Pavilion REIT or PAVREIT is one of the few largest retail concentrated REIT in Malaysia. For those who have not read our previous post, Pavilion REIT were listed in the Bursa Malaysia exchange back in December 2011. As at to date, they owned a total of 5 properties. This is a similar composition as per our last updates.

Read More: 5 Key Things You Need To Know Of PAVREIT 2019 Performance

Since our last update, there have been a number of events and developments that have taken place. Hence, in this post, we will look deeper into Pavilion REIT performance to see how it has performed in FY20.

1) Declined in occupancy rate in all their properties in FY20

| FY18 | FY19 | FY20 | |

| Pavilion Mall | 99% | 98% | 97% |

| Pavilion Tower | 94% | 86% | 86% |

| Da Men Mall | 74% | 72% | 69% |

| Intermark Mall | 94% | 97% | 86% |

| Elite Pavilion Mall | 97% | 95% | 83% |

As constantly shared in a number of ours post, occupancy rate of the REIT’s portfolio is a crucial operational indicator. It is the lifeblood of any REIT. In a constant environment, an increase in occupancy rate will help grow the overall financial performance of the REIT.

Looking at Pavilion REIT occupancy rate, it has overall declined with all its retail properties recording a drop as compared to FY19. Pavilion Mall which is the biggest revenue contributor has slightly declined from 99% in FY18 to 97% in FY20. Da Men Mall on the other hand reported a drop down below the 70% range. The overall poor sentiment is mainly attributable to the uncertainty of COVID-19 pandemic with various measures introduced by the Malaysian government. As a result, a number of tenants did not renew upon the expiry of their lease.

2) Low tenant concentration risk

One favourable aspect of Pavilion REIT is the relatively Low tenant concentration risk. If we were to look closely at the tenant composition, the top 10 tenants cumulatively accounts for 14.7% of the total gross rental income. This is fairly favourable as a loss in income from any one tenants would not be highly detrimental to Pavilion REIT overall performance.

3) Declined in net property income in FY20

| MYR in 000s | FY18 | FY19 | FY20 |

| Revenue | 554,977 | 585,353 | 510,220 |

| Net Property Income | 374,787 | 375,184 | 233,524 |

The financial performance of Pavilion REIT has overall declined in FY20. Its net property income dropped from MYR 375.2 million in FY19 to MYR 233.5 million in FY20. This is mainly attributable to the overall market sentiment as a result of the COVID-19 pandemic. With the uncertainty of the pandemic, various measures have been introduced by the Malaysian government such as the movement control order, conditional movement control order and restricted movement control order. These measures have definitely impacted retailer adversely with retail traffic declining as compared to its pre-COVID level.

With that, it comes to no surprise that the net property income has declined. Occupancy rate has declined with non renewal of expired tenancies. Not only that, Pavilion REIT have also suffered higher cost mainly due to rental relief given to support its tenant and higher provision for doubtful debt. With the gradual rollout of vaccine and easing of measures, it will be very much dependent on the REIT manager ability to regain the momentum.

4) Year on year decline in distribution per unit from FY18 to FY20

| MYR in cents | FY18 | FY19 | FY20 |

| Distribution Per Unit ( DPU) | 8.78 | 8.50 | 4.13 |

The next aspect we will look at is the distribution per unit. As per expected, the distribution per unit declined to 4.13 cents in FY20. This is fairly in line with the drop in overall occupancy rate of its properties. Similarly, the rental relief granted to the affected tenants have resulted in an overall lower DPU.

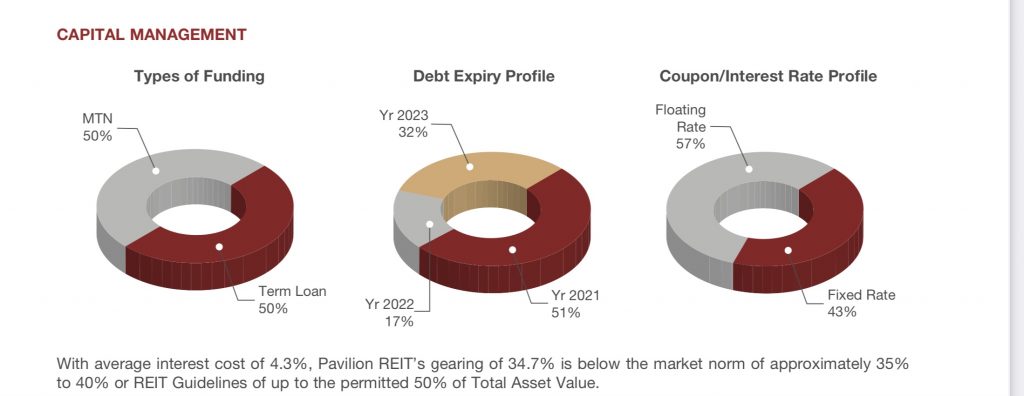

5) Relatively balanced and healthy debt profile

In terms of its overall debt profile, Pavilion REIT has a reported gearing of 34.7% which is below the permissible limit. This would give them ample debt headroom for further asset acquisition and enhancement initiatives. Of the total debt, approximately 43% of the debts are fixed rate in nature with the remaining 57% subject to interest rate risk. Depending how you view it, this would also allow them to benefit from a Low interest environment.

Summary

Based on our overall analysis, Pavilion REIT has been adversely affected by the COVID-19 pandemic. Their financial performance has overall declined alongside their occupancy rate. This comes to no surprise with retail sector being one of the hardest hit sector from the COVID-19 pandemic. With rollout of vaccine and gradual easing of measures, hopefully this would be favourable to Pavilion REIT. As usual, we will let you decide if this is worth investing in.

What are your thoughts on Pavilion REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.