AIMS APAC REIT is a REIT listed in the Singapore Exchange in April 2007. They invests in industrial-related assets spanning across Singapore and Australia. As at the date of this writing, they own 26 properties in Singapore and 2 properties in Australia.

Their sponsor is AIMS Financial Group which was established in 1991. It is a diversified financial service and investment group with office based in Sydney and businesses across Australia, China, Hong Kong and Singapore.

Given that AIMS APAC REIT has been listed for more than 15 years, we are curious about how it has performed. As usual, we will start out by looking at its FY20 performance before diving into its 1H21 performance.

Historical Performance (FY18 to FY20)

1) Acquisition of Boardriders Asia Pacific HQ

The first key event worth mentioning in FY20 is the acquisition of Boardriders Asia Pacific HQ in July 2019. This property is a freehold industrial facility located in Gold Coast. It is leased to GSM Operations for a period of 12 years on a triple net lease basis. For those who are new to this term, it is a lease structure where the master tenant bears the expenses of the properties. This is favourable to AIMS APAC REIT as it reduces the fluctuation in expenses.

Generally, this acquisition is a plus as it further expands AIMS APAC REIT portfolio and geographical presence in Australia.

2) Declining Occupancy Rate but within Industry Average

Looking at the occupancy rate of AIMS APAC REIT overall portfolio, it has declined from 94% in FY19 down to 89.4% in FY20. The decline could be due to COVID-19 uncertainty. Nevertheless, the overall occupancy rate is still within a healthy level above JTC Corporation’s overall industry average of 89.2% in the first quarter 2020.

Given the uncertainty of COVID-19 impact, no doubt that many REITs in Singapore are impacted. It will be definitely an area investors should keep an eye on which we will discussed at the later part of this post when we look into its 1H21 operational performance.

3) Overall Improvement in Financial Performance

| SGD in mil | FY18 | FY19 | FY20 |

| Revenue | 116.9 | 118.1 | 118.9 |

| Net Property Income | 76.4 | 78.5 | 89.1 |

The next aspect which is interesting to look into is its financial performance. Despite the slight decline in occupancy rate, the net property income improves in FY20. In fact, the net property income has increased year on year from SGD 76.4 mil in FY18 to SGD 89.1 mil in FY20.

The increase in performance from FY18 to FY19 is mainly attributed to the improved in overall occupancy rate from 90.5% in FY18 to 94.0% in FY19. Similarly, the net property income in FY20 has improved mainly attributed from the newly acquired Boardriders Asia Pacific HQ in July 2019 as well as the full year rental contribution from 51 Marsiling Road.

4) Year on Year Decline in Distribution Per Unit

| SGD in mil | FY18 | FY19 | FY20 |

| Distribution Per Unit (DPU) | 10.3 | 10.25 | 9.5 |

With the improved financial performance in FY20, we would expect the distribution per unit in FY20 to improve as well. That is not the case. If we were to look closely, the distribution per unit has declined from 10.3 cents in FY18 to 9.5 cents in FY20.

The drop in FY19 is fairly small hence, we will not be looking into that. The dropped in FY20 however is considerably huge. As per management, the decline is mainly due to the partial retention of AIMS APAC REIT investment in Australia in order to conserve capital for working capital purposes. Furthermore, due to the uncertainty of COVID-19, the REIT manager has provided rebates to support tenants to help them fare through the uncertainty.

Through this exercise, we would hope that the management would be able to retain the occupancy rate in 1H21.

5) Gearing of 34.8% well within a healthy level

As at 31 March 2020, AIMS APAC REIT has a total borrowing of SGD 541.9 mil translating to a gearing level of 34.8%. This is way below the permissible limit of 50% giving them ample debt headroom for further acquisition and asset enhancement initiatives.

One area concerning debts is the interest rate risk. AIMS APAC REIT has a mixture of both fixed rate and variable rate loan of which 81.1% of the borrowings are fixed in nature. This would reduce its uncertainty when it comes to interest rate expenses. The downside is that they would not benefit from a low interest rate environment. From our view, this is fairly healthy given the mixture of both fixed and variable loan.

Read more: How Do Interest Rates Affect REITs

1H21 Performance

With the recent release of the 1H21 financial, we will quickly run through its operational and financial performance to see how it has performed.

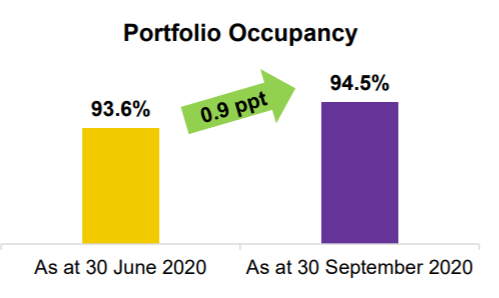

6) Improved in occupancy rate from in 1H21

In 1H21, the overall occupancy rate has improved from 89.4% in 31 March 2020 to 94.5% in 30 September 2020. This improvement is mainly attributable to the leases secured at 8 & 10 Pandan Crescent and 15 Tai Seng Drive driven by increasing for Logistics and Warehouse space amidst the ongoing COVID-19 pandemic.

