COVID-19 pandemic took the world by surprise impacting healthcare, businesses, and economy as a whole including the REITs sector. While most REITs are adversely affected, REITs like Atrium and Axis REIT have performed fairly well.

Nobody is able to time the market. Unless you are exceptionally good at timing and entering the market at its lowest point and exiting before the next drop, chances are you will ride through the bear and bull market. Looking at KLSE index as a proxy, there have been a few market crashes (massive and mini).

Depending on your entry point, your investment would go either way. Let’s assume that you have invested MYR 16k into the KLSE index on 1st August 2006 cruising through the stock market crash. To date, that invested sum would have still grown to c.MYR 26k. That is a CAGR growth of 3.2% p.a.

Now that we know the average return of KLSE. The big question is; do REIT generally outperform or underperform the market?

For those who are new to REITs, REITs are known for their attractive dividend yield. Investors who are capital gain seekers would typically not be attracted to REITs.

To find out, we will illustrate by using the same MYR 16k and allocate MYR 1k each across all 16 REITs in Malaysia at their IPO date. This would be a simple illustration not taking into account any stock split.

The result?

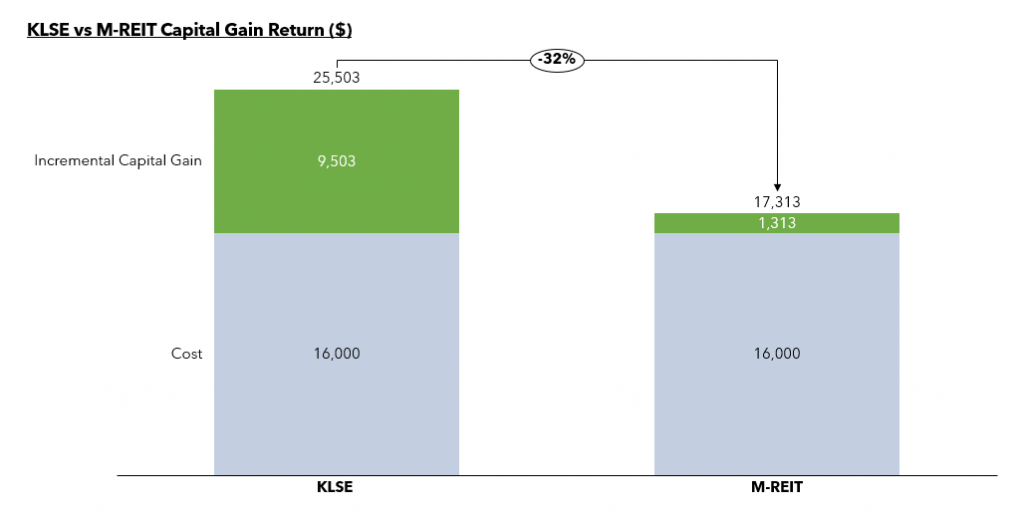

Returns NOT attractive from pure capital gain play

From a pure capital gain play, investing in REITs is not an entirely attractive proposition. MYR16k (MYR 1k each) invested across each REITs would have grown to c.MYR 17k today. That return is 32% lower than if you have invested in KLSE Index. Hence, you will be better off investing in KLSE index and get a much better return.

Of course, this not exactly an apple to apple comparison given the timing of investment on each individual REITs.

Malaysia REITs is a dividend play instrument

Unlike REITs listed in the United States where it is highly volatile giving investors the opportunity to profit from capital gain growth, REITs in Malaysia are typically less volatile. Hence, investors who are looking to grow its REITs portfolio should not isolate its return from a pure capital gain perspective.

REITs portfolio should also be assess from its overall total return which is often known for its attractive dividend payout.

