Manulife US REIT is a Singapore REIT listed in the Singapore Exchange on May 2016 with assets presence in key markets in The United States. They are one of the few REITs which focusses on office properties in the United States alongside REITs such as Prime US REIT and Keppel Oak REIT.

As at 30 June 2020, their portfolio is valued at approximately USD 2.0 billion which comprises of 9 office properties. They have a rather strong sponsor, Manufacturers Life Insurance Company (Manulife) which is a subsidiary of Manulife Financial Corporation (MFC), a leading international financial services group.

In this post today, we will be looking at how Manulife US REIT has performed historically and in 1H20.

Historical Performance (FY17 to FY19)

1. Acquisition of Centerpointe and Capitol in FY19

One of the key events in FY19 is the acquisition of two key properties by Manulife US REIT. The first property, Centrepointe was acquired at USD 122 million in May 2019. Centrepointe is a two-tower, 11-storey Class A office which is located in the Washington, D.C. Metro Area.

The second property, Capitol was acquired at USD 198.8 million in October 2019. This property is located a 29-storey Class A office building located in California. It is within 15 minutes drive from Sacramento International airport and is uniquely positioned in the CBD.

Both these acquisitions are key to the further growth of Manulife US REIT which we will discuss over the next few points.

2. Overall occupancy rate at a healthy level from FY17 to FY19

| FY17 | FY18 | FY19 | |

| Figueroa | 92.9% | 93.9% | 93.8% |

| Michelson | 96.5% | 96.0% | 90.1% |

| Peachtree | 96.8% | 93.7% | 95.0% |

| Plaza | 98.9% | 98.9% | 98.9% |

| Exchange | 95.7% | 97.7% | 95.8% |

| Penn | n.a | 99.2% | 100.0% |

| Phipps | n.a | 100.0% | 100.0% |

| Centerpointe | n.a | n.a | 98.7% |

| Capitol | n.a | n.a | 94.2% |

| Average Occupancy | 95.9% | 96.7% | 95.8% |

Looking at Manulife US REIT overall occupancy rate, it has remained stable range at a range between 95.8% to 96.7% throughout FY17 to FY19. This is still within a healthy range above the market average.

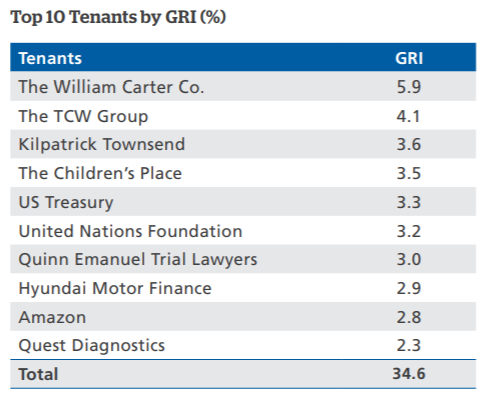

In terms of the tenant concentration, the top 10 tenants account for 34.6% of the total gross rental income. No single tenant account for more than 6% of the total rental income. In the view of its stable performance, it will be interesting to see how the assets fare through in FY20 given the outbreak of COVID-19 pandemic.

3. Increased in financial performance from FY17 to FY19

| USD in 000s | FY17 | FY18 | FY19 |

| Revenue | 92,040 | 144,554 | 177,853 |

| Net Property Income | 58,351 | 90,665 | 110,776 |

The financial performance of Manulife US REIT has been increasing on a stable trend historically. Looking at its net property income, it has increased from USD 58.4 million in FY17 to USD 110.8 million in FY19. This increase is mainly from the addition of 4 new properties in both FY18 and FY19.

If we were to look at the performance on an apple to apple comparison excluding the 4 new acquisitions, the performance is still fairly stable. The net property income declined slightly from USD 78.9 mil to USD 77.9 mil in FY19. Nonetheless, these recent acquisitions showcased the management proactiveness in growing the REIT.

4. Gearing within the permissible limit

Manulife US REIT has a total borrowing of approximately USD 816.9 million as at 31 December 2019. This translates to a gearing of 37.7% which is still within the permissible limit of 50%. This would give them ample debt headroom for further acquisition and asset enhancement initiatives.

