Atrium REIT is one of the few REITs which has been reporting great performance over the last few years. Even in the midst of COVID-19 uncertainty, they have performed relatively well. Being in the industrial sector, they are less affected as compared to REITs in other sectors such as retail and hospitality.

Having said that, there are other risks to look out for particularly the non-renewal of leases. REITs in this sector typically have higher tenant concentration and as such, non-renewal or failure to secure new tenants can be detrimental to Atrium REIT.

It has been close to half a year since we last discussed on Atrium REIT. In this post, we will be diving into Atrium REIT FY20 and 2Q21 performance to see how it has performed.

Read More:

- 5 Key Things To Know of Atrium REIT 3Q20 Performance

- 7 Key Things To Know Of Atrium REIT 2019 Performance

1) Continue to report a 100% occupancy rate as at 31st December 2020

Let’s begin with a positive point on Atrium REIT. Investors who have been following Atrium REIT development would have notice growth in a number of properties over the years. Over the last 3 years itself, Atrium REIT has grown its asset from 5 properties in FY18 to 7 properties in FY20 with another asset in the pipeline.

Looking at its existing properties performance, it has also been performing well with a stable 100% occupancy over the past few years. In the last year itself, there has been a non-renewal of leases upon expiry but the management has been able to secure new tenants to take over the lease.

2. Risk on non-renewal of lease mitigated

Looking at its overall lease expiry profile, there are a couple of leases that are due for expiry. This is particularly key given that industrial REIT typically has a higher tenant concentration. As at 31 December 2020, these are the overall lease profile of Atrium REIT portfolio.

- Atrium Shah Alam 1: Expiring on 31 May 2021

- Atrium Shal Alam 2: Expiring on 31 March 2024

- Atrium Shah Alam 3: Expiring on 24 July 2021

- Atrium Bayan Lepas 1: Expiring on 21 October 2035

- Atrium Bayan Lepas 2: Expiring on 6 October 2034

- Atrium Puchong: Expiring on 30 September 2023

- Atrium USJ: Block A (31 August 2023), Block B (31 December 2020), Block C (31 July 2022)

The good news is that all 3 leases that are due to expire have been renewed or new tenants have been found. CJ Century Logistics which previously occupy Atrium USJ Block B has informed the manager that they will not be renewing the lease. However, Rohlig Malaysia Sdn Bhd which is an existing tenant in another block will take over the lease. Likewise, the lease in Atrium Shah Alam 1 will be taken over by Ninja Logistics from Marelli Motori Asia starting 1 June 2021.

These have been positive overall for Atrium REIT. An area investors would probably want to pay close attention to is the updates on Atrium Shah Alam 3 which is due to expire on 24 July 2021.

3. Year on year increased in revenue driven by newly acquired properties

| MYR in 000s | FY18 | FY19 | FY20 |

| Revenue | 18,779 | 22,961 | 34,405 |

| Net Property Income | 17,257 | 21,413 | 32,238 |

With the active acquisition initiatives over the past few years and the stable occupancy rate of Atrium REIT overall portfolio, it comes to no surprise that Atrium REIT has reported a solid performance in FY20. Revenue has increased from MYR 18.8 mil in FY18 to MYR 34.4 mil in FY20. This has more than doubled. The huge growth is mainly fueled by the contribution from both Atrium Bayan Lepas 1 and 2 which was fully acquired in FY20.

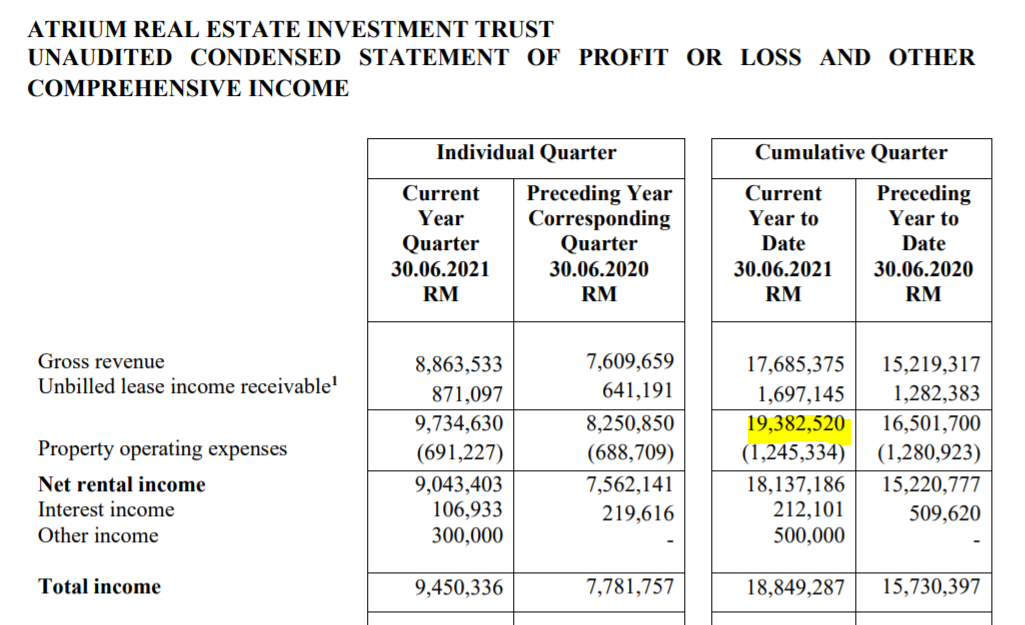

Likewise, 1H21 performance does not disappoint. The reported revenue for 1H21 is at MYR 19.4 mil as compared to MYR 16.5 mil in 1H20. This is a 17.5% increase as compared to its preceding year.

4. Recorded the highest distribution per unit over the last 3 years

| MYR (Cents) | FY18 | FY19 | FY20 |

| Distribution Per Unit | 8.10 | 6.63 | 9.00 |

Atrium REIT reported its highest distribution per unit in the last 3 years. The DPU increased from 8.10 cents in FY18 to 9.00 cents in FY20 giving investors a yield of 7.83% based on its FY20 closing price. If we were to look at the DPU in FY19, there is a drop in distribution per unit to 6.63 cents due to an enlarged share base from the placement and right issue issued in conjunction with the acquisition of Atrium Bayan Lepas. However, as the rental income from Atrium Bayan Lepas kicks in FY20, the distribution per unit begun picking up again.

5. Completed acquisition of Atrium Shah Alam 4

To further grow, Atrium REIT has completed its acquisition of Atrium Shah Alam 4 from Permodalan Nasional Berhad for a consideration of MYR 45 mil in 1Q21. It is currently undergoing a major asset enhancement initiative to upgrade the existing factory building to a grade A warehouse facility.

Summary

Based on our overall analysis, Atrium REIT has performed fairly well in FY20 and 1H21 in the midst of the COVID-19 uncertainty. The acquisition of Atrium Bayan Lepas has definitely benefited Atrium REIT which is evident from the overall improvement in financial performance and distribution per unit in FY20.

What are your thoughts on Atrium REIT FY20 Performance? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.