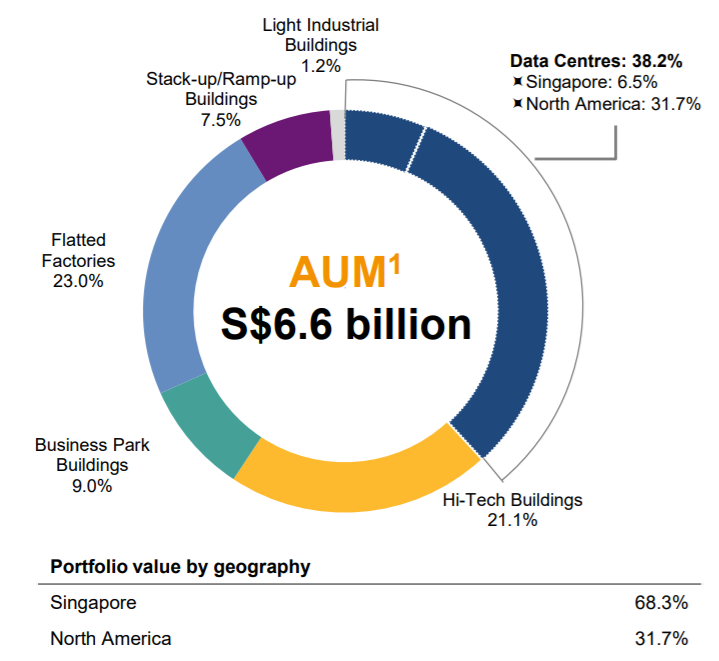

Mapletree Industrial Trust is a REIT listed in the Singapore Exchange in October 2010. They invest primarily in industrial focussed assets with an asset under management of SGD 6.6 billion as at 31 December 2020.

They are one of the few REITs which are sponsored by Mapletree Investment (MIPL). This is alongside REITs such as Mapletree Logistics Trust and Mapletree Commercial Trust. For those who are new to MIPL, they are a leading real estate company headquartered in Singapore with asset under management of SGD 60.5 billion as at 31 March 2020. Hence, it is without a doubt that they have a fairly strong backing.

Many businesses have taken a hit with the uncertainty of the Covid-19 pandemic. In this post today, we will dive into how Mapletree Industrial Trust has performed historically as well as in 9M21. Hopefully, it will be insightful to your REITs journey.

1) Proposed Acquisition of data centre in Virginia

The first key thing you need to know of Mapletree Industrial latest report is its planned acquisition of the data centre in Virginia. If we were to look at REITs in other sectors, it is without a doubt that data centres have been highly demanded in the current market. As such, we view the expansion as a positive move allowing them to tap into the resilient data centre sector.

Upon the completion of the acquisition, this property will be leased on a triple net lease structure to a multinational corporation with an existing lease of more than years. For those who are not familiar, under a triple net lease structure, most of the expenses will be paid by the tenants. Hence this would reduce or minimize the property expenses of Mapletree Industrial Trust.

2) Proposed divestment of 26A Ayer Rajah Crescent

26A Ayer Rajah Crescent is a 7-storey data centre developed by Mapletree Industrial Trust for Equinix back in January 2015. As part of the deal, there is an option to purchase the property by Equinix of which they have exercised their option to do so.

The property will be divested at a price of SGD 125 million which is 23.3% above the development cost of SGD 101.4 million.

3) Proactive acquisition growing its portfolio from 99 properties in FY18 to 111 properties

A positive aspect we like about Mapletree Industrial Trust is its proactive growth strategies. Back in FY18, they owned a total of 99 properties of which they have grown to a total of 111 properties in December 2020. This amounts to a total asset under management of SGD 6.6 billion.

Looking at the chart above, approximately 68.3% of the properties are located in Singapore with 31.7% in the Americas.

