Sunway REIT (KLSE: 5176) is one of the largest diversified real estate investment trusts (REITs) in Malaysia. It was listed in the Bursa Malaysia Market on July 2010 with an initial portfolio of 8 assets. Ever since their initial listing, they have successfully grown their assets to 17 properties with a total value of approximately MYR 8 bil across Malaysia as at 30 June 2020.

Due to its diversified and reputable past performance, they are one of the popular REITs in Malaysia. With the recent release of its FY20 Annual Report, we will look into a few key things you need to know based on its 2020 results

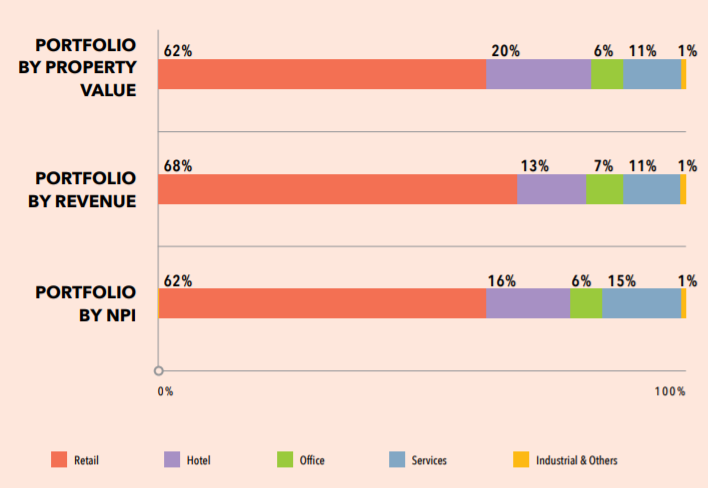

1. The retail sector is the biggest contributor as compared to their other sectors

Though Sunway REIT is a diversified REIT, its retail sector contribute the most both in terms of the property value and the revenue contribution. The retail sector accounts for 62% of the total property value and 68% of the Sunway REIT gross revenue.

This is followed by the hotel sector which contributes to approximately 13% of the total revenue in FY20. The services sector which comprises of two assets being Sunway Medical Centre and Sunway University are the 3rd biggest contributor.

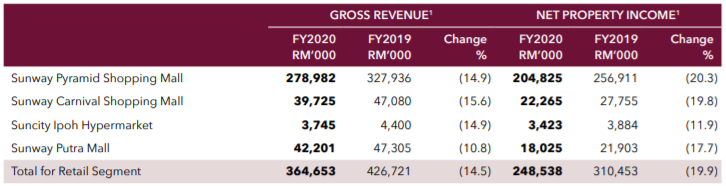

2. Sunway Pyramid Is the Crown Jewel of Sunway REIT

If we were to dive deeper to the 4 retail properties they owned echoing the previous point, Sunway Pyramid would be deemed as their crown jewel mall contributing to more than half of Sunway REITs revenue. Sunway Pyramid Mall is located at Sunway City with an average occupancy rate at 97.6% in FY20 as compared to 98.2% in FY19. The slight decrease is attributed to the fit-out period during the year for new tenants.

3. Proposed Acquisition of The Pinnacle Sunway

The REIT Manager has also proposed to acquire The Pinnacle Sunway, a 24-storey Grade A office building with MSC status and GBI certification, located in the Sunway City township. Sunway Pinnacle will be acquired at a price of MYR 450 mil through a combination of debt (MYR 45.0 mil) and proceeds from proposed Private Placement (MYR 405.0 mil). The entire acquisition is expected to be completed in the second quarter of 2021 in which upon completion will boost Sunway REIT overall property value to MYR 8.5 bil.

Read More: How do REITs raise capital

4. Declining in retail segment performance due to tenant rebate

All the 4 retail properties experience a decline in both the revenue and net property income. The decline is mainly attributed to the rental support granted to tenants across all retail properties who were affected by restrictions and loss of business during the MCO, CMCO and RMCO. Looking at the average occupancy rate, the occupancy rate remain fairly stable as compared to FY19.

5. Dropped in occupancy rate for the hotel sector

| FY18 | FY19 | FY20 | |

| Sunway Resort Hotel | 74% | 65% | 50% |

| Sunway Pyramid Hotel | 71% | 68% | 59% |

| Sunway Clio Property | 72% | 74% | 58% |

| Sunway Hotel Seberang Jaya | 76% | 75% | 51% |

| Sunway Putra Hotel | 73% | 62% | 48% |

| Sunway Hotel Georgetown | 92% | 85% | 53% |

The hotel sector has been severely affected across various REITs in Malaysia. Looking at the average occupancy rate of Sunway REIT in this sector, almost all the 6 hotels occupancy rate declined. The decline in FY20 is due to poor demand resulting from the COVID-19 pandemic as well as a temporary halt to the operation of hotels with the imposition of MCO and CMCO.

