Champion REIT is a Hong Kong based REIT listed on the Hong Kong Stock Exchange in May 2006. Its portfolio consists of 3 key assets being Three Garden Road and Langham Place located in Hong Kong plus the recently acquired 66 Shoe Lane which is located in London.

Both its Hong Kong properties are located in a well-positioned location. Three Garden Road, a Grade A commercial complex is located in the Central Business District in Hong Kong. Langham Place on the other hand is located in Mongkok. This one of the busiest public transportation hubs and a popular shopping destination with tourists and locals alike.

In this post today, we will dive in to look at how Champion REIT has performed in FY20 and 1H21.

Historical Performance (FY18 to FY20)

1) Overall decline in operational performance of both its office and retail assets

| Occupancy Rate (%) | FY18 | FY19 | FY20 |

| Three Garden Road | 99% | 93% | 87% |

| Langham Place Office | 100% | 98% | 89% |

| Langham Place Mall | 100% | 100% | 100% |

| Passing Rent (HKD psf) | FY18 | FY19 | FY20 |

| Three Garden Road | 98.60 | 107.80 | 110.40 |

| Langham Place Office | 42.70 | 46.50 | 47.70 |

| Langham Place Mall | 259.10 | 209.50 | 179.30 |

Let’s start out by looking at Champion REIT portfolio occupancy rate. Champion REIT office assets reported a year-on-year decline in occupancy while its retail asset reported a stable occupancy. The occupancy rate for Three Garden Road dropped from 99% in FY18 to 87% in FY20 whereas Langham Place Office decline from 100% in FY18 to 89% in FY20.

Despite the lower average occupancy reported b the office portfolio, the passing rent of both these properties has been on an increasing trend. The previous gap between the average passing rent of the property and the market rent provided Champion REIT sufficient buffer to achieve a mild positive rental reversion amid the battered market environment.

Its retail asset, Langham Place Mall on the other hand has reported a year-on-year drop in passing rent. This is possibly due to the competitiveness of the retail sector which is made worse in the current market environment. The positive aspect is nevertheless the stable occupancy rate achieved.

2) Reported the lowest financial performance in the last 3 years

| HKD in mil | FY18 | FY19 | FY20 |

| Revenue | 2,677 | 2,778 | 2,633 |

| Net Property Income | 2,405 | 2,481 | 2,347 |

Given the overall decline in operational performance, it comes as no surprise that the financial performance of Champion REIT has declined. Revenue has declined from HKD 2.8 bil in FY19 to HKD 2.6 bil in FY20 while net property income has declined from HKD 2.5 bil in FY19 to HKD 2.3 bil in FY20.

If we were to look deeper, the actual contributor is from the Langham Place Mall. Both Three Garden Road and Langham Place Office Tower has reported a year-on-year increase in revenue mainly driven by the higher overall passing rent. Langham Place Mall which has a stable occupancy rate has reported a decline in overall rent which is drive the overall revenue of Champion REIT down.

An area investors should keep a closer lookout for is the performance of the office assets. While the overall financial performance is positive, we would expect the performance to decline in FY21 given the lower occupancy.

3) Decline in distribution per unit in FY20

| HKD | FY18 | FY19 | FY20 |

| Distribution per unit | 0.26 | 0.27 | 0.25 |

In line with the overall decline in financial performance, Champion REIT has likewise reported a lower distribution per unit in FY20 which do not come as a surprise given the overall global market sentiment. Based on the closing unit price of HKD 4.53 on 31 December 2020, this would give investors a distribution yield of 5.5%.

Read More: Why you should never buy a REIT just because they have a high dividend yield

4) Increase in gearing level but well within the permissible limit

| FY18 | FY19 | FY20 | |

| Gearing (%) | 18% | 18% | 23% |

As at 31 December 2020, Champion REIT reported a gearing level of 23%. This is a year-on-year increase from 18% in FY18 to 23% in FY20. Nevertheless, its gearing level is still well below the permissible limit of 50% imposed by the REIT code giving them ample debt headroom for future asset acquisition and enhancement initiatives.

