IREIT Global is a Singapore-listed REIT with asset presence in Europe predominantly in Germany and Spain. For those who have not read our previous post on IREIT Global, they are managed by IREIT Global Group Pte. Ltd. which is an entity jointly owned by City Development Limited and Tikehau Capital which are no strangers to many. Both are listed company in Singapore Stock Exchange and Paris Stock Exchange respectively. IREIT global will no doubt benefit from the expertise and support from them.

As at 31 December 2020, IREIT Global owns a total of 9 assets of which 5 are located in Germand and 4 are located in Spain. In this post, we will be looking at IREIT global FY20 performance to see how it has performed.

1. Slight improvement in occupancy rate in FY20

| FY19 | FY20 | |

| Berlin Campus | 100.0% | 100.0% |

| Born Campus | 100.0% | 100.0% |

| Darmstadt Campus | 100.0% | 100.0% |

| Munster Campus | 100.0% | 100.0% |

| Concor Park | 98.2% | 97.5% |

| Germany Portfolio | 99.7% | 99.6% |

| Delta Nova IV | 93.6% | 84.8% |

| Delta Nova VI | 94.5% | 92.5% |

| Il-lumina | 69.2% | 90.2% |

| Sant Cugat Green | 77.1% | 77.1% |

| Spain Portfolio | 80.7% | 85.2% |

If we were to look at the overall occupancy rate of IREIT Global, it has improved slightly. Given that IREIT Global has properties in both Germany and Spain, we will look at the occupancy rate by segment. Its Germany portfolio has remain fairly stable at 99% over the last 2 years. The portfolio in Spain on the other hand has improved from 80.7% in FY19 to 85.2% in FY20.

The improvement in the Spanish portfolio is mainly from the II-lumina asset where it has improved tremendously from 69.2% in FY19 to 90.2% in FY20. This is an overall commendable achievement with the uncertainty of COVID-19 pandemic.

2. Huge reliant on 2 key tenants which posses tenant concentration risk

The next aspect we would like to highlight is the huge tenant concentration risk of IREIT global. The top 2 tenants of IREIT global make up approximately 66.3% of the total portfolio composition with the remaining 33.7% spreading across various tenants. The 2 tenants are Deutsche Telekom and Deutsche Rentenversicherung Bund.

Deutsche Telekom is a German telecommunications company headquartered in Bonn and by revenue the largest telecommunications provider in Europe. Likewise, Deutsche Rentenversicherung Bund is a government body. Depending how you view it, this could be both good and bad.

The positive point is that given the strong reputation of these companies, it is highly unlikely for them to default. The downside is that a non renewal in the lease or default will be detrimental to IREIT global.

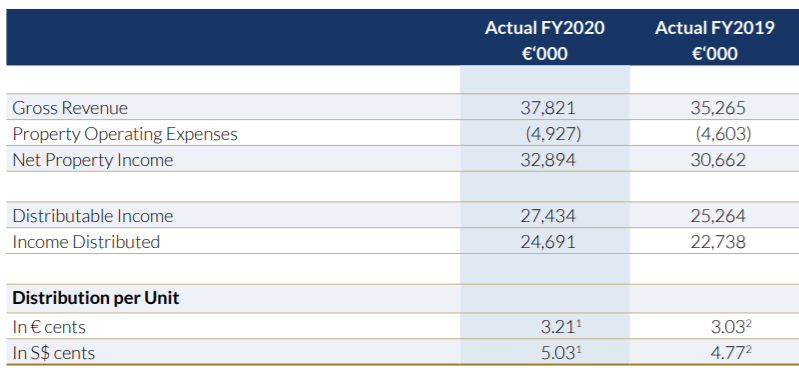

3. Improved in financial performance in FY20

| €‘000 | FY19 | FY20 |

| Revenue | 35,265 | 37,821 |

| Net Property Income | 30,662 | 32,894 |

The revenue of IREIT Global has increased from € 35.3 million in FY19 to € 37.8 million in FY20. Likewise, the net property income has increased from € 30.7 million in FY19 to € 32.9 million in FY20. These increased is mainly to the consolidation of the operating results of the Spanish Properties in the financial statement where the remaining 60% interest in the Spanish Properties was completed in October 2020.

4. Distribution per unit increased from € 3.03 cents to € 3.21 cents in FY20

In FY20, IREIT Global declared a distribution per unit of € 3.21 cents. This is a 5.9% increase as compared to the DPU of € 3.03cents for in FY19. In SGD terms, this is an increase from 4.77 cents in FY19 to 5.03 cents in FY20. The overall increase is mainly due to the consolidation of the operating results of the Spanish Properties, following the completion of the acquisition of the remaining 60% interest.

5. Gearing level of 34.8% within a healthy range

As at 31 December 2020, IREIT Global has a total borrowings of € 267.7 million which translate to a gearing of 34.48%. This is within the permissible limit giving them ample debt headroom for further asset acquisition and enhancement initiatives to further grow the REIT. Of the total borrowing, 100.0% of the gross borrowings are floating interest rates in nature. To reduce interest rate risk, these borrowings had been hedged with interest rate swaps. In addition to that, IREIT Global has an interest coverage ratio of 7.4 times which is relatively healthy.

Summary

Based on our overall analysis, IREIT Global has been performing relatively well both operationally and financially. Its average occupancy rate has improved slightly despite the uncertainty of Covid-19 pandemic. Similarly, its financial performance has commendable. The one aspect which we find risky is the huge reliance of two key tenants which account for approximately 66% of the total.

What are your thoughts on IREIT Global FY20 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.