IGB REIT (KLSE: 5227) is a retail REIT which is traded in the Bursa Malaysia stock exchange since 2012. As at the date of this analysis, it is traded at MYR 1.74.

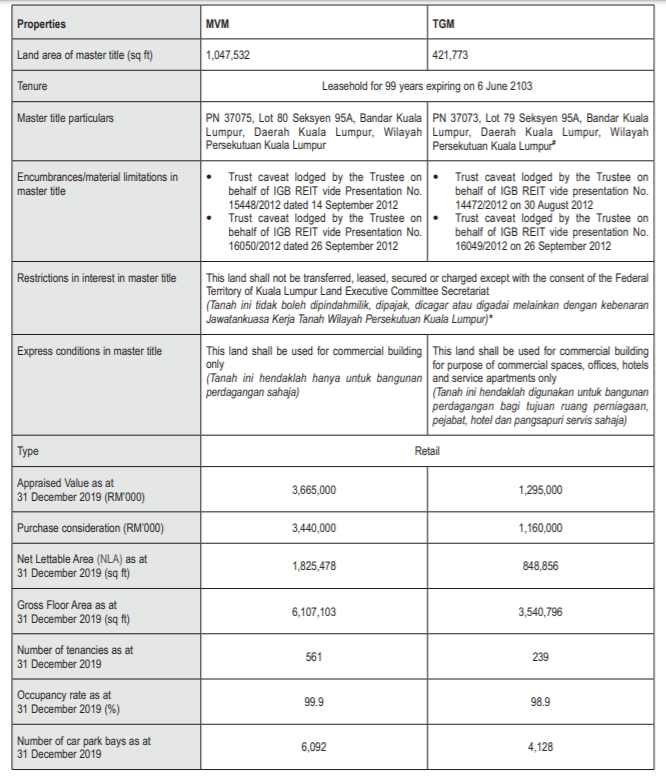

IGB REIT currently owns two main retail malls in Malaysia, Mid Valley Megamall and The Gardens Mall. If you have stayed in Kuala Lumpur, you would have most likely visited these malls.

Their business model is the same as any ordinary retail REIT. They lease out space in the mall to tenants and in return collecting rental income. Rental income itself would make up their main revenue which account for approximately 67% of the total revenue in 2019. There are also other stream such as car park income and advertising income which account for a small proportion of their total revenue.

In this post today, we will be covering 5 key things you need to know about IGB REIT 2019 performance.

