2020 have been a roller coaster ride with various events occuring. The prominent one which is still an ongoing event is the COVID-19 pandemic. COVID-19 pandemic have impacted our lives one way or another. From a simple trip to the mall to the way we work, there are number safe distancing measure to adhere to which is slowly becoming a norm.

The REIT sector itself are affected at a different scale depending on its sectors. This brings us to the topic today. REITs can be an amazing dividend generating investment for its high dividends and the potential for capital gain appreciation. However, how can you evaluate the performance of your REIT. An exercise which is particularly important in our current economic climate.

Before we dive into the topic itself, let us clarify that there are a number of other factors investors need to take into account when evaluating their REIT. But here’s 3 ways you can consider to evaluate the performance of your REIT.

1. Evaluate how your REITs have perform against its peers in the similar REIT sector

We have previously shared that each REITs perform differently depending on the sector they are operating in. Before you invest in any REITs, it is important that you evaluate and understand the sector risk you are investing in. There is no way to completely wipe out risk in investment but what you can do is minimize the risk by understanding what you are investing it. By understanding the sector, it will help you better appreciate how certain events will impact your investments.

It also allows you to evaluate your REITs against other REITs in the similar sector. COVID-19 pandemic has definitely taken a toll on a number of REITs predominantly REITs in the hospitality sector. Healthcare REITs on the other hand has remain defensive.

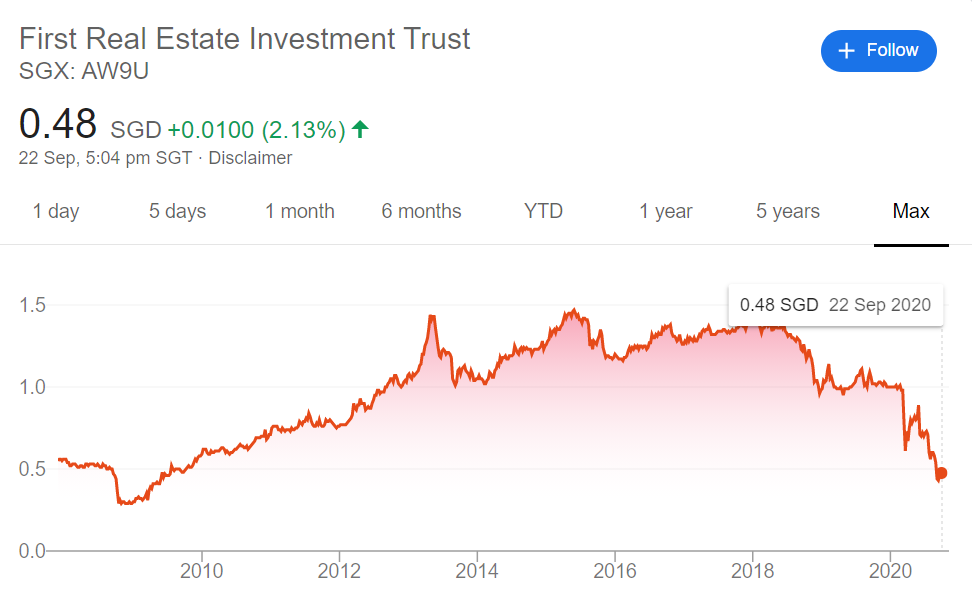

We will use healthcare REITs as an illustration. Looking at REITs in the healthcare sector, you would have expect the REITs to be rather defensive. By comparing against REITs in the similar sector, it allows to see how it had performed.

Looking at the 3 healthcare REITs in Singapore and Malaysia, you will notice that First REIT had been declining over the years. This is a potential red flag investor can pick up when performing an evaluation as the decline in First REIT is probably driven by other factors given that the sectors and its peers are performing rather well.

However, if you were to look at REITs in the hospitality sector, you will then notice that all the REITs in this sector are in a decline. This decline is expected due to the pandemic.

There might be other factors which could contribute to the decline. But at a high-level look, you would have expected the REITs in this sector to decline. At least for the short term.

2. Review through its operational performance on a regular basis

Many investors missed out this step which in our opinion is key. Operational performance is the lifeblood of any REIT. A strong operational performance would likely translate to an amazing financial performance. In return, an increase in dividend for investors.

So what do we mean by operational performance? There are various areas you can look into but for starters, here are 3 operational performance indicator we always look out for.

- Occupancy Rate: Depending on the level of details available, occupancy rate should be reviewed based on the overall REITs average occupancy rate as well as its individual properties occupancy rate. The idea of this exercise is that it allows investors to gauge how the individual properties have been performing as compared to the prior year occupancy rate. Improved occupancy rate essentially means that more space are being occupied and hence more rental income. However, these level of details are usually only available annually.

- Weighted Average Lease Expiry: WALE is an indicator of the average time period when the leases of a REIT will expire. The longer the WALE, the higher the security of future income stream to the REIT. Understanding the WALE allows investors to keep an eye for leases due for renewal.

- Tenant Profile: Tenant profile is another operational areas we like to look at. An indicator investors can consider looking at is the tenant concentration risk. Tenant concentration risk refers to an over reliant of one single tenant occupying the entire REIT portfolio. This can be a good thing thing but depending on how you view it, the over reliant will be potentially detrimental in the event where they decided to not renew the lease.

3) Review the financial performance of your REIT

The third aspect your can evaluate the performance of your REIT is by reviewing the financial performance of your REITs. This exercise can be done through a review of the annual report and the quarterly report which are made available.

There are many aspect you can look such as the debt profile, profit and loss performance, balance sheet position and etc. The idea is to scan for potential red flags which is opposing your initial expectation of the REITs.

A simple illustration on how you can do so (not limited to the following):

- Compare the historical gearing trend over the years

- Look at the PL performance against prior quarters/years performance (Income Statement Review)

- Assessing the Income Available for Distribution versus Historical Distribution

- Reviewing the cash flow statement

- Reviewing the net worth of the REITs (Balance Sheet Review)

For the sake of this post, we will not be going in details into the individual aspect to review. But we hope you get the idea behind the following exercise.

Summary

You may have invested in a REIT due to the REIT portfolio strong occupancy rate with a potential growth prospect. The financial performance may have been growing consistently. All these traits might change 3 months down the road due to certain unforeseen events. It could be that an anchor tenant went into bankruptcy defaulting payment resulting in a huge drop in occupancy rate and ultimately a decline in financial performance.

For this simple reason, it is extremely important investors to do a periodic review of their REITs investments. This exercise allow you to evaluate the performance of your REIT to see if there is any change in the REIT fundamentals which is not aligned with your investment goals.

There are many other aspects you can look into when evaluating your REITs but for starters, this could be a good starting point.

Let us know how you evaluate your REITs portfolio. If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.