This is a definitely a plus to AIMS APAC REIT operating in this sector.

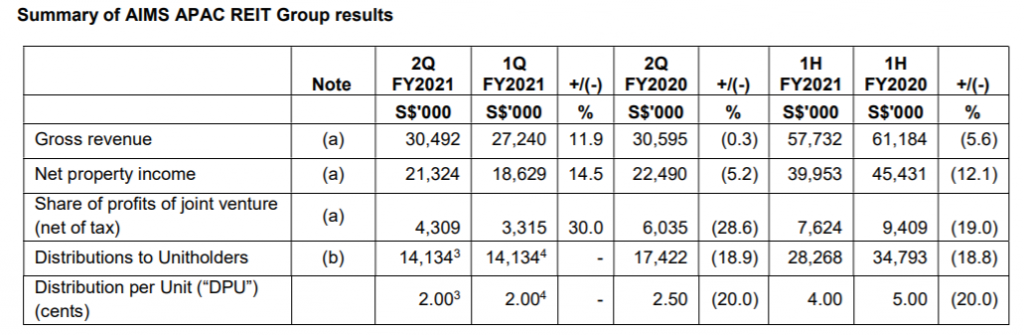

7) Decline in financial performance compared to previous half

Despite improvement in overall occupancy rate in 1H21, the net property income is lower by 12.1% as compared to the previous 1H20. The decreased is mainly attributed by Q121 performance whereby there is an estimated provision for waiver of rent for eligible tenants of approximately S$2.6 million as well as lower contributions of some of the properties from the conversion from master leases to multi-tenancy leases.

Similarly, the DPU has declined compared to the previous half consistent with the drop in overall financial performance as well as due to the amount reserved for distribution to Perpetual Securities holders.

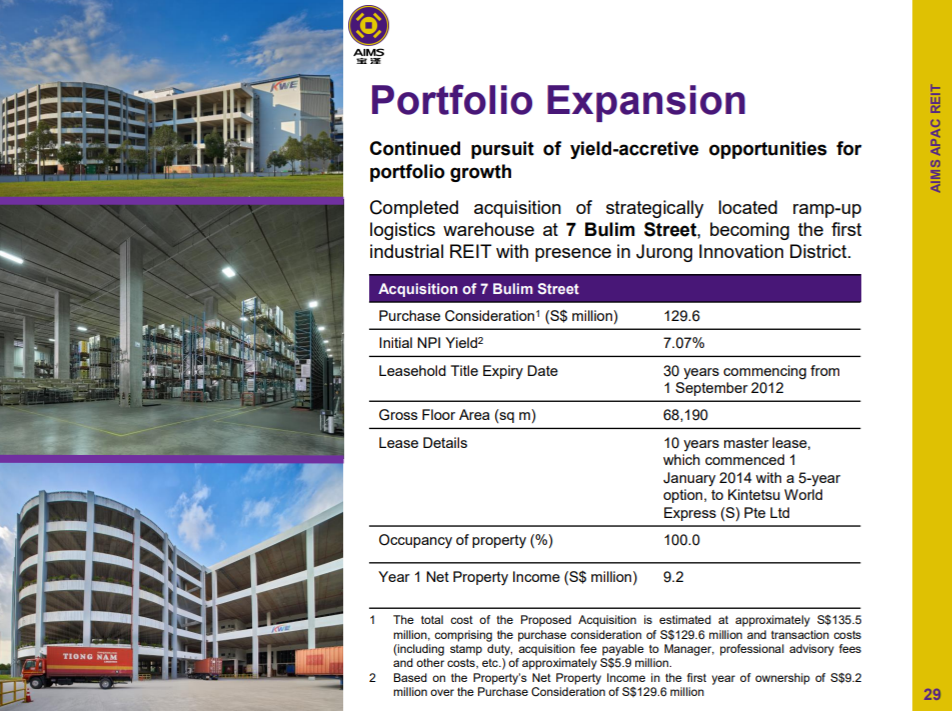

8) Completed Acquisition of 7 Bulim Street on October 9 2020

Another event for noting in regards to AIMS APAC REIT is its recent acquisition of 7 Bulim Street in October 2020. This acquisition is located in the Jurong Innovation District with leased signed with Kintetsu World Express for a period of 10 years starting January 2014.

With this acquisition, this bring their total portfolio to 28 properties.

Summary

In Summary, AIMS APAC REIT has been showing a mixed in performance. Their overall occupancy rate has been improving despite the COVID-19 pandemic fueled by increasing demand. The management proactive acquisition in growing the REIT is also fairly commendable.

The downside of AIMS APAC REIT is the declined in financial performance especially its distribution per unit downtrend since FY18. Nevertheless, with the contribution from 7 Bulim Street kicking in next quarter as well as the increase in demand for Logistics and Warehouse space, we would expect the overall performance to increase next quarter onwards. Definitely an area to keep a lookout on.

What are you thoughts of AIMS APAC REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

join our community over at Facebook and Instagram.