In regards to its exposure to interest rate risk, 95.1% of their gross borrowings has been hedged into fixed rates.

Read more: How do interest rates affect REITs

5. Slight decline in distribution per unit in FY18 but picked up in FY19

Distribution per unit of Manulife US REIT, on the other hand, has declined slightly in FY18 from 5.77 cents in FY17 to 5.57 cents in FY18. The DPU subsequently increase in FY17 to 5.96 cents. Improvement in distribution per unit in FY19 is mainly from the increased in income from the acquisitions made in both FY18 and FY19.

With the full rental income of its FY19 acquisitions yet to kick in, we would expect FY20 DPU to be higher. Nevertheless, the COVID-19 pandemic would potentially impact the distributions. We will look into it over the next few points.

1H20 Performance

6. Slight decrease in occupancy rate in 3Q20

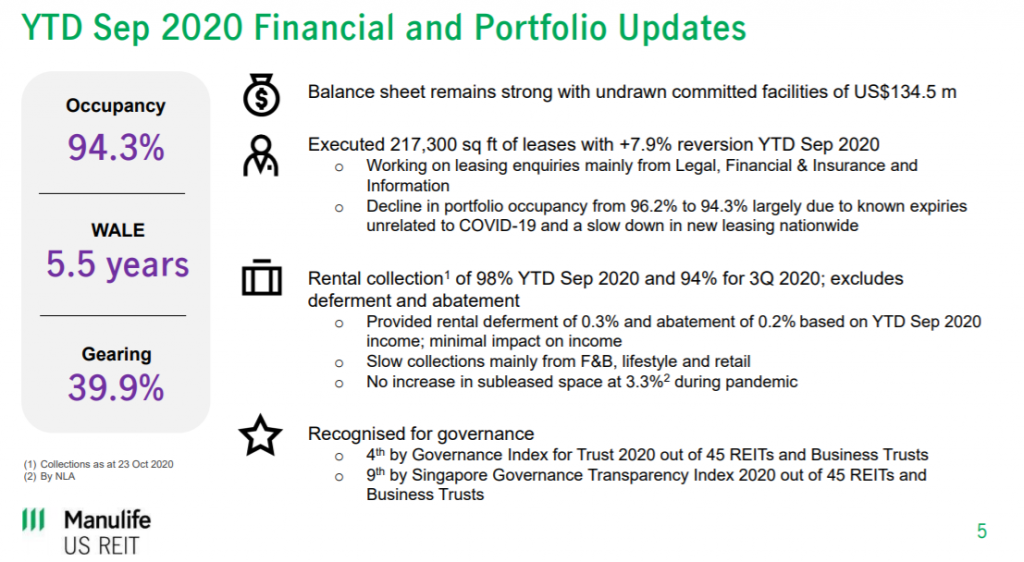

Though this segment relates to 1H20 updates, we will look into its operational overview quickly given that the 3Q20 updates are available. Based on the September 2020 updates, Manulife US REIT registers an occupancy rate of 94.3%. This is a slight drop from its December 2019 occupancy rate.

The drop as per management is largely due to known lease expiry and is unrelated to COVID-19 pandemic.

7. Better 1H20 financial performance fueled by the new acquisitions

The 1H20 financial performance has improved compared to the previous half. Net Property income increased from USD 52.3 million in 1H19 to USD 62.2 million in 1H20. DPU on the other hand increased from 3.04 cents in 1H19 to 3.05 cents in 1H20. These improvements are mainly due to the 2 acquisition made in May 2019 and October 2019 in which is fully reflected in 1H20 financials.

Summary

Based on REIT Pulse overall analysis, Manulife US REIT has been performing well historically from FY17 to FY19. The REIT manager active acquisition throughout the past few years is another plus point as it helps drive growth to the REIT.

The 1H20 performance has been stable as well mainly fueled by the new acquisitions. Despite the slight drop in occupancy rate, it still remains fairly healthy above the market average occupancy.

What are your thoughts on Manulife US REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.