1) Growth in historical financial performance with uncertainty in the future

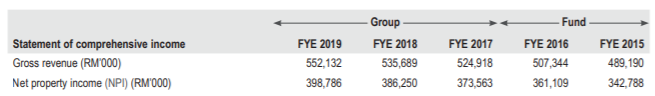

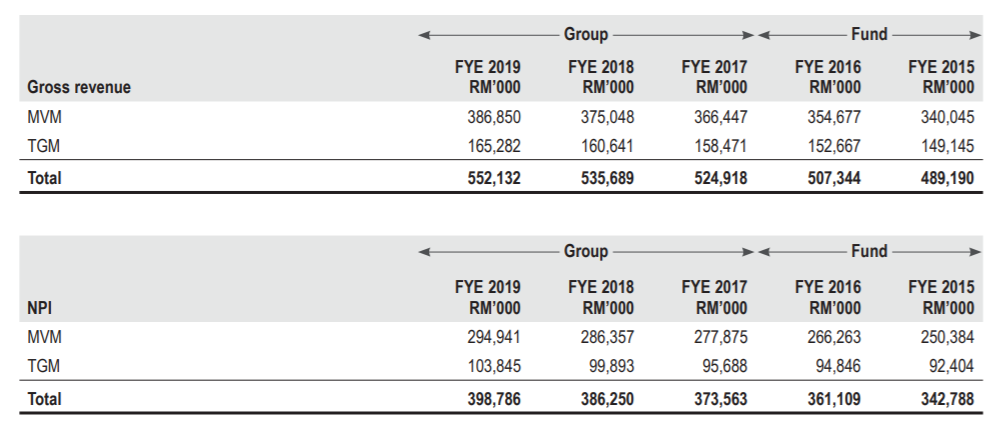

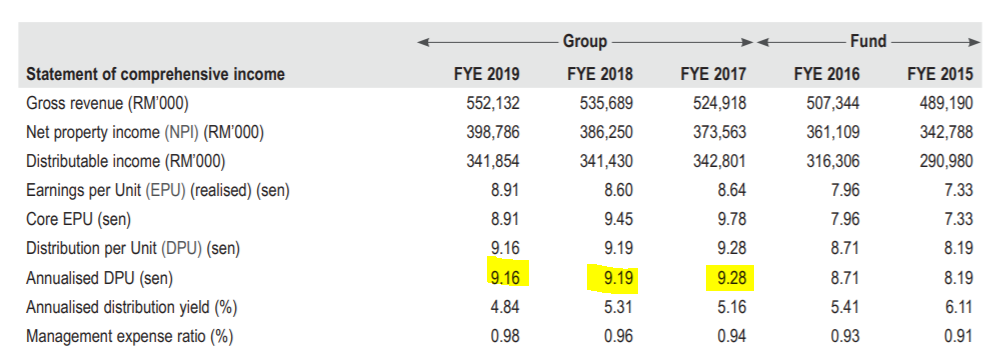

The first area we will be looking at is IGB REIT financial performance. At a high-level glance, the gross revenue and NPI have been growing year on year at an increasing trend. As there is no new acquisition during the year, there are only two possible reasons for a REIT to grow. The first being an improvement in occupancy rate and secondly from positive rental reversion.

In the next point where we discussed on occupancy rate, you will see why the revenue has been growing.

From the two properties owned, Mid Valley Megamall is the crown jewel for IGB REIT. It accounts for approximately 70% of the revenue earned.

With the current movement restriction order and the development of COVID-19, this could be adverse to retail REIT in general. Either in the form of drop-in occupancy rate, negative rental reversion, or even through rebates provided to tenants. This is definitely an area investor should pay attention to if they decided to invest in IGB REIT.

2) Strong occupancy rate

The occupancy rate as at 31 December 2019 of both Mid Valley Megamall and The Gardens Mall is at 99.9% and 98.9% respectively.

Looking back at the historical occupancy rate throughout 5 years, it has always ranged between 97.2% to 99.9%. Looking at recent occupancy rate itself, we can see a growth in occupancy for Mid Valley Megamall from 99.3% in FY18 to 99.9% in FY19. Management has done a good job of keeping the malls occupied. Also partly from having a well-located mall.

The tenant concentration risk is low as well. Management has represented that there no single tenant accounting for more than 10% of the revenue. This is definitely a plus point as a loss in a few tenants will not be very detrimental to the performance of the REIT.

3) Distribution per Unit (DPU)

One of the key reason why investors love REITs is for their generous dividend. Looking at the historical distribution, we note a declining DPU from 9.28 cents in FY17 to 9.16 cents FY19.

As discussed in the financial performance section earlier, we would expect performance to be uncertain in 2020. This will potentially be adverse to the distribution per unit.

Looking at the dividend yield as of 31 December 2019, that would give investors a yield of 4.84%. Based on the current trading price of MYR1.74, this would give investors a yield of 5.26%. That is if the distribution for FY20 remains the same.

4) Gearing and Borrowing

The gearing ceiling impose by the Malaysian Authorities is at 50%. As of 31 December 2019, the gearing of IGB REIT is 23.3% which is still below the limit. The borrowing of IGB REIT are fixed rate in nature and hence they are not subject to any interest rate risk.

5) Price to book ratio

The net asset value (NAV) per share as of December 2019 is at approximately MYR1.07. Based on the current trading price of MYR1.74, this would come up to a price to book ratio of 1.63. This is an indicator of IGB REIT being overvalued at the current price.

Summary

No doubt that historically, the growth in the performance on IGB REIT has been strong with great occupancy rate and positive rental reversion. However, at the current trading price, the REIT is still overvalued (price to book more than 1) with a declining distribution per unit.

If you were to invest in IGB REIT today given that the distribution remain the same, you would get a yield of 5.26%. The next question investor should ask would be how will the COVID-19 outbreak impact the REIT and their tenant’s performance going forward.

That’s it for our analysis on IGB REIT. What is your take on IGB REIT? Share your thoughts with us at the comment below.

If you like this analysis, here is more REIT analysis.