CMMT REIT or also known as CapitaLand Malaysia Mall Trust (KLSE: 5180) is a retail REIT based in Malaysia with retail properties presence in 3 states. There were listed in the Bursa Malaysia exchange in 2010 and as at the date of this analysis, they are traded at MYR0.86.

Similar to any other retail REIT in Malaysia, CMMT REIT main business model is to lease out retail space by collecting rental income. The ability for the REIT to grow would very much depend on the manager’s ability to look for high yield acquisition as well as enhancement of their existing properties.

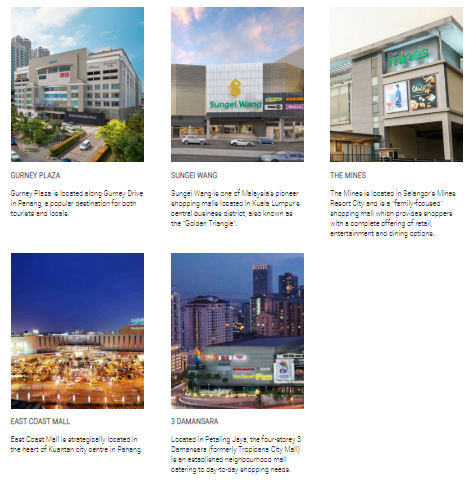

As of 31 December 2019, they owned 5 retail properties across Malaysia with 3 in Klang Valley, 1 in Kuantan and another 1 in Penang.

In this post today, we will go through a few key things you need to know about CMMT REIT performance.

1) Gurney Plaza Mall CMMT’s Crown Jewel

Having owned 5 different retail properties across Malaysia, we notice that the Gurney Plaza Mall which is located in Penang is their crown Jewel.

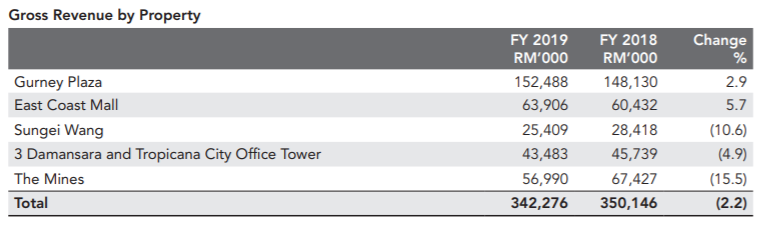

We have put together the revenue earned in 2019 from each of the properties against the total net lettable area. Gurney Plaza Mall itself contributed to approximately 45% of the total revenue in 2019. Our initial thought was maybe the NLA of Gurney Plaza is much bigger.

However, if you look at the revenue efficiency, the revenue per square feet earned by Gurney Plaza is at MYR1.7k per square feet. This is way higher when compared to the properties in the Klang Valley region.

For those who have been to Penang, you will notice that Gurney Plaza is very well-positioned to attract both tourists and locals. When compared to properties such as Sungei Wang, the competition and possibly location have pulled down the rental yield. We will discuss this next.

2) Increasing pressure on properties in the central region

One of the important aspect for a REIT to be sustainable is the ability to maintained a high occupancy rate. Looking at the occupancy rate trend, it has been declining from 96% in FY15 to 93.8% in FY19.

If we were to look at the occupancy of the last 2 years, it has improved from 93.2% in FY18 to 93.8% in FY19. But if you were to look at the revenue in 2019, it has further fallen.

The one possible reason is from the increasing pressure in the Klang Valley region. It appears that to further retain or attract tenants to the malls in Klang Valley, the management has reduced the rental rates. Which explains why the revenue continues to drop even when the occupancy improves.

If this continues, there will be a continuing declining trend from CMMT REIT, especially in the current uncertain environment.

3) Declining revenue and distribution per unit

Revenue for both Gurney Plaza and East Coast Mall has been increasing year on year. This is contributed by both stable occupancy rate (both close to 100%) and a positive rental reversion.

The performance of the other 3 malls in Klang Valley, on the other hand, has been declining. For these 3 properties, the occupancy rate has improved. However, intense pressure and competition have resulted in a decrease in the rental rate to attract tenants. Thus, a decline in revenue.

Distribution from REIT is one of the key factor investors looks into. The DPU has been declining consecutively from 8.60 cents in 2015 to 6.25 cents in 2019. That would give investors a yield of 6.25% based on 2019 closing market price.

Based on the current trading price of MYR0.86, that would give investors a yield of 7.3%. That is if the distribution remains the same.

4) Gearing and Borrowings

As of 31 December 2019, CMMT REIT has a total borrowings of approximately MYR1.4 bill translating to a gearing level of 33.7%. This is still below the regulatory limit and would provide them with a comfortable debt headroom to fund further acquisitions and for further asset enhancement initiatives.

5) Low valuation

Price to book ratio is one of the indicators to identify undervalue REITs. The historical price to book of CMMT REIT before FY18 has always been above 1. FY18 onwards, the unit price has been declining which resulted in a price to book of less than 1.

Having said that, investors should perform due diligence on the REIT and not invest best on the fact that it is undervalued. “Cheap can get cheaper”. It is also important to look at the business fundamental and prospect of the REIT.

6) Outlook uncertainty

With the announcement of movement restriction order and the uncertainty of COVID-19, the outlook for CMMT REIT remains uncertain. Tenants which are in non-essential business are forced to close. This would mean that they would continue paying rent while having no income inflow.

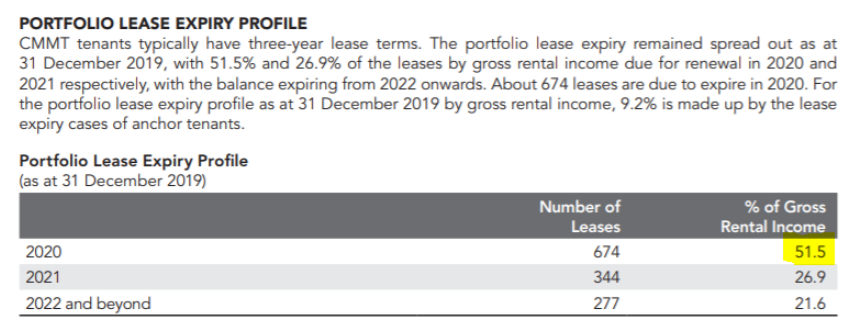

Looking at the lease expiry profile, 51.5% of the rental income are reliant on the lease which is due to expire in 2020 in the midst of the COVID-19 and MCO. Whether the lease will be further renewed will definitely be a question mark.

Summary

The uncertainty of COVID-19 and its impact on business will potentially be adverse to all the retail REIT in general. Hence, it is important that investors invest in fundamentally strong REIT which is able to brace the storm.

That’s it for our analysis on CMMT REIT. What is your take on this REIT? Share your thoughts with us at the comment below.

If you like this analysis, here is more REIT analysis.