue growth but also net property income growth. These growths are mainly due to new acquisitions exercise by the REIT manager. To put things into perspective, here is a summary of the acquisition in the past 5 years.

- Acquisition of two properties, Da Men Mall and Intermark Mall in March 2016.

- Acquisition of Elite Pavilion Mall in April 2018.

To take a further step, we have decided to look at the performance by property across five years. Our goal is to analyse if the revenue growth is contributed by the operational improvement or merely from the newly acquired assets.

Pavilion Kuala Lumpur Mall which accounts for c.79% of the total revenue has been growing year on year from RM399 mil in 2016 to RM462 mil in 2019. This is a positive aspect for PAVREIT as, without Pavilion Kuala Lumpur Mall, PAVREIT would not even be worth looking at anymore. Even without the 3 acquired building, PAVREIT revenue growth would have been a positive year on year with the exception of 2015-2016.

DA MEN Mall which was acquired in 2016 has been performing rather badly with a decline in revenue from RM32 mil in 2016 to RM24 mil in 2019. This is mainly from the decline in occupancy rate.

Stable Distribution Per Unit

The distribution per unit of Pavilion REIT has been growing from 8.23 cents in 2015 to 8.78 cents in 2018. However, we note a drop in DPU from 8.78 cents in 2018 to 8.50 cents in 2019. This is mainly due to an increase in property expenses such as maintenance and interest expenses during the year. This is due to the additional borrowings made to fund the acquisition of Elite Pavillion Mall in April 2018.

Based on the closing price of RM1.74 on 31 December 2019, this would give PAVREIT a dividend yield of c. 4.9%. Going forward, we would expect the DPU to stabilise at the range of 8.50 cents or lower given the impact from COVID-19.

Gearing and Borrowings

As at 31 December 2019, PAVREIT has a total borrowings of RM2,167 mil. This arrives at a gearing level of 33.9% which is still within the permissible range. This would still give them some debt headroom for further acquisition and enhancement initiatives.

If we look at the total borrowings of RM2,167 mil, it consists of both floating-rate interest loan and fixed-rate interest loan. What this means is that the fixed interest instrument is pegged to a fixed interest rate which was agreed on upfront. There will not be any impact on interest fluctuation. The floating rate instrument, on the other hand, will be subject to interest rate fluctuation. During times of interest rate cut, they would likely benefit from lower finance cost and vice versa during the interest rate hike. You can read more on how interest rate affects REITs in one of the articles we shared last week.

In our opinion, PAVREIT would likely benefit from the interest rate cut measure by Bank Negara Malaysia. At least for the short term.

Price to Book ratio

Price to book ratio is one of the indicators which can be used to determine if a REITs is undervalued or overvalued. Their NAV per unit has been increasing over the year mainly from the acquisition exercise and asset enhancement initiative. Based on the market price of RM1.74 and net asset value of RM1.31 as of 31 December 2019, this would give them a price to book ratio 1.33. This would suggest that PAVREIT is overvalued.

But again, there is no one size fit all answer when it comes to investment. You will have to make the call if PAVREIT is worth buying.

Summary

In summary, PAVREIT mall main asset, Pavilion Kuala Lumpur Mall has been doing relatively well. The mall plays a huge role in PAVREIT performance. The remaining assets performance are either declining or too early to look at. But nevertheless, these assets play a smaller role individually to the overall portfolio of PAVREIT. The uncertainty of COVID-19 and its impact on the economy will definitely be an area investors should be wary of.

PAVREIT is currently trading a premium (Price to book of 1.27) even at the current trading price of RM1.66. From our perspective, we think that is is not worth paying a premium given the uncertainty of the economic condition now.

That’s it for our analysis on PAVREIT. What is your take on this REIT? Share your thoughts with us at the comment below.

If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.

I noticed many people generally consider PAVREIT is a good REIT, with or without doing their own analysis. I would like to point out some negative things below:

1) Concentrated risk in term of property and geographical diversification as its heavily dependent on income from flagship property Pavilion KL Mall.

2) Cost of debt is higher compared to most MREITs, even smaller MREITs beat its borrowing rate.

3) Low shareholding from its sponsor.

4) Decreasing Distribution margin indicates that its revenue couldn’t keep up with increasing expenses. From 60% @ 2015 to 44% @ 2019.

5) Decreasing interest cover ratio indicates its revenue couldn’t keep up with increasing borrowing interest. From more than 8.5 @ 2015 to 3.4 @ 2019

Agreed. PAVREIT is heavily reliant on Pavillion KL Mall (sort of their crown jewel). I personally find this a risk at a high-level glance before diving into the numbers itself. But the merits of the mall is that it is a relatively prime mall in Kuala Lumpur (hopefully still the same in years to come).

Adding on to the point you raised on the interest, debt and margin. These are a few areas investors need to look out for especially during this period.