Apart from a decline in occupancy rate, a partial rebate has been granted to the lessees to help ease their burden. As a result, this has resulted in a drop in guaranteed revenue on top of the drop in occupancy rate. The hotel industry is one of the sectors which are severely affected and with the extension of the movement restriction till December, this will continue to impact the industry.

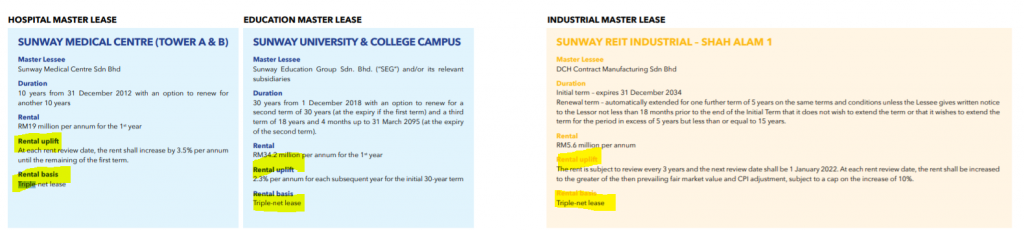

6. Favourable terms for the Services and Industrial Sector

The services sector which comprises of both Sunway Medical Centre and Sunway University & College as well as the industrial sector which comprises of Sunway REIT Industrial – Shah Alam 1 are entered into favourable terms. All these 3 properties are entered in a triple net lease agreement which basically means the tenants are responsible for most of the REIT’s property expenses including taxes, building insurance, and maintenance fees. This would reduce the fluctuation of property expenses borne by Sunway REIT.

Secondly, all these 3 leases are entered with a positive rental uplift.

- Sunway Medical Centre: 3.5% increase p.a

- Sunway University & College: 2.3% increase p.a

- Shah Alam 1- Sunway REIT Industrial: Review every 3 years

As the rental rates can be increased over the years along with the triple net lease arrangement, these properties will give investors a predictable positive return.

7. Overall Year on Year Positive Growth from FY17 to FY19 with a decline in FY20

| MYR in 000s | FY16 | FY17 | FY18 | FY19 | FY20 |

| Revenue | 507,013 | 522,868 | 560,406 | 580,299 | 556,875 |

| Net Property Income | 373,851 | 388,817 | 419,930 | 439,695 | 416,809 |

| Net Realised Income | 262,473 | 270,586 | 281,947 | 286,477 | 248,393 |

Excluding the performance in FY20, Sunway REIT is one of the few REITs in Malaysia which has successfully attained a positive year on year revenue, net property income and net realised income from FY16 to FY19. The performance for FY20, on the other hand, has declined due to the COVID-19 pandemic. As shared in the earlier post, the retail sector and hotel sector are severely affected due to the pandemic.

Moving forward, we would expect the hotel industry to continue to be affected in FY21.

8. Gearing below permissible limit with a mixture of a fixed and variable loan

| FY16 | FY17 | FY18 | FY19 | FY20 | |

| Gearing | 33% | 34% | 39% | 38% | 41% |

| Fixed: Variable ratio | 46%:54% | 43%:57% | 34%:66% | 45%:55% | 43%:57% |

The gearing of Sunway REIT as at 30 June 2020 is at 41% still below the permissible limit giving them ample headroom for further growth opportunities. Looking at the debt profile, more than half of the loans are variable in nature which subjects them to an interest rate risk.

However, with the interest rate cut in Malaysia, this would be favourable to Sunway REIT in the short term.

Read More: How does Interest Rate Affect REITs

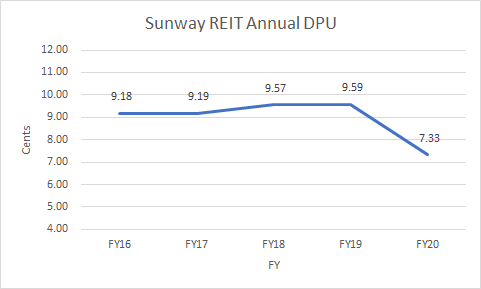

9. Stable Growing DPU from FY17 to FY19 with a decline in FY20 due to COVID-19

Last but not least, the distribution per unit of Sunway REIT has been growing steadily from FY17 to FY19 before declining in FY20. The decline due to the uncertainty of COVID-19 pandemic. It will be interesting to see if the REIT manager manages to fare through the adversity and continue the uptrend DPU achieved historically.

Summary

Overall, Sunway REIT performance has been fairly commendable with strong growth prospect. The REIT manager has successfully grown the REIT from 8 properties to a staggering 17 properties with another property due to be acquired. The decline in FY20 is mainly attributed to the uncertainty of the COVID-19 pandemic.

From the NAV per unit as at 30 June 2020 of MYR 1.48 as compared to the latest traded price of MYR 1.68, this would give investors a price to book of 1.14. As usual, we will let you decide if this is worth investing.

What are your thoughts on Sunway REIT? If you are just getting started, feel free to read more of our REIT Guide and REIT Analysis. You can also read more about what REITs are if you are new to REITs.

Do join our community over at Facebook and Instagram.

Informative