Sasseur REIT is a retail outlet focused REIT listed on the Singapore Exchange in March 2018. Since their initial listing, their portfolio composition with 4 retail outlet properties located in China. They are sponsored by Sasseur Cayman Holding Limited, a privately-owned outlet mall operator which currently manages and operates eleven outlet malls.

As at the date of writing, here is the portfolio composition of Sasseur REIT:

In this post today, we will look at Sasseur REIT FY20 performance to see how it has performed since it IPO.

1) Occupancy Rate decline slightly in FY20 but still at a healthy level

| FY18 | FY19 | FY20 | |

| Sasseur (Chongqing) | 99.3% | 100.0% | 100.0% |

| Sasseur (Bishan) | 88.1% | 92.5% | 81.4% |

| Sasseur (Kunming) | 94.2% | 94.9% | 95.8% |

| Sasseur (Hefei) | 97.4% | 96.3% | 94.9% |

| Average Occupancy | 95.1% | 96.0% | 93.5% |

The ability for a REIT to grow organically is from its ability to maintained a stable and strong occupancy rate as well as increasing its rental reversion. Looking at Sasseur REIT average occupancy, it has improved from 95.1% in FY18 to 96.0% in FY19. This is mainly contributed by Sassuer Chongqing, Sasseur Bishan and Sasseur Kunming where a slightly increase is noted.

In FY20 however, the average occupancy rate declined slightly to 93.5% from 96.0% in FY19. The slight drop is mainly attributable to the performance of Sasseur Hefei and Sasseur Bishan. From our viewpoint, this could potentially be a spillover effect as a result from the COVID-19 pandemic. Given that the situation in China are improving gradually, this would potentially be favorable. Nevertheless, this is still within a healthy and stable range.

2) Year on Year Increase in Net Property and Rental Income

| SGD in 000s | FY18 (14 months) | FY19 | FY20 |

| Net Property and Rental Income | 115,973 | 118,015 | 125,248 |

Before we dive into its financial performance, the FY18 financials are based on 14 months data from 1 November 2017 to 31 December 2018. Looking at its performance from FY18 to FY20, it has increased year on year. Its net property and rental income increased from SGD 115.9 million in FY18 to SGD 125.2 million in FY20. This is mainly contributed by the overall stable occupancy rate throughout the years.

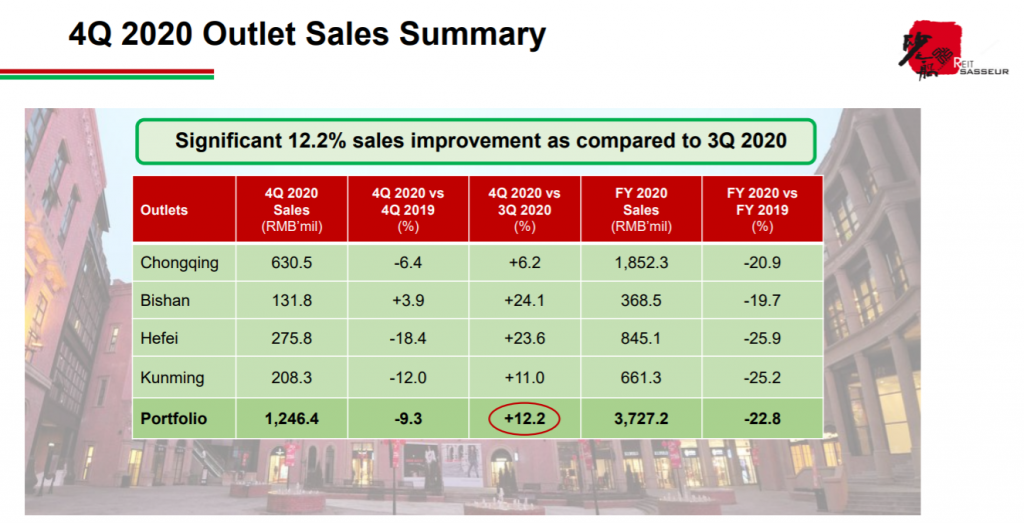

If we were to look at its outlet sales summary, no doubt that the sales performance has declined:

- -9.3% lower in 4Q20 as compared to 4Q19

- -22.8% lower in FY20 as compared to FY19

However, given the gradual economic recovery from the COVID-19 pandemic, this would potentially be a positive sign to Sasseur REIT. Just by looking at the outlet sales in 4Q20 as compared to 3Q20, it has increased by 12.2%.

3) Slight improvement in DPU in FY20

| SGD in Cents | FY18 | FY19 | FY20 |

| Distribution Per Unit (DPU) | 5.128 | 6.533 | 6.545 |

In line with the financial performance of Sasseur REIT, its distribution per unit has been increasing year on year. It has improved from 5.128 cents in FY18 to 6.545 cents in FY20. This is fueled by a improvement in performance of Sassuer REIT. Given the gradual improvement of the COVID-19 pandemic, we would expect the overall outlook for Sasseur to further improve. Definitely an area to keep a close lookout.

4) Healthy leverage ratio of 27.9%

As at 31 December 2020, Sasseur REIT has a total borrowings of SGD 504.2 million. This would translated to a leverage ratio of 27.9% which is way below the permissible limit of 50%. With that, this would give them ample debt headroom for further acquisition and asset enhancement initiatives. This is definitely something the management could look into given that there is no further acquisition since its initial listing in 2018.

In addition to that, its interest coverage ratio is at 7.8 times which representing a huge improvement from 4.7 times in 4Q19.

Summary

Based on our analysis of Sasseur REIT, there are areas which we like and dislike about them. Looking at the positive side of things, both their operational and financial performance have been amazing throughout the years. The gradual recovery of economy which is evident from the improvement of tenants sales is definitely a plus to Sasseur REIT.

The downside on the hand is that there have been not much inorganic growth in regards to Sasseur REIT where their properties composition remain at 4 since its listing. Having said that, we are in view that having no acquisition is better than acquisition which is dilutive.

What are your thoughts on Sasseur REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.

I’ve stayed away despite the good results because this type of mall is highly risky.

Bishan at 80% means one in five shop is closed. That could drag the whole mall down in a negative spiral of death where shoppers decide simply to go elsewhere.

At least big premium developments like the ones in Capitaland China seem less prone to this type of risk.

I could be wrong, actually Sasseur REIT has proven me wrong these past couple of years, but I still have decided to stay away. There are safer yields to be had in the market.