Read More: What are REITs and what you need to know about these investments

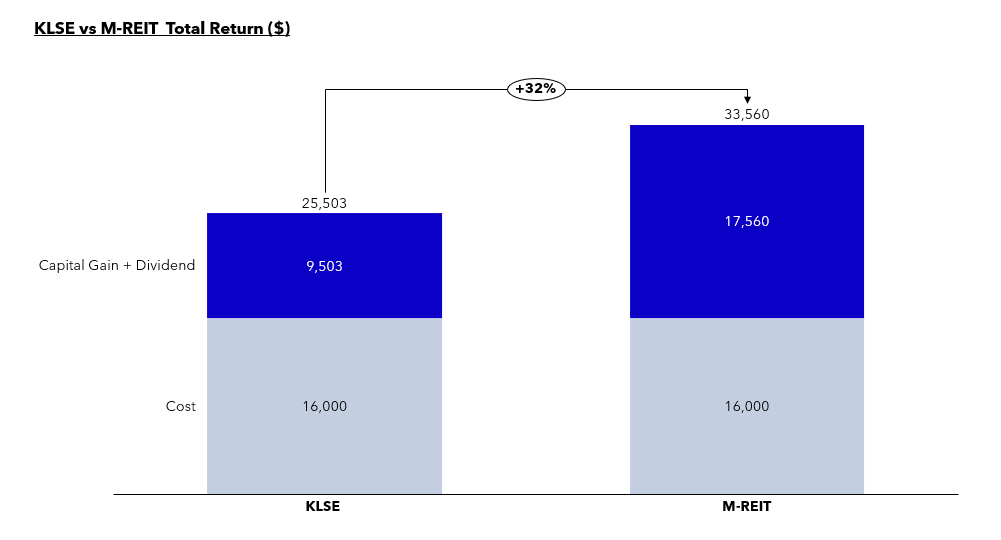

Overall returns is attractive when returns is viewed from capital gain + dividend point of view

Considering dividend distributed by REITs, REITs return surpassed return of KLSE. The similar MYR 16k investment would have grown to a staggering MYR 34k. More than doubled the initial capital invested. Not exactly disappointing. From a CAGR growth point of view, that is a 6% year on year return.

Investors who are purely looking at capital gain as a benchmark return would have avoided REITs. However, taking a step back, the actual prove otherwise.

REITs return differs from REIT to REITs

Not all REITs are equal. Investors who invest in individually REITs would see different results. Investing randomly into any of the 15 out of 16 REITs in Malaysia would have still grown the initial capital. That is with exception of Al-Salam REIT whereby investors who have invested MYR16k during their IPO would have seen their overall portfolio declined to MYR 12k.

Comparing the individual REIT return to investing to the entire REIT basket, 7 out of 16 REITs would have provided better returns that if you have invested in them individually. AXIS REIT is a strong runner. Since its IPO, every MYR 16 k invested in Axis REIT would’ve turned into MYR 48 k. Including dividends, every MYR 16 k would cumulatively become MYR 82 k.

Healthcare and Industrial REIT segment outperformed other sectors

Healthcare REIT is known for its defensive nature where it is less subject to market volatility. They are one of the few sectors that are needed regardless of the market uncertainties. In Malaysia, there is only one healthcare REITs being Al-Aqar REIT. Its performance have been fairly impressive when compared to the average M-REIT return.

- Al-Aqar REIT: Investment of MYR 16k during its IPO would have grown investors return to MYR 38 k to date. A 6.0% CAGR growth.

While healthcare REITs has been performing well, industrial REIT outperformed its peers. Two REITs with huge exposure of industrial assets in Malaysia is no other than Axis REIT and Atrium REIT. Unlike healthcare REITs which is defensive in nature, industrial REIT growth is partly attributable to the growing demand in warehousing space with the rise in COVID-19.

- Atrium REIT: Investment of MYR 16k during its IPO would have grown investors return to MYR 39 k to date. A 6.5% CAGR growth

- Axis REIT: Investment of MYR 16k during its IPO would have grown investors return to MYR 82 k to date. A 10.7% CAGR growth

Retail and Hospitality sector lag behind

Two main sectors which are impacted by the COVID-19 uncertainties is the retail and hospitality sector. The restricted movement and border closure have resulted in massive drop in demand for hospitality space and likewise demand of retail space.

While generally a strong performer, hospitality REIT has slump during COVID. YT Hospitality REIT is the only pure hospitality REIT in Malaysia with assets presence across Malaysia, Australia and etc.

In Summary, while investment returns from capital gain point of view appears to be unattractive, the total return (capital gain + dividend) appears to be lucrative. So if you’re just getting started, Malaysia REITs do appears to be a fairly great investment options.

Disclaimer: The article is written to the best extent possible. Please do your own due diligence before investing.

If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about some of the great reasons to invest in REITs.