4) Strong and stable occupancy rate

| FY18 | FY19 | FY20 | Dec-20 | |

| Singapore Portfolio | 89% | 88% | 90% | 92% |

| America Portfolio | 97% | 97% | 98% | 98% |

| Overall | 90% | 88% | 91% | 93% |

In terms of its operational performance, Mapletree Industrial Trust has been growing at a strong and stable pace. Its overall occupancy rate has increased from 90% in FY18 to 93% in Dec-20. Not only that, its Singapore portfolio occupancy has improved to a staggering 92% in Dec-20 despite the Covid-19 uncertainty. As for its America Portfolio, its occupancy rate has remained strong at a range of 97% to 98% over the years.

The improvement in the overall occupancy rate is mainly fueled by the demand for industrial space.

5) Year on year growth in financial performance

| SGD in 000s | FY18 | FY19 | FY20 | 9M21 | Extrapolated |

| Revenue | 363,230 | 376,101 | 405,858 | 326,141 | 434,855 |

| Net Property Income | 277,603 | 287,770 | 318,069 | 259,183 | 345,577 |

In terms of its financial performance, Mapletree Industrial Trust has been performing favourably over the years. Its net property income has grown from SGD 277.6 million in FY18 to SGD 318.1 million in FY20. They have also reported a net property income of SGD 259.2 million in 9M21 of which after extrapolation would be approximately SGD 345.6 million. This would still represent a positive expected growth by Mapletree Industrial Trust.

The key drivers for the growth in financial performance are mainly:

- Its proactive acquisition of properties over the year effectively growing the overall portfolio of Mapletree Industrial Trust

- The REIT manager ability to manage and maintain a strong and growing occupancy rate of its existing properties.

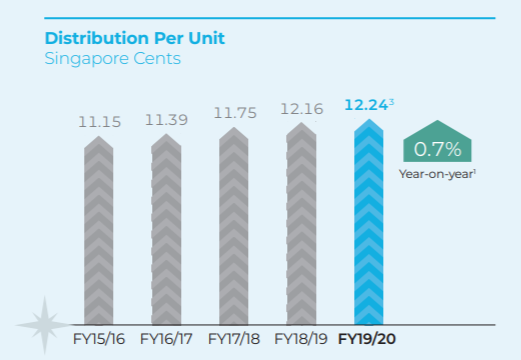

6) Growing distribution per unit from FY16 to FY20

Distribution per unit similarly has grown from 11.15 cents in FY16 to 12.24 cents in FY20. This is in line with its strong operational and financial performance over the years. Its recent 9M21 result reported a distribution per unit of 9.25 cents. If everything stays constant, the distribution per unit post extrapolation is expected to improve as well.

Read More: Why you should never buy a REIT purely from its dividend yield

7) Healthy gearing level of 37.3% as at December 2020

As at December 2020, Mapletree Industrial Trust has borrowings of approximately SGD 1.9 billion. This translates to a gearing of 37.3% which is way below the permissible limit giving them ample debt headroom for future acquisition and asset enhancement initiatives.

Its debts are mainly fixed with 96.2% of the debts fixed rate in nature. This would reduce its interest rate risk.

Summary

Based on our analysis of Mapletree Industrial Trust historical and 9M21 performance, they have been performing favourably. Its occupancy rate has been stable over the years. Financial performance has been great as well with a strong distribution per unit growth year on year. Despite the COVID-19 uncertainty, its performance remained resilient which is overall a plus to investors.

What are your thoughts on Mapletree Industrial Trust? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.

It’s a good reit that unfortunately is way too overvalued. This gives it a lacklustre yield and your money is better invested elsewhere.

P/nav cannot grow indefinitely, this reit will have a sell off at some point until it gets brought down back to planet earth.

For people who invested 10 years ago: congratulations on finding a golden goose.

Exactly. Investors who enter way before the growth of the REIT would definitely benefit the most. Just purely from a dividend yield perspective, definitely not the best for now.