1H21 Performance

5) Financial performance continues to decline in 1H21

The financial performance of Champion REIT has continued to decline in 1H21. Rental income has declined from HKD 1.3 bil in 1H20 to HKD 1.3 bil in 1H21. This decline is contributed by all 3 of its assets. The positive aspect is that the office asset continues to report a higher passing rent with a slight improvement in occupancy from Langham Place Office.

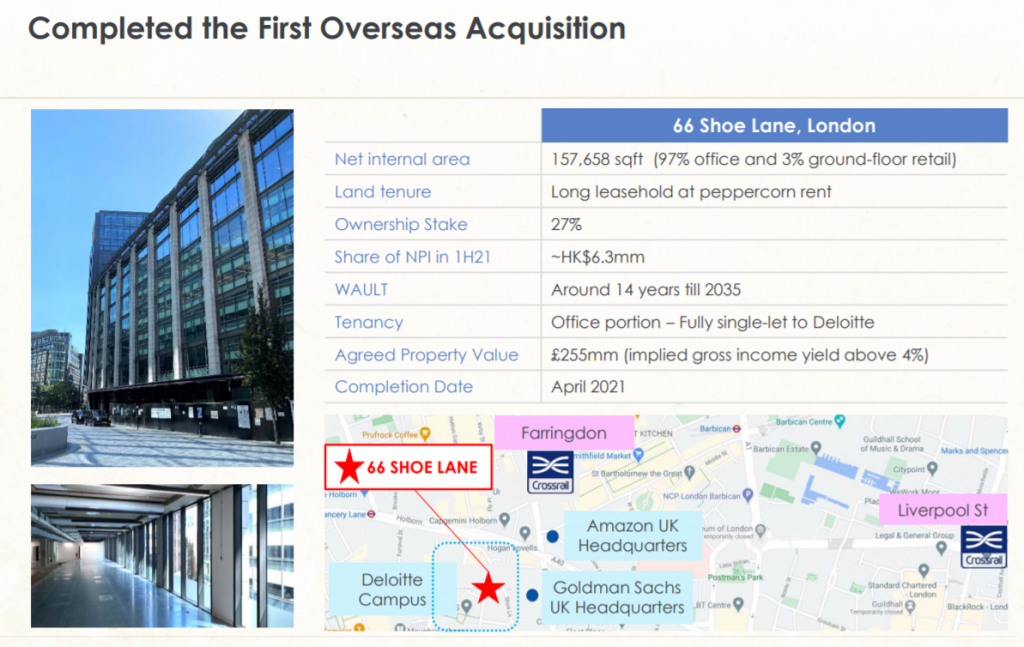

6) Completed its 1st acquisition in London

In April 2021, Champion REIT has completed its first overseas acquisition in London for a 23% ownership. This is an asset that is predominantly in the office sector which is fully single let to Deloitte. From our point of view, this acquisition is a plus to Champion REIT given the overall declining performance in its existing portfolio. Nevertheless, this acquisition would not hold much weightage to Champion REIT overall given the minimal ownership stake.

Summary

Based on our overall analysis, the operational and financial performance of Champion REIT has declined overall. Its retail asset continues to report a negative rental reversion despite maintaining an overall stable occupancy rate. The positive aspect is from its recent acquisition in London which would give them an overall geographical diversification.

What are your thoughts on Champion REIT FY20 and 1H21 performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

If you are looking for a brokerage account, Tiger Brokers is currently offering a deal of a lifetime that you might not want to miss.

- Registration: 500 Coins

- Account Opening: 60 Commission-Free Trades within 180 Days (Applicable for U.S. stocks, H.K. stocks, Singapore stocks and Australian stocks )

- Funding your account with more than ≥ SGD 2,000: 1 FREE Apple(NASDAQ: AAPL)share

Do consider using our link and promo code “REITPULSE” as this will support our blog while earning some rewards. Likewise, you can read more on our reviews on Tiger Brokers.

Grab Your FREE Copy of Guide to REITs

A comprehensive guide to help you get started with Real Estate Investment Trust (REITs) in Malaysia and Singapore

Do join our community over at Facebook and Instagram.